- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Xeris Biopharma (XERS): Valuation Insights After New Recorlev Patent, Profit Boost, and 2025 Outlook Upgrade

Reviewed by Simply Wall St

Xeris Biopharma Holdings (XERS) just reported an impressive quarter, swinging to a profit alongside strong revenue growth and raising its outlook for 2025. The company also secured a new patent for its Recorlev treatment, which extends protection against future generics.

See our latest analysis for Xeris Biopharma Holdings.

After a stellar year, Xeris Biopharma’s recent quarter added to the momentum, as improving fundamentals and a new patent gave investors plenty to cheer about. Despite last month’s 22% slide in the share price, the stock’s 107% year-to-date share price return and remarkable 146% total shareholder return over the past 12 months highlight strong ongoing interest from the market and a major shift in sentiment compared to previous years.

If Xeris’ turnaround and growth story intrigued you, it’s a great time to explore other healthcare names making waves with innovation and upside. See the full list for free.

With shares still trading at a notable discount to analyst targets, even after significant gains, investors may be wondering if Xeris Biopharma remains undervalued or if the market has already priced in its future growth potential.

Most Popular Narrative: 32.7% Undervalued

With Xeris Biopharma's fair value estimate from the most widely followed narrative standing at $10.67, the last close of $7.18 points to a large valuation gap. The bullish outlook hinges on powerful catalysts, making this gap hard to ignore.

Continued investment in expanding the commercial footprint, enhancing patient support, and deepening engagement with healthcare professionals positions Xeris to capture a larger share of the growing at-home and patient-centric treatment market. This strategy supports both revenue growth and improved SG&A leverage.

Curious about what’s sparking this bold price target? Dive into the narrative’s blueprint for explosive growth, margin expansion, and a future profit multiple that could surpass the industry average. Examine the assumptions that shape this forecast; some numbers may surprise you.

Result: Fair Value of $10.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a limited product lineup and rising development costs could threaten Xeris Biopharma’s growth if market conditions shift unexpectedly.

Find out about the key risks to this Xeris Biopharma Holdings narrative.

Another View: Sizing Up Value from a Multiples Perspective

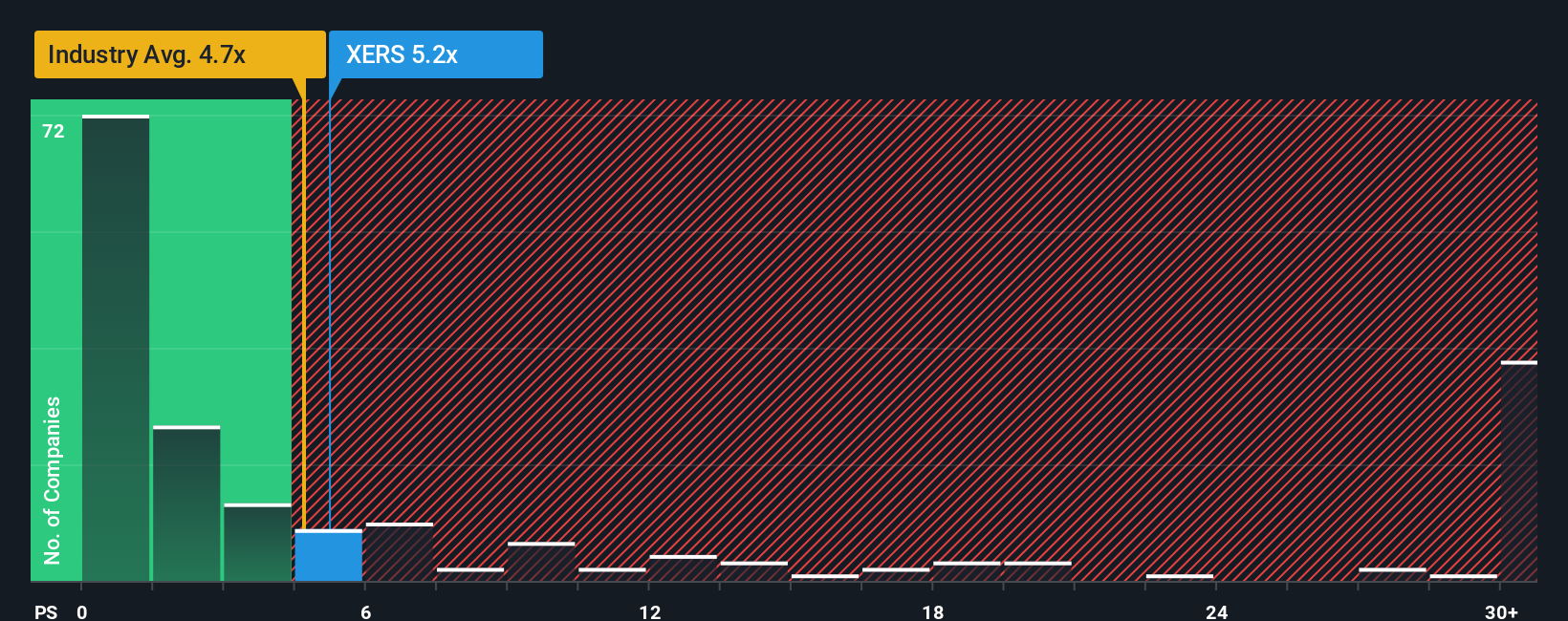

While the fair value estimate sees Xeris Biopharma as significantly undervalued, a look at its price-to-sales ratio presents a more cautious take. The company's ratio stands at 4.5x, which is higher than both the industry average of 4x and its peer average of 2.8x. This suggests the stock is expensive by this metric, despite fundamentals. With the fair ratio at 6.4x, could the market eventually close this gap, or is there valuation risk to consider?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xeris Biopharma Holdings Narrative

If you have a different perspective or want to investigate the numbers on your own terms, it’s quick and easy to craft your own narrative. Do it your way

A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Stop limiting yourself to just one stock; take action now to uncover diverse investment ideas that could amplify your returns and expand your portfolio potential.

- Accelerate your portfolio’s growth by scanning these 25 AI penny stocks, which are set to transform industries with advanced automation, machine learning, and artificial intelligence solutions.

- Maximize your income strategy by tapping into these 16 dividend stocks with yields > 3%, a group of stable companies delivering consistent yields above 3%.

- Ride the next tech wave by spotting these 82 cryptocurrency and blockchain stocks that are driving innovation in decentralized finance, digital assets, and secure transaction technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Reasonable growth potential and fair value.

Market Insights

Community Narratives