- United States

- /

- Life Sciences

- /

- NYSE:AVTR

Avantor (AVTR): Valuation Insights Following Board Appointment and Growing Investor Optimism

Reviewed by Kshitija Bhandaru

Avantor (NYSE:AVTR) has attracted fresh market interest after appointing Gregory T. Lucier to its Board of Directors. This development comes alongside growing signs of activist involvement and shifting sentiment toward domestic life sciences firms.

See our latest analysis for Avantor.

Avantor’s latest board appointment and steady stream of positive developments have reignited interest among investors, coming amid momentum-building news for U.S. life sciences companies. This renewed confidence saw Avantor’s share price climb sharply in the past week. However, the one-year total shareholder return still lags behind the market, which suggests there is more work to be done for long-term holders as optimism builds around potential company changes.

If you’re looking for other healthcare innovators benefiting from recent shifts in the industry, check out the full list via our See the full list for free..

With the stock rebounding but long-term returns still lagging, investors are left to wonder if Avantor is now trading at a bargain given recent leadership changes and sector tailwinds. Alternatively, some may question whether the market has already priced in the company’s future growth potential.

Most Popular Narrative: Fairly Valued

Avantor closed at $14.29 against a consensus narrative fair value of $14.12, indicating the stock sits almost exactly in line with projected fair value based on analysts' aggregate expectations. This sets up a critical question: what are the underlying forces justifying this balance?

The global growth in demand for biopharmaceuticals and healthcare solutions is being reinforced by Avantor's major contract wins and extensions with large pharma and biotech consortia. These positions Avantor to capture greater market share as end-market funding and patient procedures return to normalized or higher levels, creating sustained potential for above-market revenue growth.

What numbers are driving Avantor’s fair value call? It’s not just about sector recovery, but bold assumptions about future growth, margin shifts, and a transformative contract pipeline. The narrative hinges on key forecasts and ambitious operational targets that could alter the company’s long-term earning power. Can you guess which critical projections tip the balance?

Result: Fair Value of $14.12 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and sluggish bioprocessing demand could undermine forecasts and challenge the positive case for Avantor in the coming quarters.

Find out about the key risks to this Avantor narrative.

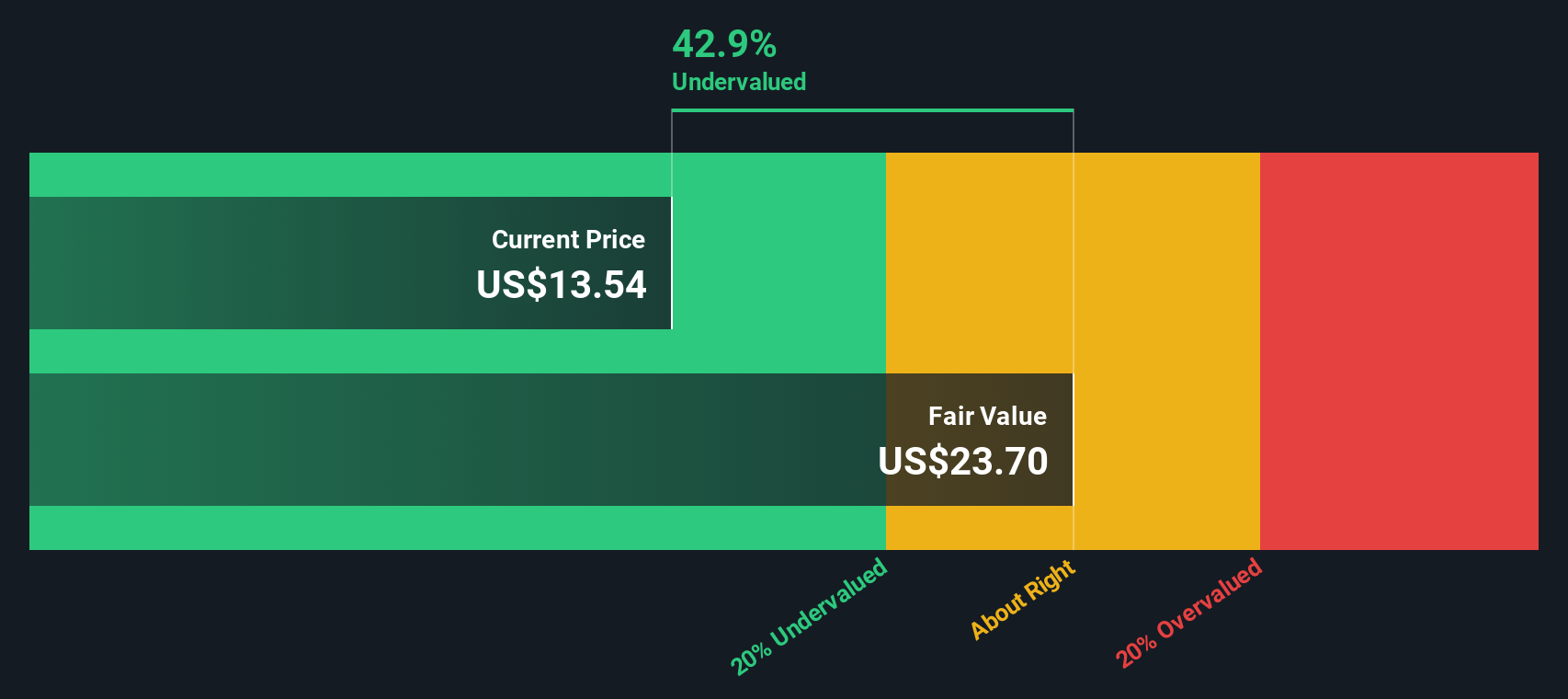

Another View: Our DCF Model Says Shares Are Undervalued

While analysts see Avantor as fairly valued based on consensus expectations, the Simply Wall St DCF model estimates the shares are trading below their intrinsic value. According to our model, Avantor could be worth as much as $26.38 per share, which suggests a significant undervaluation. Could long-term cash flows offer hidden upside, or do market concerns outweigh the model’s projections?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Avantor Narrative

If you would rather reach your own conclusions or want to drill down into the details, you have the tools to build a fresh narrative in just a few minutes, your way. Do it your way

A great starting point for your Avantor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know new opportunities rarely wait. Find companies with untapped potential, income streams, or breakthrough technology and strengthen your portfolio decisions today.

- Uncover reliable passive income prospects with these 19 dividend stocks with yields > 3%, which offers yields over 3% for steady cashflow growth.

- Spot breakthrough innovators by browsing these 25 AI penny stocks, leading the way in artificial intelligence advancements with high-impact industry applications.

- Capture value before the crowd by targeting these 886 undervalued stocks based on cash flows, which may be trading below their intrinsic worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVTR

Avantor

Engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives