- United States

- /

- Biotech

- /

- NYSE:ADCT

Shareholders Will Likely Find ADC Therapeutics SA's (NYSE:ADCT) CEO Compensation Acceptable

Key Insights

- ADC Therapeutics to hold its Annual General Meeting on 3rd of June

- CEO Ameet Mallik's total compensation includes salary of US$746.2k

- The total compensation is 44% less than the average for the industry

- ADC Therapeutics' EPS grew by 7.0% over the past three years while total shareholder loss over the past three years was 64%

Performance at ADC Therapeutics SA (NYSE:ADCT) has been rather uninspiring recently and shareholders may be wondering how CEO Ameet Mallik plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 3rd of June. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for ADC Therapeutics

Comparing ADC Therapeutics SA's CEO Compensation With The Industry

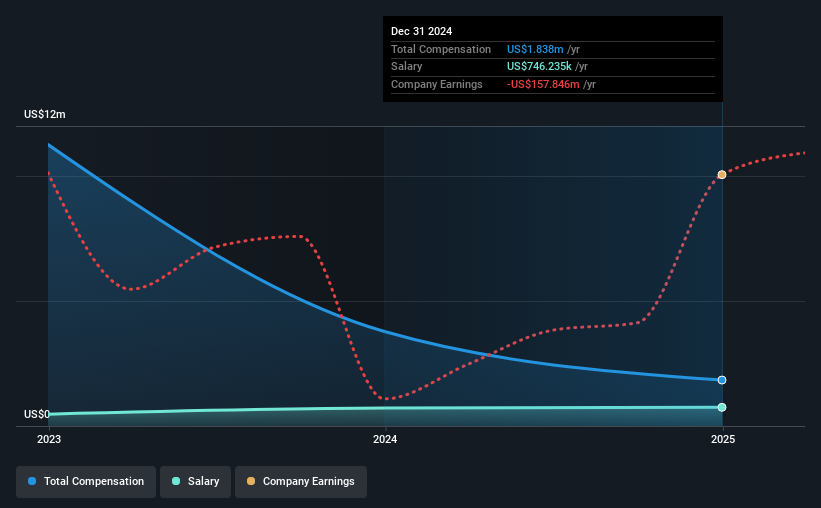

Our data indicates that ADC Therapeutics SA has a market capitalization of US$241m, and total annual CEO compensation was reported as US$1.8m for the year to December 2024. We note that's a decrease of 51% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$746k.

In comparison with other companies in the American Biotechs industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$3.3m. That is to say, Ameet Mallik is paid under the industry median. Moreover, Ameet Mallik also holds US$3.8m worth of ADC Therapeutics stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$746k | US$721k | 41% |

| Other | US$1.1m | US$3.1m | 59% |

| Total Compensation | US$1.8m | US$3.8m | 100% |

Speaking on an industry level, nearly 22% of total compensation represents salary, while the remainder of 78% is other remuneration. ADC Therapeutics is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at ADC Therapeutics SA's Growth Numbers

ADC Therapeutics SA's earnings per share (EPS) grew 7.0% per year over the last three years. It achieved revenue growth of 10% over the last year.

We think the revenue growth is good. And, while modest, the EPS growth is noticeable. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has ADC Therapeutics SA Been A Good Investment?

Few ADC Therapeutics SA shareholders would feel satisfied with the return of -64% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The loss to shareholders over the past three years is certainly concerning. The disappointing performance may have something to do with the flat earnings growth. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for ADC Therapeutics (of which 2 are significant!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from ADC Therapeutics, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ADCT

ADC Therapeutics

Provides antibody drug conjugate (ADC) technology platform to transform the treatment paradigm for patients with hematologic malignancies and solid tumors.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives