- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

Here's Why We're Not Too Worried About Zai Lab's (NASDAQ:ZLAB) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Zai Lab (NASDAQ:ZLAB) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Zai Lab

When Might Zai Lab Run Out Of Money?

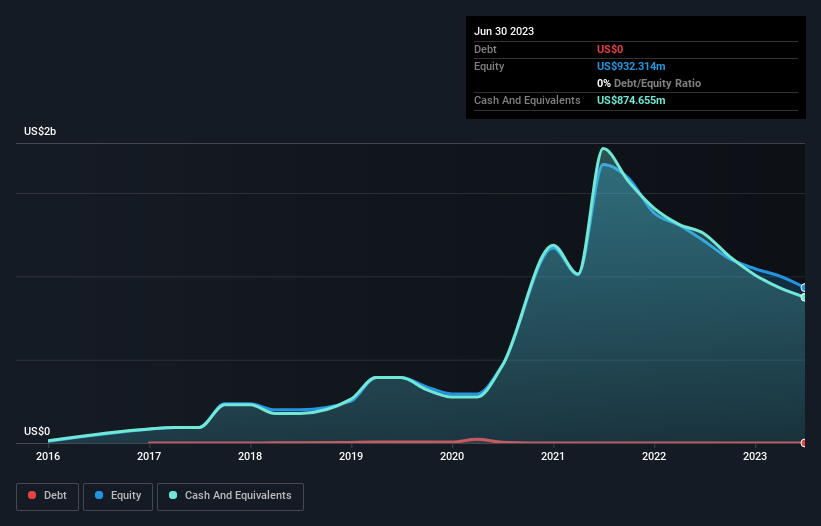

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When Zai Lab last reported its balance sheet in June 2023, it had zero debt and cash worth US$875m. In the last year, its cash burn was US$371m. Therefore, from June 2023 it had 2.4 years of cash runway. Importantly, analysts think that Zai Lab will reach cashflow breakeven in 3 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is Zai Lab Growing?

It was fairly positive to see that Zai Lab reduced its cash burn by 21% during the last year. And considering that its operating revenue gained 38% during that period, that's great to see. It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Zai Lab To Raise More Cash For Growth?

We are certainly impressed with the progress Zai Lab has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$2.4b, Zai Lab's US$371m in cash burn equates to about 16% of its market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is Zai Lab's Cash Burn A Worry?

The good news is that in our view Zai Lab's cash burn situation gives shareholders real reason for optimism. One the one hand we have its solid cash runway, while on the other it can also boast very strong revenue growth. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. An in-depth examination of risks revealed 2 warning signs for Zai Lab that readers should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zai Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ZLAB

Zai Lab

A biopharmaceutical company, focuses on discovering, developing, and commercializing products that address medical conditions in the areas of oncology, immunology, neuroscience, and infectious diseases.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion