- United States

- /

- Biotech

- /

- NasdaqGS:ZYME

Zymeworks (ZYME) Is Up 13.8% After Positive Zanidatamab Trial and Share Buyback Plan - What's Changed

Reviewed by Sasha Jovanovic

- Zymeworks Inc. recently announced positive topline results from its Phase 3 HERIZON-GEA-01 trial of its lead HER2-targeted antibody, zanidatamab, for first-line treatment of HER2-positive gastroesophageal adenocarcinoma, alongside a new share repurchase program of up to US$125 million and leadership changes including the appointment of an Acting Chief Investment Officer.

- A unique aspect is Zymeworks’ ongoing shift toward a royalty-driven business model, leveraging major partnerships and clinical assets to bolster future cash flows and financial flexibility.

- We'll examine how the robust Phase 3 trial outcomes for zanidatamab and the share repurchase plan influence Zymeworks’ investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Zymeworks Investment Narrative Recap

To be a shareholder in Zymeworks, you need to believe in the company’s ability to deliver long-term value from its royalty-driven model and successful partnerships, especially as assets like zanidatamab advance through late-stage trials. The latest positive Phase 3 results for zanidatamab are a meaningful step toward near-term regulatory and commercial catalysts, though the biggest risk remains the dependency on partner execution and royalty milestones. If any setbacks emerge with these collaborations, this could materially affect expected revenue, but, for now, the topline data supports the primary investment thesis.

Of the recent announcements, the new US$125 million share repurchase program stands out, as it may reflect management’s confidence in further value creation following the zanidatamab trial data. While share buybacks alone do not address Zymeworks’ reliance on partner milestones, they can reinforce financial flexibility and signal a commitment to shareholder value at a moment when successful trial outcomes are front of mind.

Yet, despite these advancements, investors should be aware that risks tied to partner royalties and milestone payments could...

Read the full narrative on Zymeworks (it's free!)

Zymeworks' narrative projects $150.9 million in revenue and $24.2 million in earnings by 2028. This requires 7.1% yearly revenue growth and a $97.9 million increase in earnings from the current level of -$73.7 million.

Uncover how Zymeworks' forecasts yield a $34.20 fair value, a 25% upside to its current price.

Exploring Other Perspectives

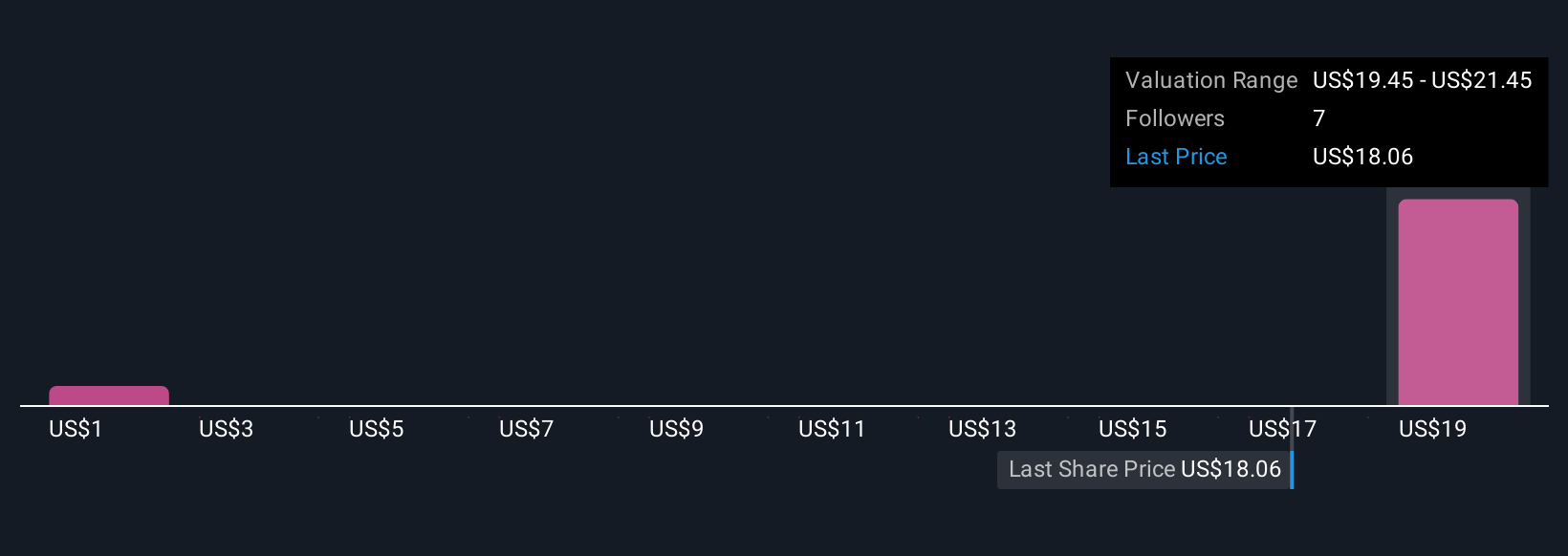

Fair value estimates from the Simply Wall St Community range from US$1.43 to US$34.20, based on two independent analyses. While this reflects sharply different expectations, reliance on milestone payments and royalties remains a central risk affecting Zymeworks’ performance and outlook.

Explore 2 other fair value estimates on Zymeworks - why the stock might be worth as much as 25% more than the current price!

Build Your Own Zymeworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zymeworks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zymeworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zymeworks' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zymeworks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZYME

Zymeworks

A clinical-stage biotechnology company, discovers, develops, and commercializes biotherapeutics for the treatment of cancer, and autoimmune and inflammatory diseases (AIID).

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.