- United States

- /

- Biotech

- /

- NYSE:ABBV

Is AbbVie’s Expanding Migraine And Oncology Pipeline Reshaping The Investment Case For AbbVie (ABBV)?

Reviewed by Sasha Jovanovic

- In recent weeks AbbVie has reported positive late-stage trial results for migraine drug atogepant, advanced oncology assets including PVEK for rare blood cancers, and secured Canadian reimbursement progress for ulcerative colitis therapy SKYRIZI.

- Together with new EPKINLY approvals and upcoming ASH hematology presentations, these updates underline AbbVie’s effort to broaden its portfolio beyond legacy immunology earnings.

- Next, we’ll examine how the atogepant Phase 3 migraine data and broader pipeline progress affect AbbVie’s existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AbbVie Investment Narrative Recap

To own AbbVie, you generally have to believe its newer immunology, neuroscience and oncology drugs can offset Humira’s erosion and support the dividend despite high debt and thin recent margins. The latest atogepant migraine data and oncology updates support that diversification story but do not fundamentally change the near term focus on Skyrizi and Rinvoq growth or the key risk from pricing pressure and future patent cliffs.

Among the recent updates, the Phase 3 ECLIPSE results for atogepant stand out because they build on AbbVie’s existing migraine franchise and help reduce reliance on a concentrated immunology portfolio. If regulators ultimately clear atogepant for acute treatment, investors may view it as incremental support for earnings resilience, but the core questions around biosimilar competition and healthcare cost controls remain central.

Yet while that growth angle is appealing, investors should be aware that concentrated exposure to a few drug platforms could magnify the impact of any future safety or pricing shocks...

Read the full narrative on AbbVie (it's free!)

AbbVie’s narrative projects $73.0 billion revenue and $20.8 billion earnings by 2028. This requires 7.7% yearly revenue growth and a roughly $17.1 billion earnings increase from $3.7 billion today.

Uncover how AbbVie's forecasts yield a $243.55 fair value, a 8% upside to its current price.

Exploring Other Perspectives

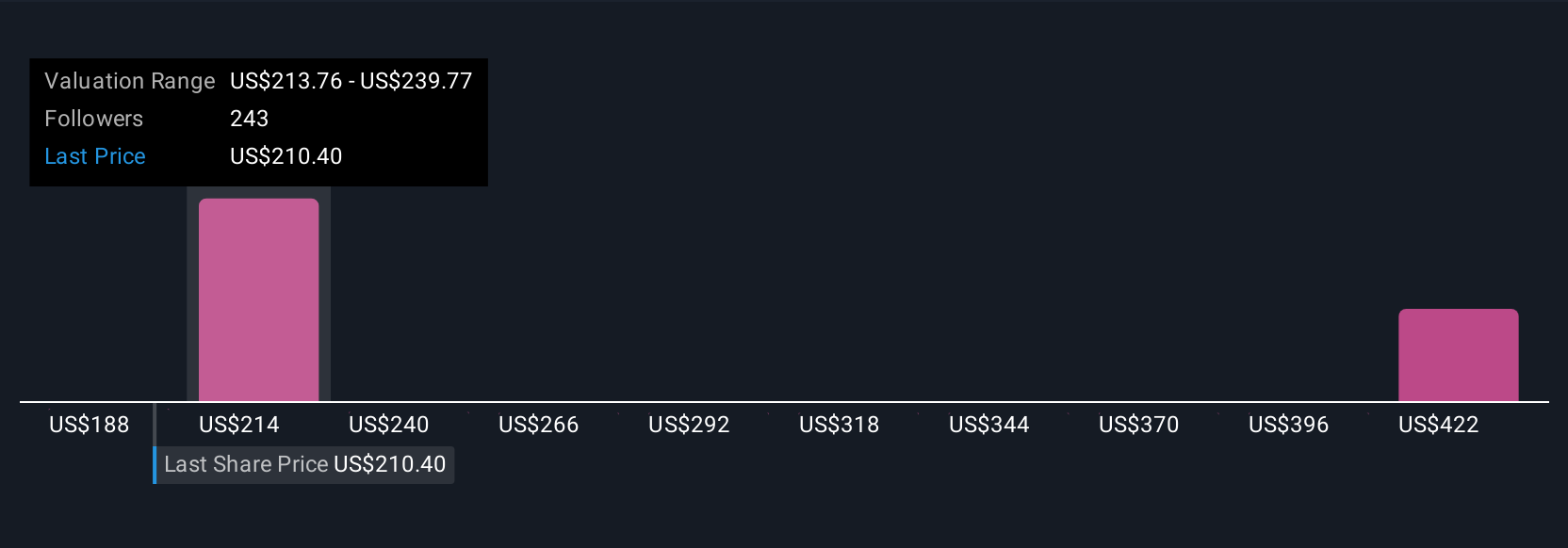

Five Simply Wall St Community fair value estimates for AbbVie span roughly US$227.78 to US$431.46 per share, showing how far apart individual views can be. Against that spread, the concentration risk in AbbVie’s immunology and neuroscience portfolios gives you an important lens to interpret how future pipeline wins or setbacks might affect the business.

Explore 5 other fair value estimates on AbbVie - why the stock might be worth just $227.78!

Build Your Own AbbVie Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AbbVie research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free AbbVie research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AbbVie's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026