- United States

- /

- Life Sciences

- /

- NYSE:AVTR

Does Engine Capital’s Activist Push Signal a Rebound Opportunity for Avantor in 2025?

Reviewed by Bailey Pemberton

If you have been watching Avantor lately, you know it has not been a smooth ride. After a rough year—down 43.5% over the last 12 months—the stock has suddenly come alive, surging 20.7% in just the past week and up 11.5% for the month. With activist investors like Engine Capital stepping in and pushing for a potential sale or strategic shakeup, it is no wonder there is renewed interest in what comes next for this materials and life sciences company.

But even with all the recent headlines and price swings, the big question remains: is Avantor actually undervalued, or is the market right to be cautious? The stock is still well below where it started the year—down 32.6% year-to-date—despite this recent pop. Analysts, too, have mixed views, with price targets pulled down as competitive pressures linger and investors debate how much growth is truly ahead.

Take a closer look though and you will find that Avantor scores a 5 out of 6 on a rigorous valuation scorecard, passing nearly every test for being undervalued. That alone should get any investor’s attention, but it is also just the start. Next, we will break down each of the main methods analysts use to judge whether Avantor’s current share price is really a bargain, and hint at an even better way to understand valuation that you will not want to miss by the end of the article.

Why Avantor is lagging behind its peers

Approach 1: Avantor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental tool for valuing a company. It uses estimates of future cash flows and discounts them back to today's value. In essence, it projects how much cash Avantor is expected to generate each year, then calculates what those future dollars are worth in today’s terms by accounting for risk and time.

For Avantor, analysts estimate the company generated $544.6 million in free cash flow (FCF) over the last twelve months. Projections see this figure rising over the coming years and reaching $938 million by the end of 2028. Looking out a full 10 years, extrapolated forecasts suggest free cash flow could top $1.45 billion by 2035, though these long-range figures become increasingly speculative the further out you go.

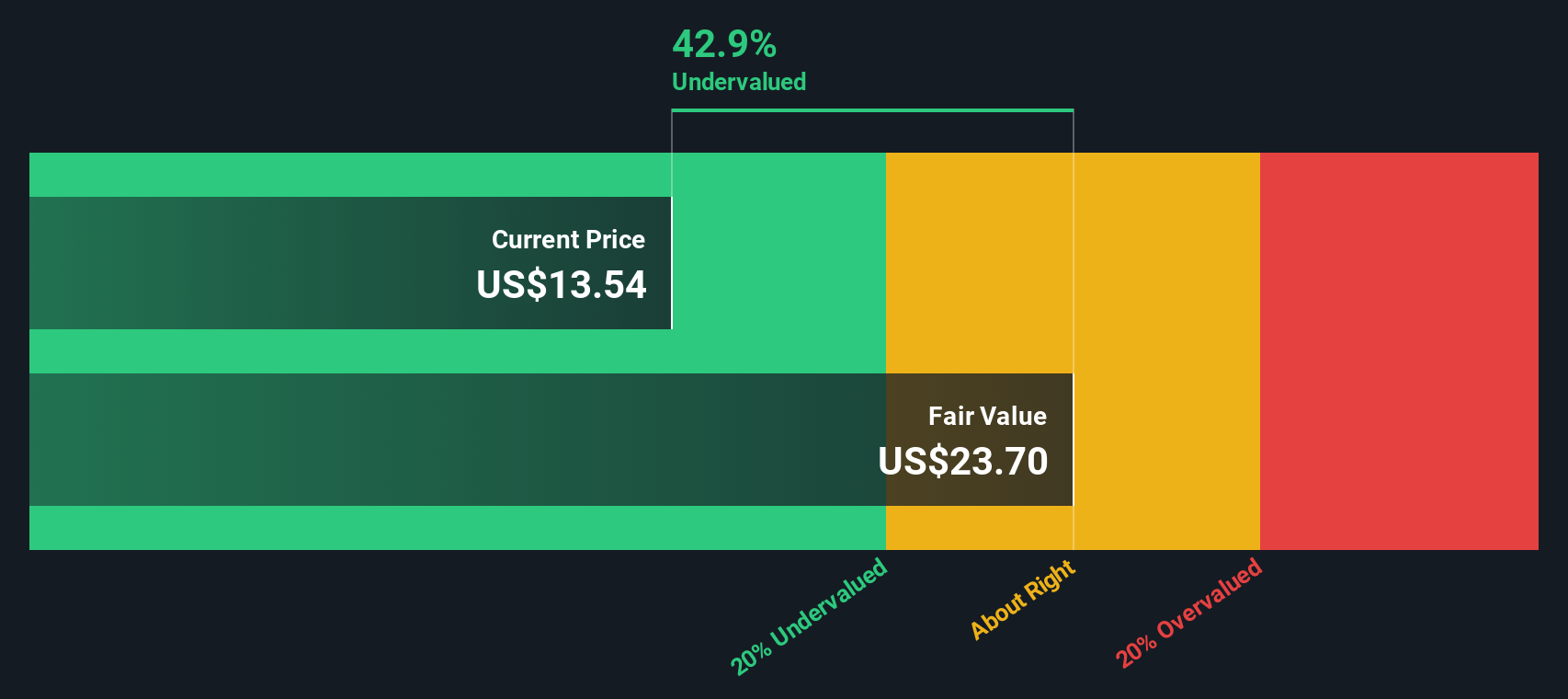

Based on these projections and the DCF methodology, the estimated fair value for Avantor shares is $30.05. Compared to the recent share price, this indicates the stock is trading at a 52.4% discount to its intrinsic value, suggesting significant potential upside if the forecasts are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Avantor is undervalued by 52.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Avantor Price vs Earnings

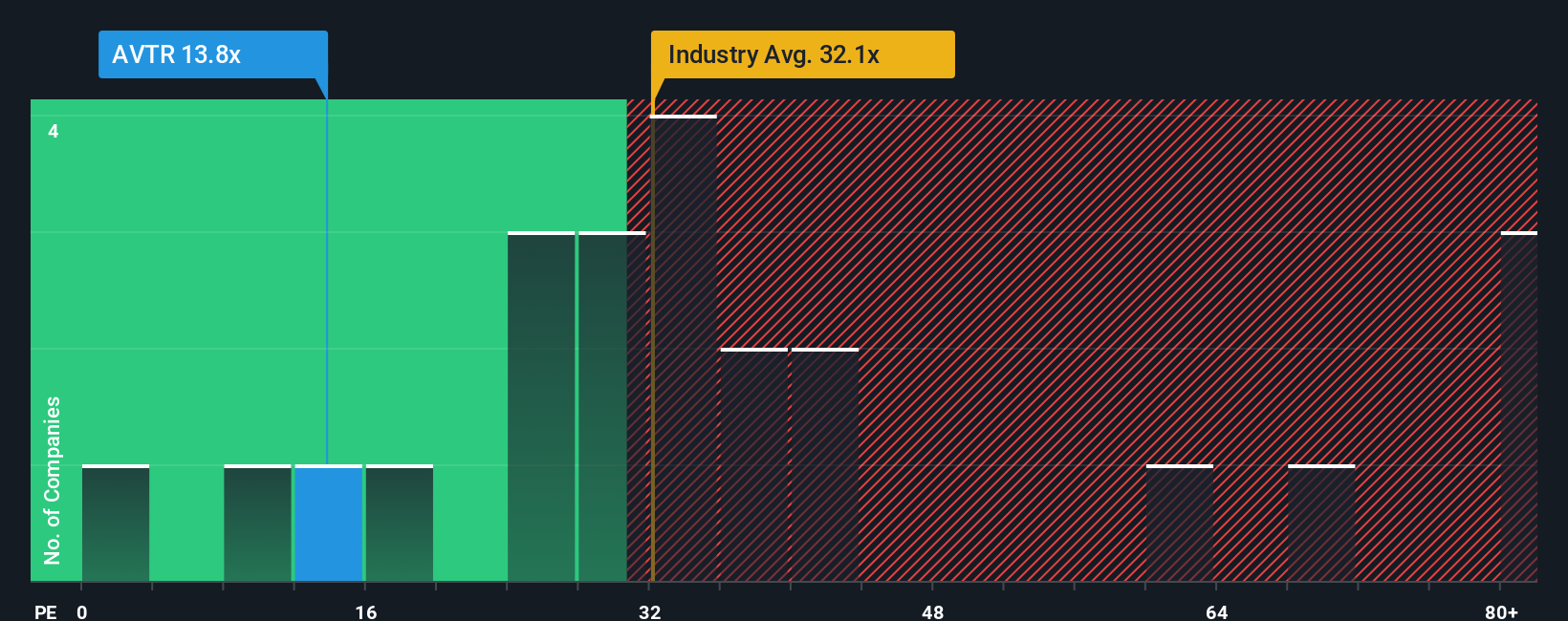

For companies that are consistently profitable, the Price-to-Earnings (PE) ratio is a classic and practical way to assess valuation. The PE ratio tells you how much investors are willing to pay for each dollar of a company’s earnings. A high PE often means the market expects greater growth or lower risk. A low PE can signal skepticism about future prospects or higher risk compared to peers.

Right now, Avantor trades at a PE multiple of 14.2x. That is significantly below both the Life Sciences industry average of 31.2x and the peer average of 56.5x. On paper, this large discount might suggest Avantor is undervalued. However, it is also important to consider why the company deserves a higher or lower ratio compared to its peers. Earnings growth, profit margins, and risk factors all play a role in what a “fair” PE should be for a specific company.

This is where Simply Wall St’s Fair Ratio comes in. Instead of just comparing Avantor to peers in isolation, the Fair Ratio combines earnings growth, profitability, industry characteristics, market cap, and other risk factors into a single, more tailored benchmark. For Avantor, the Fair Ratio is currently 16.7x. By comparing Avantor’s actual PE of 14.2x to this Fair Ratio, we see the stock is trading at a notable discount to its fair value based on these broader fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Avantor Narrative

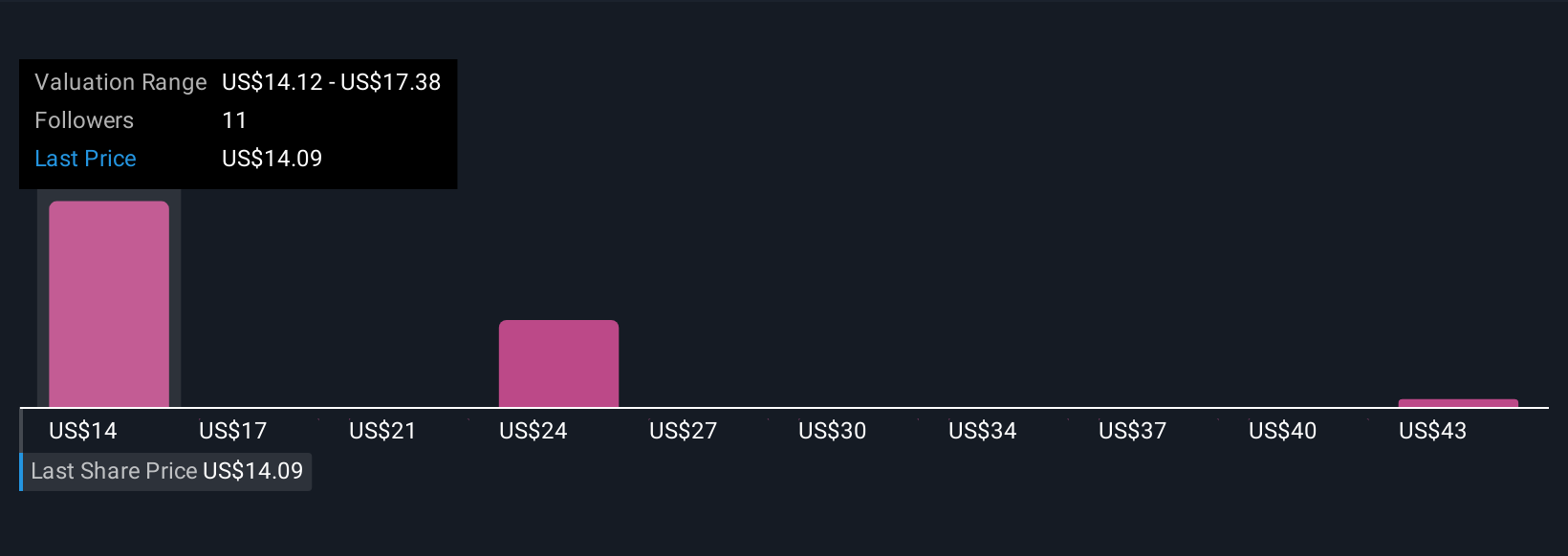

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story—your perspective on a company like Avantor—that ties together your assumptions about future revenues, profit margins, and business drivers to create your own fair value estimate, adding context and meaning behind the numbers.

Rather than relying only on strict formulas or consensus analyst targets, Narratives connect what you believe about Avantor’s industry position, strategy, and financial outlook with a dynamic forecast and valuation. This approach brings the company's story to life in your investment decision. On Simply Wall St’s Community page, you can easily create or explore Narratives, an approach trusted by millions of investors, to express, test, or compare your personal investment thesis. By comparing your calculated Fair Value with the current Price, you get a clear signal for when to buy or sell, all while benefiting from real-time updates as new news or earnings data arrives.

For example, some Avantor investors are bullish, forecasting robust pharma growth and margin recovery, leading to a high Narrative fair value of $19.00. Others remain cautious about ongoing price pressures and prefer a conservative estimate of just $12.00. With Narratives, you can quickly see where your own outlook fits, making smarter, more informed decisions with every new turn in Avantor’s story.

Do you think there's more to the story for Avantor? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVTR

Avantor

Engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives