- United States

- /

- Biotech

- /

- NYSE:ABBV

Does AbbVie Still Offer Upside After Its Big Run And Recent Pullback?

Reviewed by Bailey Pemberton

- If you are wondering whether AbbVie is still worth considering after its big run, or if its best days are behind it, this breakdown is for you if you care about what you are actually paying for the growth story.

- Despite a 25.0% gain year to date and a 34.2% rise over the last year, AbbVie has cooled off recently, slipping 0.4% over the past week and 4.1% over the past month after touching around $224.31.

- Recent headlines have focused on AbbVie's continued push to diversify beyond Humira with its immunology and oncology portfolio. This includes growing interest around newer drugs that aim to offset patent cliff concerns. At the same time, investors are digesting regulatory updates and pipeline milestones. Together, these factors help explain why the stock has paused after a strong multi year climb of 54.3% over 3 years and 163.9% over 5 years.

- On our framework AbbVie scores a 4 out of 6 valuation checks. This suggests the market is not obviously overpaying, but the price is not extremely cheap either. Next, we will walk through the different valuation lenses investors use, before finishing with a more holistic way to think about what AbbVie is really worth.

Approach 1: AbbVie Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those back into present dollars. For AbbVie, the model starts from roughly $19.9 billion in free cash flow over the last twelve months and uses analyst forecasts for the next few years, then extends those trends further into the future.

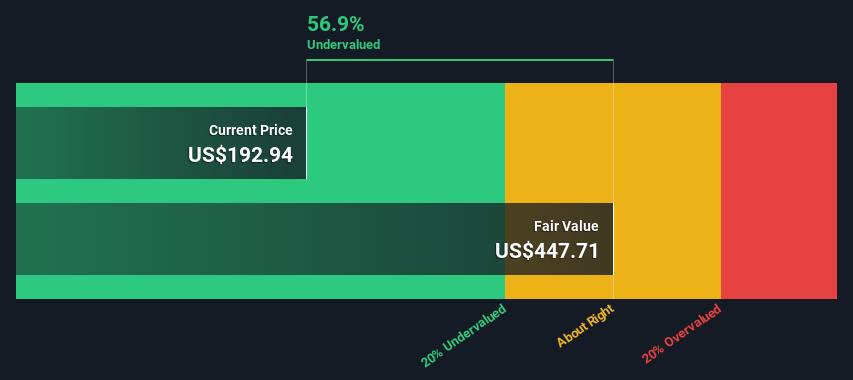

Analysts and extrapolated estimates point to free cash flow rising to about $41.1 billion by 2035, implying solid long term growth as newer immunology and oncology drugs scale up. Using a 2 Stage Free Cash Flow to Equity framework, these future cash flows are discounted back to today to arrive at an intrinsic value of roughly $419 per share.

Compared with the current share price, this implies AbbVie is trading at about a 46.5% discount to its estimated fair value. This suggests meaningful upside if the cash flow trajectory plays out as expected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AbbVie is undervalued by 46.5%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

Approach 2: AbbVie Price vs Sales

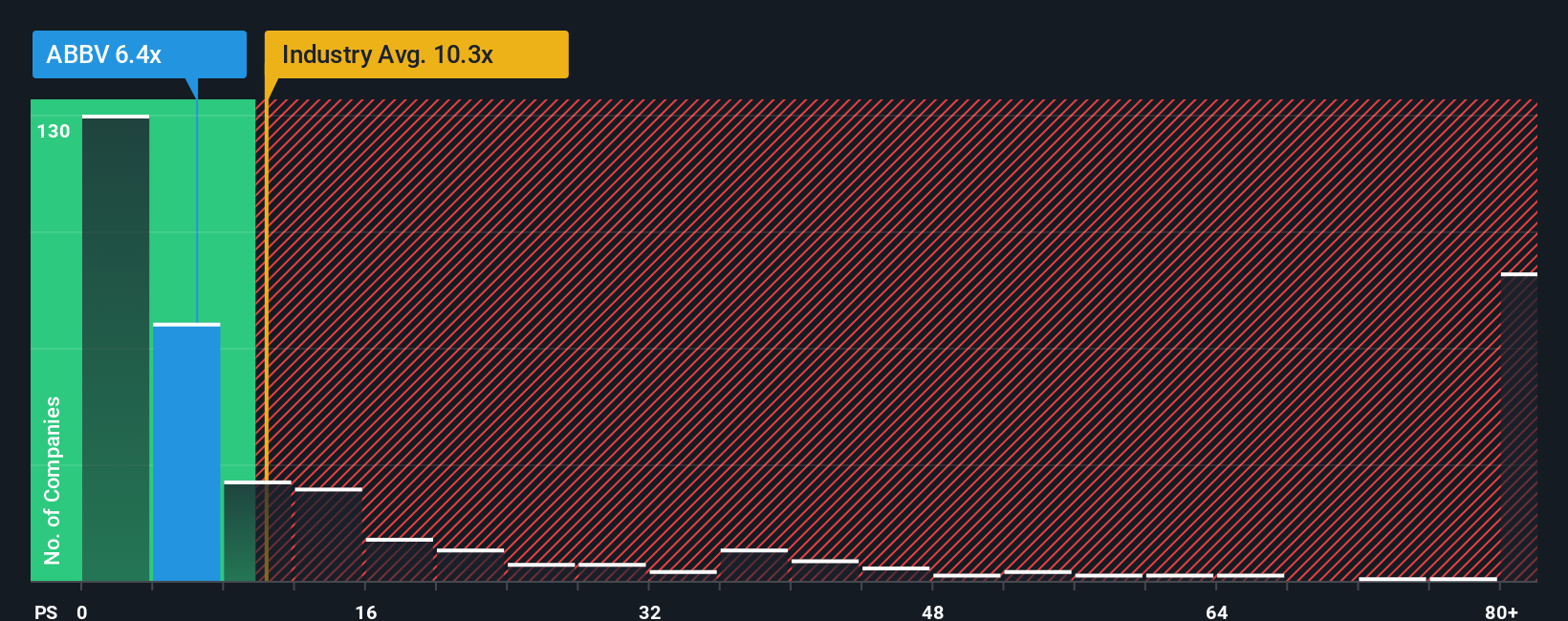

For a mature, profitable pharma business like AbbVie, the price to sales multiple is a useful way to gauge what investors are willing to pay for each dollar of revenue, especially when earnings can be distorted by one off items or accounting adjustments. In general, faster growing, more profitable, and lower risk companies can justify a higher normal sales multiple, while slower growth or higher uncertainty tends to pull that multiple down.

AbbVie currently trades around 6.65x sales, which is slightly above the Biotechs peer average of about 6.30x, but well below the broader industry average of roughly 12.31x. To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what AbbVie’s sales multiple should be given its growth profile, margins, industry, market cap, and risks. For AbbVie, this Fair Ratio is 11.22x, which indicates that the stock trades at a meaningful discount to what those fundamentals might warrant.

This Fair Ratio framework is more informative than just lining AbbVie up against peers because it embeds company specific drivers rather than assuming all biotechs deserve the same multiple. With AbbVie’s actual 6.65x price to sales sitting well below the 11.22x Fair Ratio, the stock appears undervalued on this basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AbbVie Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page where you turn your view of AbbVie into a clear story that links its business drivers to a forecast for revenue, earnings and margins. This then connects to a Fair Value you can compare to today’s price to inform your decision, with each Narrative updating automatically as fresh news, earnings or pipeline data arrives. For example, one investor might build a more bullish AbbVie Narrative closer to a 255 dollar fair value based on strong and durable growth from Skyrizi, Rinvoq and neuroscience. A more cautious investor might anchor a 170 dollar fair value around patent risk, pricing pressure and pipeline execution uncertainty. This makes it easy to see how different assumptions about the same company can lead to very different conclusions about what the stock may be worth.

Do you think there's more to the story for AbbVie? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)