In 2015 Mike McMullen was appointed CEO of Agilent Technologies, Inc. (NYSE:A). First, this article will compare CEO compensation with compensation at other large companies. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for Agilent Technologies

How Does Mike McMullen's Compensation Compare With Similar Sized Companies?

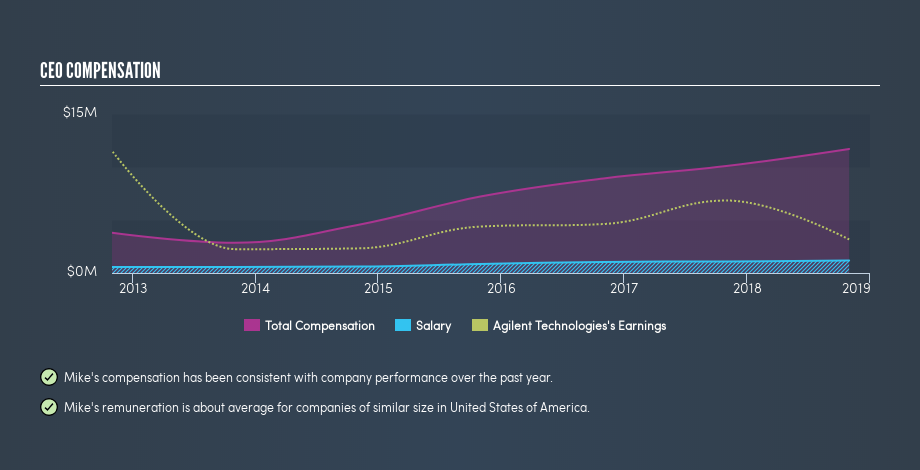

Our data indicates that Agilent Technologies, Inc. is worth US$25b, and total annual CEO compensation is US$12m. (This is based on the year to October 2018). That's a notable increase of 16% on last year. We think total compensation is more important but we note that the CEO salary is lower, at US$1.2m. We looked at a group of companies with market capitalizations over US$8.0b and the median CEO compensation was US$11m. Once you start looking at very large companies, you need to take a broader range, because there simply aren't that many of them.

So Mike McMullen is paid around the average of the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance.

You can see a visual representation of the CEO compensation at Agilent Technologies, below.

Is Agilent Technologies, Inc. Growing?

Over the last three years Agilent Technologies, Inc. has grown its earnings per share (EPS) by an average of 7.2% per year (using a line of best fit). It achieved revenue growth of 8.0% over the last year.

I'm not particularly impressed by the revenue growth, but the modest improvement in EPS is good. Considering these factors I'd say performance has been pretty decent, though not amazing. It could be important to check this free visual depiction of what analysts expect for the future.

Has Agilent Technologies, Inc. Been A Good Investment?

Boasting a total shareholder return of 116% over three years, Agilent Technologies, Inc. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Mike McMullen is paid around what is normal the leaders of larger companies.

While we would like to see improved growth metrics, there is no doubt that the total returns have been great, over the last three years. So all things considered I'd venture that the CEO pay is appropriate. Whatever your view on compensation, you might want to check if insiders are buying or selling Agilent Technologies shares (free trial).

Important note: Agilent Technologies may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives