- United States

- /

- Biotech

- /

- NasdaqGM:XNCR

Xencor (XNCR) Presents Early XmAb819 Data Could This Shape Its Long-Term Pipeline Strategy?

Reviewed by Sasha Jovanovic

- Xencor recently announced initial results from its ongoing Phase 1 study evaluating XmAb819, a bispecific antibody targeting advanced clear cell renal cell carcinoma, with details shared at the AACR-NCI-EORTC Conference in Boston.

- The XmAb 2+1 format employed in XmAb819 is designed to more selectively target tumor cells while potentially sparing normal tissue, representing a significant innovation in T-cell engagers for difficult-to-treat cancers.

- We'll examine how Xencor's clinical progress with XmAb819 could impact the company's long-term pipeline growth prospects and differentiation.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Xencor Investment Narrative Recap

To be a shareholder in Xencor, you generally need confidence in its ability to advance innovative antibody therapies like XmAb819 and XmAb942, translating pipeline progress into future marketable products. The recent preliminary data from the Phase 1 XmAb819 trial may increase interest in pipeline expansion, but does not yet materially change the most important near-term catalyst, which remains XmAb942 in IBD, or mitigate the key risk of costly, independent late-stage clinical trials with uncertain commercialization outcomes.

Of the company's recent developments, the April 2025 interim results for XmAb942 in inflammatory bowel diseases are especially relevant for investors, as this program represents Xencor's primary late-stage asset and a major driver of expected revenue growth. Its performance will likely be more impactful for near-term business prospects, especially as competition in the IBD segment intensifies and clinical trial efficiency becomes critical.

However, with the growing pressure to efficiently execute and differentiate in a crowded trial setting, investors should be especially mindful that...

Read the full narrative on Xencor (it's free!)

Xencor's outlook anticipates $180.3 million in revenue and $29.0 million in earnings by 2028. This assumes a 7.1% annual growth rate in revenue and an earnings increase of $200.1 million from current earnings of -$171.1 million.

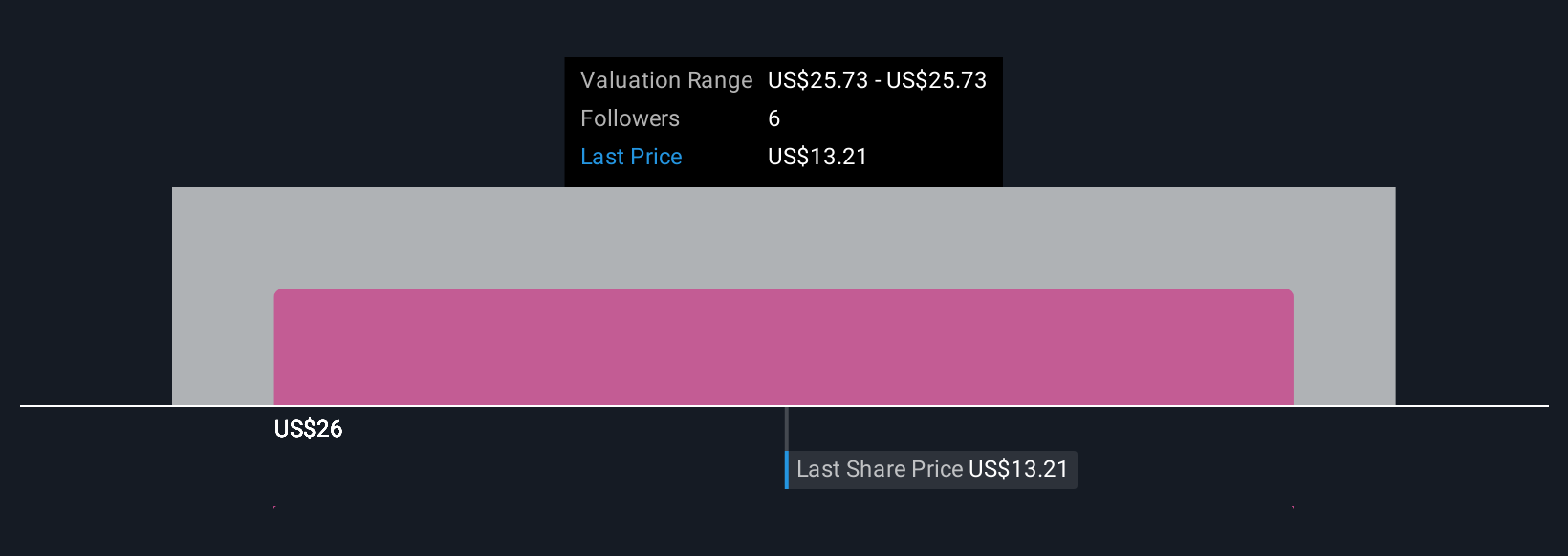

Uncover how Xencor's forecasts yield a $25.73 fair value, a 75% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put Xencor’s fair value at US$25.73, with one estimate so far. Consider how risks around rising clinical trial complexity may affect the company’s future revenue and earnings, and explore additional viewpoints on the stock for a broader perspective.

Explore another fair value estimate on Xencor - why the stock might be worth as much as 75% more than the current price!

Build Your Own Xencor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xencor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Xencor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xencor's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XNCR

Xencor

A clinical-stage biopharmaceutical company, focuses on the discovery and development of engineered monoclonal antibodies for the treatment of asthma and allergic diseases, autoimmune diseases, and cancer.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives