- United States

- /

- Biotech

- /

- NasdaqGS:ZYME

Zymeworks Inc.'s (NASDAQ:ZYME) 27% Share Price Surge Not Quite Adding Up

Zymeworks Inc. (NASDAQ:ZYME) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 46%.

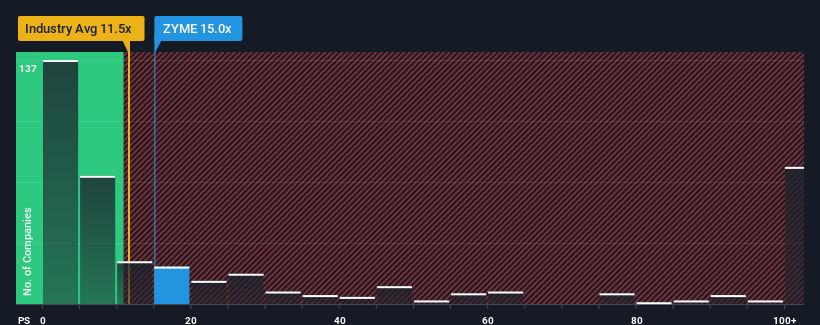

Following the firm bounce in price, Zymeworks may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 15x, since almost half of all companies in the Biotechs in the United States have P/S ratios under 11.5x and even P/S lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Zymeworks

What Does Zymeworks' Recent Performance Look Like?

Zymeworks hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zymeworks.How Is Zymeworks' Revenue Growth Trending?

In order to justify its P/S ratio, Zymeworks would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 89%. Even so, admirably revenue has lifted 61% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 35% per annum during the coming three years according to the eight analysts following the company. With the industry predicted to deliver 193% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Zymeworks is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Zymeworks' P/S

Zymeworks' P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Zymeworks trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 3 warning signs for Zymeworks (1 doesn't sit too well with us!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zymeworks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZYME

Zymeworks

A clinical-stage biotechnology company, discovers, develops, and commercializes biotherapeutics for the treatment of cancer, and autoimmune and inflammatory diseases (AIID).

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives