- United States

- /

- Pharma

- /

- NasdaqGS:ZVRA

Here's What Analysts Are Forecasting For Zevra Therapeutics, Inc. (NASDAQ:ZVRA) After Its Third-Quarter Results

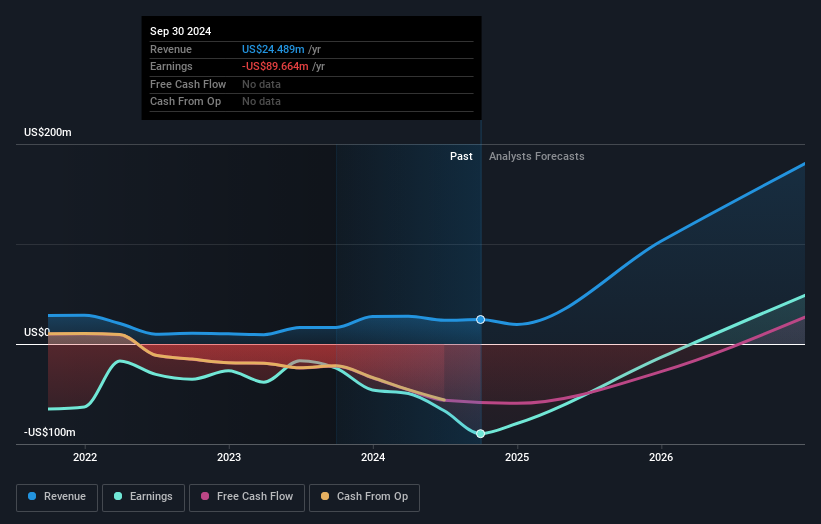

As you might know, Zevra Therapeutics, Inc. (NASDAQ:ZVRA) last week released its latest third-quarter, and things did not turn out so great for shareholders. Statutory earnings fell substantially short of expectations, with revenues of US$3.7m missing forecasts by 24%. Losses exploded, with a per-share loss of US$0.69 some 64% below prior forecasts. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Zevra Therapeutics

Following the latest results, Zevra Therapeutics' eight analysts are now forecasting revenues of US$102.7m in 2025. This would be a sizeable 319% improvement in revenue compared to the last 12 months. Losses are predicted to fall substantially, shrinking 87% to US$0.22. Before this earnings announcement, the analysts had been modelling revenues of US$98.0m and losses of US$0.35 per share in 2025. So it seems there's been a definite increase in optimism about Zevra Therapeutics' future following the latest consensus numbers, with a very promising decrease in the loss per share forecasts in particular.

Despite these upgrades,the analysts have not made any major changes to their price target of US$20.14, implying that their latest estimates don't have a long term impact on what they think the stock is worth. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Zevra Therapeutics at US$25.00 per share, while the most bearish prices it at US$15.00. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Zevra Therapeutics shareholders.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analysts are definitely expecting Zevra Therapeutics' growth to accelerate, with the forecast 215% annualised growth to the end of 2025 ranking favourably alongside historical growth of 6.9% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 10% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Zevra Therapeutics to grow faster than the wider industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. The consensus price target held steady at US$20.14, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Zevra Therapeutics going out to 2026, and you can see them free on our platform here..

You still need to take note of risks, for example - Zevra Therapeutics has 1 warning sign we think you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if Zevra Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ZVRA

Zevra Therapeutics

A commercial-stage company, focuses on addressing unmet needs for the treatment of rare diseases in the United States.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026