- United States

- /

- Biotech

- /

- NYSE:ABBV

Assessing AbbVie (ABBV) Valuation After Rinvoq Exclusivity Extension Secures Key Revenue Driver

Reviewed by Simply Wall St

If you are trying to figure out what to do with your AbbVie (ABBV) shares, the most recent development might catch your eye. The company just settled with generic drugmakers to resolve all litigation over its autoimmune blockbuster, Rinvoq, extending U.S. market exclusivity for the drug until at least April 2037. This isn’t just a headline for industry insiders; it is a game-changer for the revenue outlook, and it matters to anyone thinking seriously about the stock.

In the context of this news, AbbVie’s shares have caught a wave of momentum, up by 14% in the past three months and 16% for the year. Investors have already been paying attention in a big way, thanks in part to strong earnings beats and regulatory wins. While other pharma stocks have been jockeying for position, AbbVie has continued to expand its pipeline with new cancer treatments and even received Canadian approval for ELAHERE for ovarian cancer.

So with a big revenue driver locked in for longer, is AbbVie’s current price a bargain, or has the market already penciled in all the future growth? Let’s dig into the valuation details.

Most Popular Narrative: Fairly Valued

According to the most widely followed valuation narrative, AbbVie is currently considered fairly valued by analysts. Their latest assessments suggest that the stock's present price aligns closely with its projected earnings growth and business prospects.

Advancements and strategic investments in neuroscience, including strong uptake of Vraylar, QULIPTA, Ubrelvy, and the emerging Parkinson's portfolio (for example, VYALEV), align with growing demand for therapies addressing chronic neurological diseases in an aging population. This supports both revenue and long-term earnings stability.

The narrative is not solely about blockbuster drugs or familiar headlines. Want to see the forecasts driving this fair value? The calculations hinge on ambitious growth targets, future profit margins, and a valuation multiple higher than what most companies in this sector receive. Are these bold projections justified? Find out what is behind the price in the full narrative.

Result: Fair Value of $217.45 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected regulatory changes or setbacks in AbbVie’s concentrated pipeline could quickly challenge these optimistic growth projections and shift investor sentiment.

Find out about the key risks to this AbbVie narrative.Another View: Discounted Cash Flow Signals a Different Story

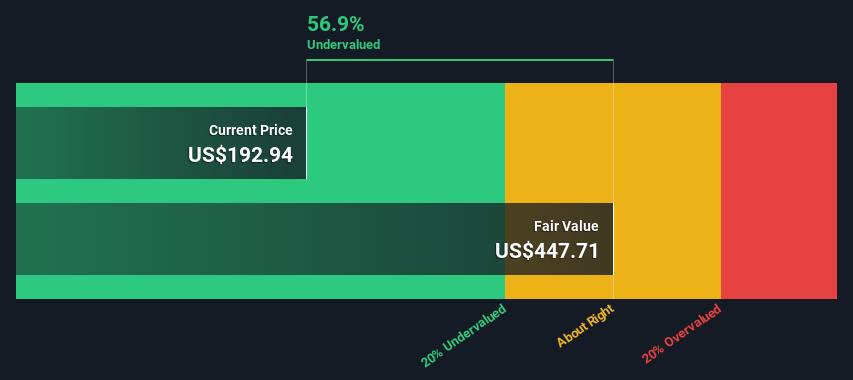

While analysts see AbbVie's price as fair based on earnings growth, our SWS DCF model presents a far more optimistic picture. It calculates that the shares are significantly undervalued. Should numbers alone sway your conviction, or is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AbbVie Narrative

If you see things differently, or enjoy diving into the numbers on your own, you can craft a personalized narrative in under three minutes using our tools, Do it your way.

A great starting point for your AbbVie research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

Looking for Your Next Investment Move?

Step ahead of the crowd and connect with ideas that could shape your financial future. There are stock opportunities out there that you do not want to miss. Let these screeners help you find them before everyone else does.

- Capture the growth potential of tomorrow’s leaders when you scan AI penny stocks driving breakthroughs in artificial intelligence and automation.

- Strengthen your income stream by finding companies that consistently deliver with dividend stocks with yields > 3% and robust financial performance.

- Spot compelling value plays fast by targeting undervalued stocks based on cash flows that are flying under the radar of most investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Medium-low risk with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives