- United States

- /

- Life Sciences

- /

- NYSE:AVTR

Avantor (NYSE:AVTR) Shareholders Booked A 60% Gain In The Last Year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. To wit, the Avantor, Inc. (NYSE:AVTR) share price is 60% higher than it was a year ago, much better than the market return of around 22% (not including dividends) in the same period. That's a solid performance by our standards! Avantor hasn't been listed for long, so it's still not clear if it is a long term winner.

See our latest analysis for Avantor

Given that Avantor only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Avantor grew its revenue by 2.3% last year. That's not great considering the company is losing money. The modest growth is probably largely reflected in the share price, which is up 60%. While not a huge gain tht seems pretty reasonable. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

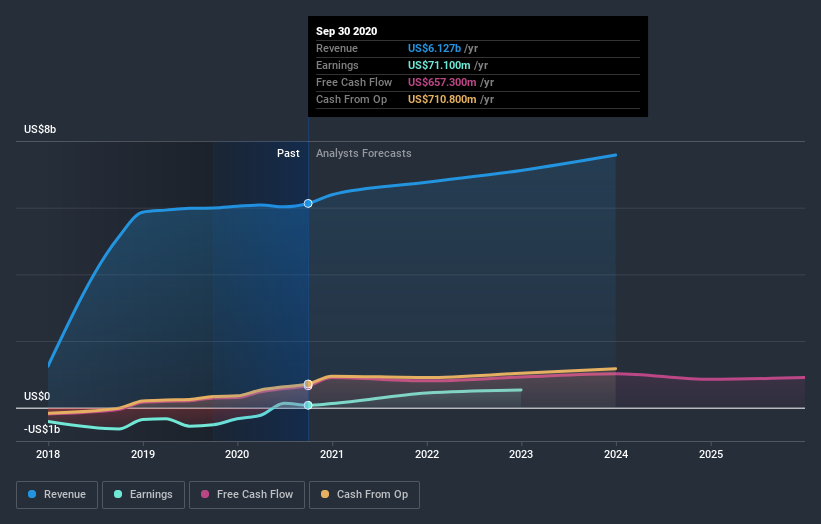

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Avantor is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Avantor stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Avantor boasts a total shareholder return of 60% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 26% in that time. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Avantor (1 is significant!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Avantor, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:AVTR

Avantor

Engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives