- United States

- /

- Life Sciences

- /

- NYSE:AVTR

Could Trump’s Pharma Tariffs Reshape Avantor’s (AVTR) Competitive Edge in US Manufacturing?

Reviewed by Sasha Jovanovic

- Avantor, Inc. (NYSE:AVTR) was recently removed from the FTSE All-World Index, following President Trump's announcement of a 100 percent tariff on imported branded or patented pharmaceutical products, with exemptions favoring companies expanding manufacturing in the US.

- This policy change is expected to enhance the competitiveness of US-based suppliers like Avantor, potentially increasing domestic demand for their life sciences and pharmaceutical offerings.

- We'll now explore how new US pharmaceutical tariffs and resulting shifts in competitive positioning could influence Avantor's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Avantor Investment Narrative Recap

Avantor’s appeal as an investment hinges on its ability to capture more market share in the life sciences and pharmaceutical supply sectors, particularly as changes in US trade policy shift buyer preferences toward domestic producers. While the company’s removal from the FTSE All-World Index is not considered a material setback for its core operations, policy-driven demand changes for US-made pharmaceuticals now serve as a key short-term catalyst. However, the biggest risk remains persistent margin pressures from intense competition and flat bioprocessing revenue growth.

Among Avantor’s recent announcements, the upcoming third quarter earnings results, set for release on October 29, may hold the most direct relevance for investors assessing how these policy changes are shaping financial performance and market expectations. Updates on guidance and margin trends could act as an early signal of whether surging domestic demand might offset ongoing cost and pricing headwinds.

But investors should also keep in mind, in contrast to the new tariff-driven tailwinds, that persistent margin compression from price competition remains a risk worthy of...

Read the full narrative on Avantor (it's free!)

Avantor's narrative projects $7.2 billion revenue and $461.3 million earnings by 2028. This requires 2.5% yearly revenue growth and a $226.1 million earnings decrease from $687.4 million.

Uncover how Avantor's forecasts yield a $14.12 fair value, a 3% upside to its current price.

Exploring Other Perspectives

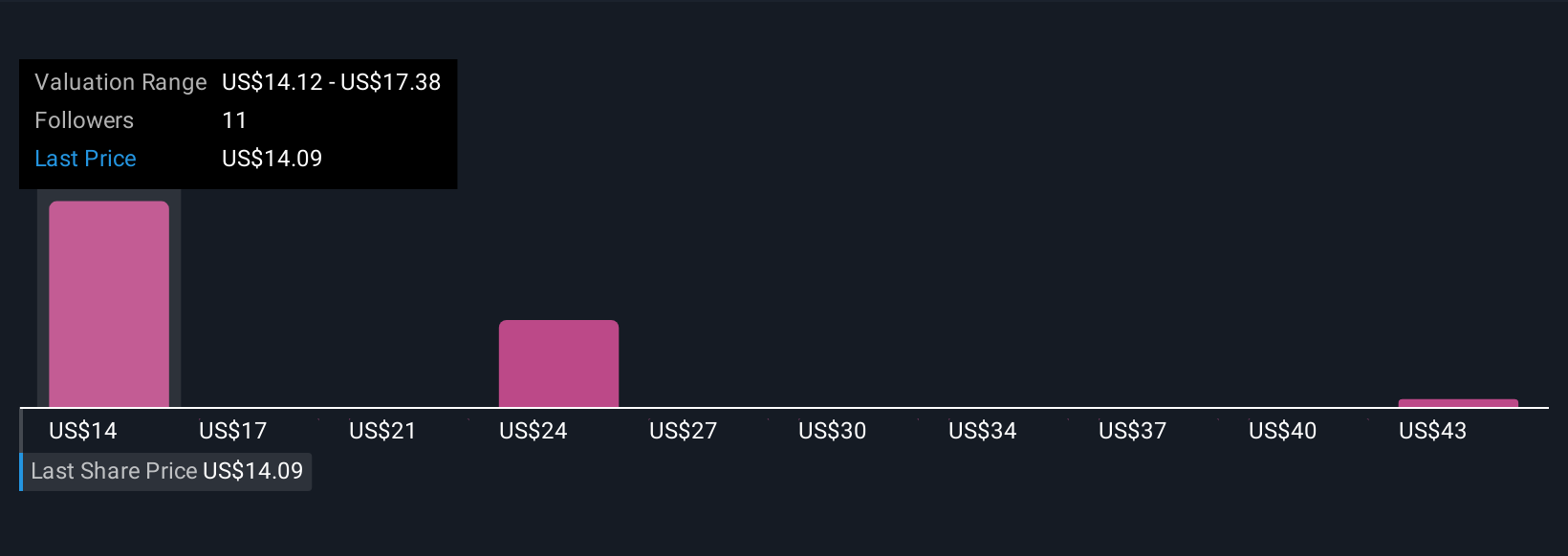

Fair value estimates from three Simply Wall St Community members span a wide range, from US$14.12 to US$46.76 per share. As you explore these viewpoints, consider that persistent margin pressures from competition could have a significant impact on future performance.

Explore 3 other fair value estimates on Avantor - why the stock might be worth over 3x more than the current price!

Build Your Own Avantor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avantor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Avantor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avantor's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVTR

Avantor

Engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives