- United States

- /

- Pharma

- /

- NasdaqGS:ZVRA

Do Zevra Therapeutics' (ZVRA) Latest Rare Disease Data Presentations Signal a Shifting Market Position?

Reviewed by Simply Wall St

- Zevra Therapeutics recently presented new and existing clinical data on MIPLYFFA (arimoclomol) for Niemann-Pick disease type C and OLPRUVA (sodium phenylbutyrate) for urea cycle disorders at major medical conferences, including the INPDA Face-to-Face Meeting and Child Neurology Society Annual Meeting.

- The presentation of extensive data from the largest clinical development program in Niemann-Pick disease type C, combined with updates on OLPRUVA, highlights Zevra's expanding leadership in rare disease therapies and ongoing regulatory review in Europe.

- We will examine how these latest clinical data presentations and European regulatory developments impact Zevra's position in the rare disease therapy market.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Zevra Therapeutics Investment Narrative Recap

For shareholders in Zevra Therapeutics, belief centers on the company’s ability to expand its presence in rare disease therapies, particularly through MIPLYFFA for Niemann-Pick disease type C, while balancing the risks of a concentrated product portfolio and variable international market access. The latest presentations of new and existing clinical data, while affirming Zevra’s clinical leadership, do not fundamentally alter the near-term catalyst: the pending European regulatory decision for MIPLYFFA, nor do they mitigate the ongoing risk of slow OLPRUVA adoption and its impact on revenue diversification. The recent oral and poster presentations at top global conferences are especially relevant, as they spotlight the scope of MIPLYFFA’s clinical program just as the Marketing Authorization Application undergoes review by the European Medicines Agency. This announcement reinforces Zevra’s pursuit of geographic expansion, a key near-term growth catalyst, given the limited US patient pool and the need for broader reimbursement pathways. However, investors should also keep in mind, in contrast, that the outlook could shift substantially if Europe’s reimbursement hurdles for MIPLYFFA prove tougher than expected...

Read the full narrative on Zevra Therapeutics (it's free!)

Zevra Therapeutics is expected to generate $296.5 million in revenue and $151.4 million in earnings by 2028. This outlook assumes annual revenue growth of 68.5% and an earnings increase of $155.3 million from the current earnings of -$3.9 million.

Uncover how Zevra Therapeutics' forecasts yield a $23.22 fair value, a 192% upside to its current price.

Exploring Other Perspectives

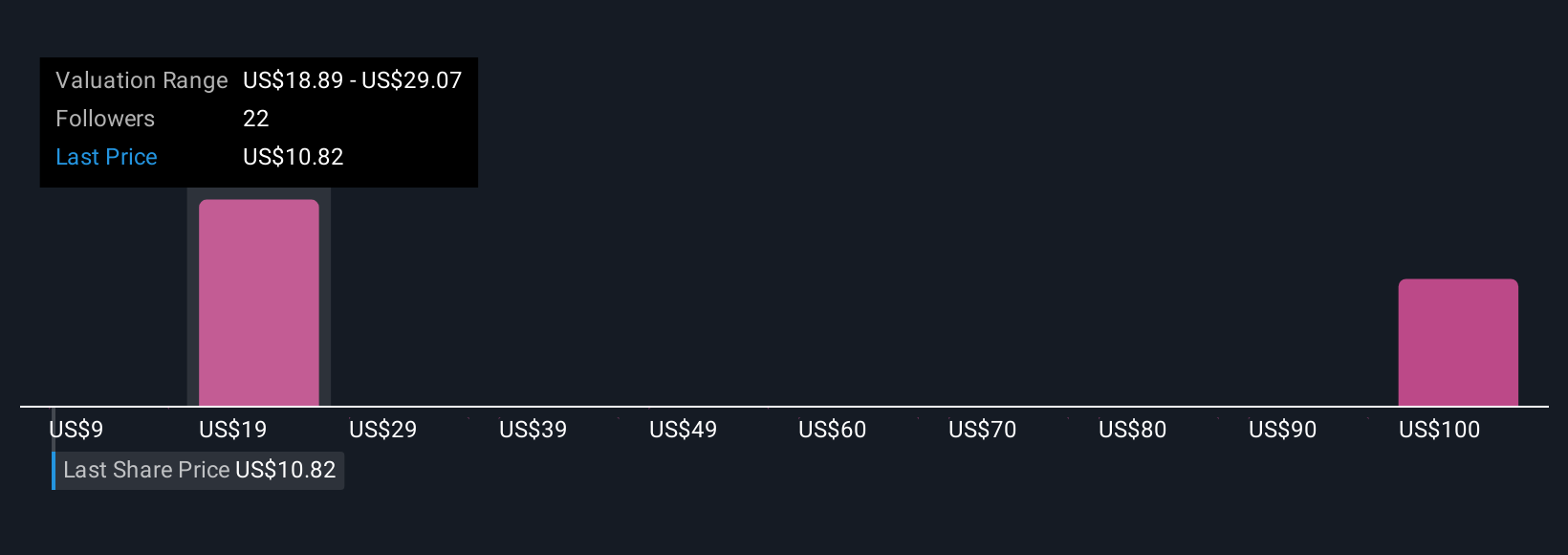

Six retail investors in the Simply Wall St Community place Zevra’s fair value between US$8.71 and US$110.52, spanning a broad range of opinions. With the company’s growth prospects tied to European MIPLYFFA reimbursement, these perspectives highlight just how differently market participants weigh Zevra’s future performance.

Explore 6 other fair value estimates on Zevra Therapeutics - why the stock might be worth just $8.71!

Build Your Own Zevra Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zevra Therapeutics research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Zevra Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zevra Therapeutics' overall financial health at a glance.

No Opportunity In Zevra Therapeutics?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zevra Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZVRA

Zevra Therapeutics

A commercial-stage company, focuses on addressing unmet needs for the treatment of rare diseases in the United States.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives