- United States

- /

- Life Sciences

- /

- NYSE:A

Agilent Technologies (A): Evaluating Valuation After Earnings Beat and FDA Approval Boost

Reviewed by Simply Wall St

Most Popular Narrative: 11.6% Undervalued

According to the community narrative, Agilent Technologies is currently viewed as undervalued by 11.6%. This suggests the stock could have upside potential if analysts' assumptions play out.

The implementation of Agilent's Ignite transformation is expected to drive growth through new pricing mechanisms, an improved digital ecosystem, and procurement cost savings. The initiative aims to increase core revenues by 5-7% annually and expand operating margins by 50 to more than 100 basis points per year, thus enhancing revenue and net margins.

Curious about the math behind that double-digit upside? The real question is which growth levers drive such a bullish projection and what assumptions make this price target possible. Want to know how ambitious revenue targets and stringent profit benchmarks stack up? The detailed narrative breaks down every key forecast behind this valuation and examines how high this ceiling could go.

Result: Fair Value of $137.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing currency headwinds and uncertainty around budget allocations in key regions could limit Agilent’s projected growth and challenge the bullish outlook.

Find out about the key risks to this Agilent Technologies narrative.Another View: The SWS DCF Model

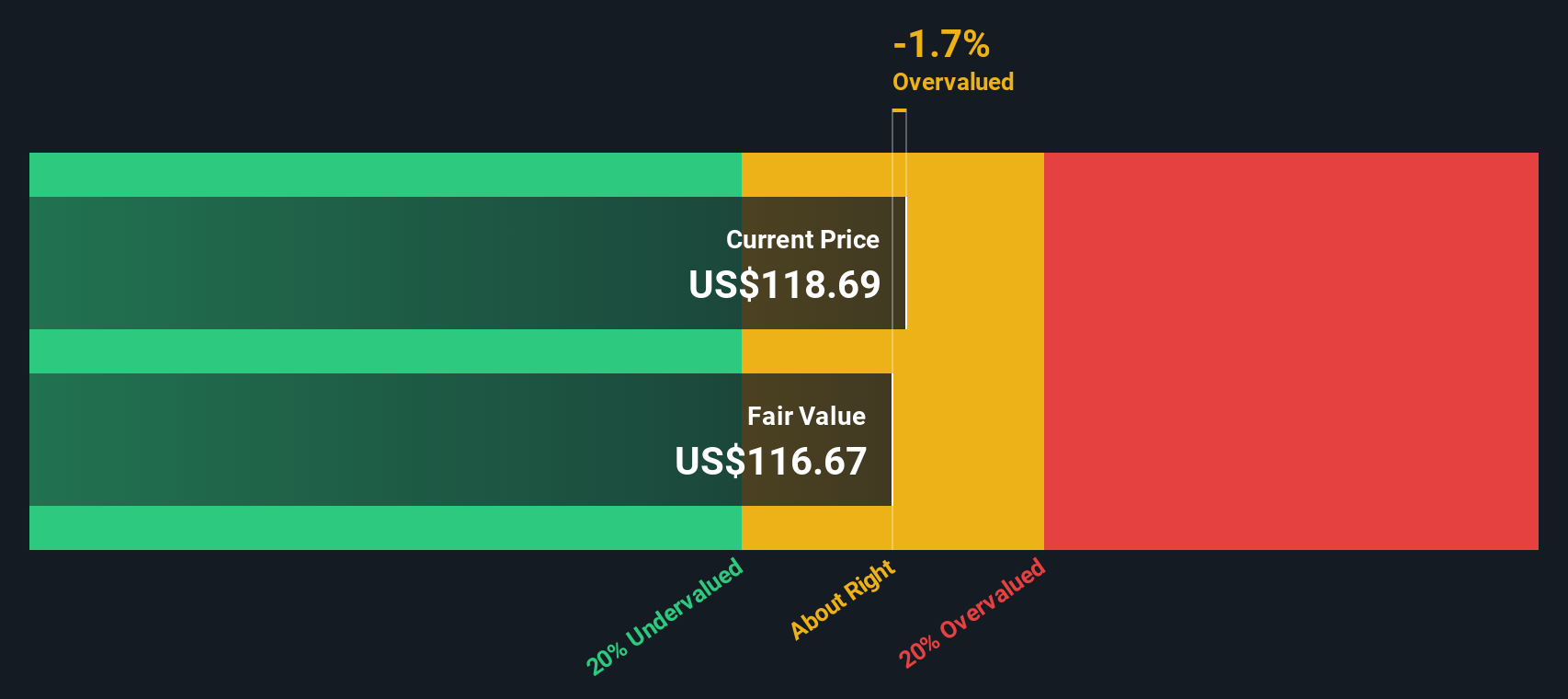

Another way to look at Agilent's value is with our DCF model, which takes a closer look at its expected cash flows. This method offers a different perspective and raises key questions about the growth outlook.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Agilent Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Agilent Technologies Narrative

If you want to dig into the details and reach your own conclusions, you can easily craft a personal view in just a few minutes. So why not do it your way?

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Agilent Technologies.

Looking for More Smart Investment Opportunities?

Why limit yourself to just one stock? Use the Simply Wall Street Screener to pinpoint game-changing investment ideas that can give your portfolio an edge. Don’t stand by while others seize the latest financial breakthroughs. Take action and stay ahead with handpicked opportunities right now:

- Uncover companies harnessing the future of medicine by spotting breakthroughs in AI-driven healthcare advancements with healthcare AI stocks.

- Boost your long-term returns by targeting companies offering robust yields. Check out a curated group of reliable picks with dividend stocks with yields > 3%.

- Seize value where others overlook it by searching for shares still trading below their cash flow potential, thanks to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives