- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Xeris Biopharma Holdings (XERS): Evaluating Valuation After a Strong Share Price Rally

Reviewed by Simply Wall St

Xeris Biopharma Holdings (XERS) has been catching the eye of investors recently, especially after a strong run in its stock price over the past several months. With attention on its financial results and growth figures, many are looking closer at what might come next for the company.

See our latest analysis for Xeris Biopharma Holdings.

Momentum has been strong for Xeris Biopharma Holdings, with a share price rally of 84% over the past 90 days and a huge 166% gain so far this year. Even more impressive, the company has delivered a 185% total shareholder return in the past twelve months, signaling that buyers see real upside and are increasingly optimistic about long-term prospects.

If this kind of growth story sparks your interest, it might be the perfect opportunity to check out other promising healthcare stocks using our screener: See the full list for free.

With such a strong rally behind it, investors are left to wonder if Xeris Biopharma Holdings is currently undervalued with room left to run, or if the market has already factored in its future growth potential.

Most Popular Narrative: 2% Overvalued

At a last close price of $9.21, Xeris Biopharma Holdings trades slightly above the consensus fair value estimate of $9.00, setting the stage for a deeper exploration into what drives this premium. Behind the headline price target are some bold expectations about margins and future revenues that could reshape how investors view the company.

Persistent high gross margins, alongside scaling sales of Gvoke, Recorlev, and Keveyis, set the stage for operational leverage and sustainable EBITDA and net margin improvements as revenue expands and expense ratios decline over time.

Curious why analysts see sustained margin growth and top-line gains setting the valuation here? There is a controversial profit forecast and an ambitious multiple at work, crucial details only revealed when you read the full narrative.

Result: Fair Value of $9.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few core products and potential competition remain key risks. These factors could quickly challenge the growth outlook for Xeris Biopharma Holdings.

Find out about the key risks to this Xeris Biopharma Holdings narrative.

Another View: Discounted Cash Flow Signals Deep Value

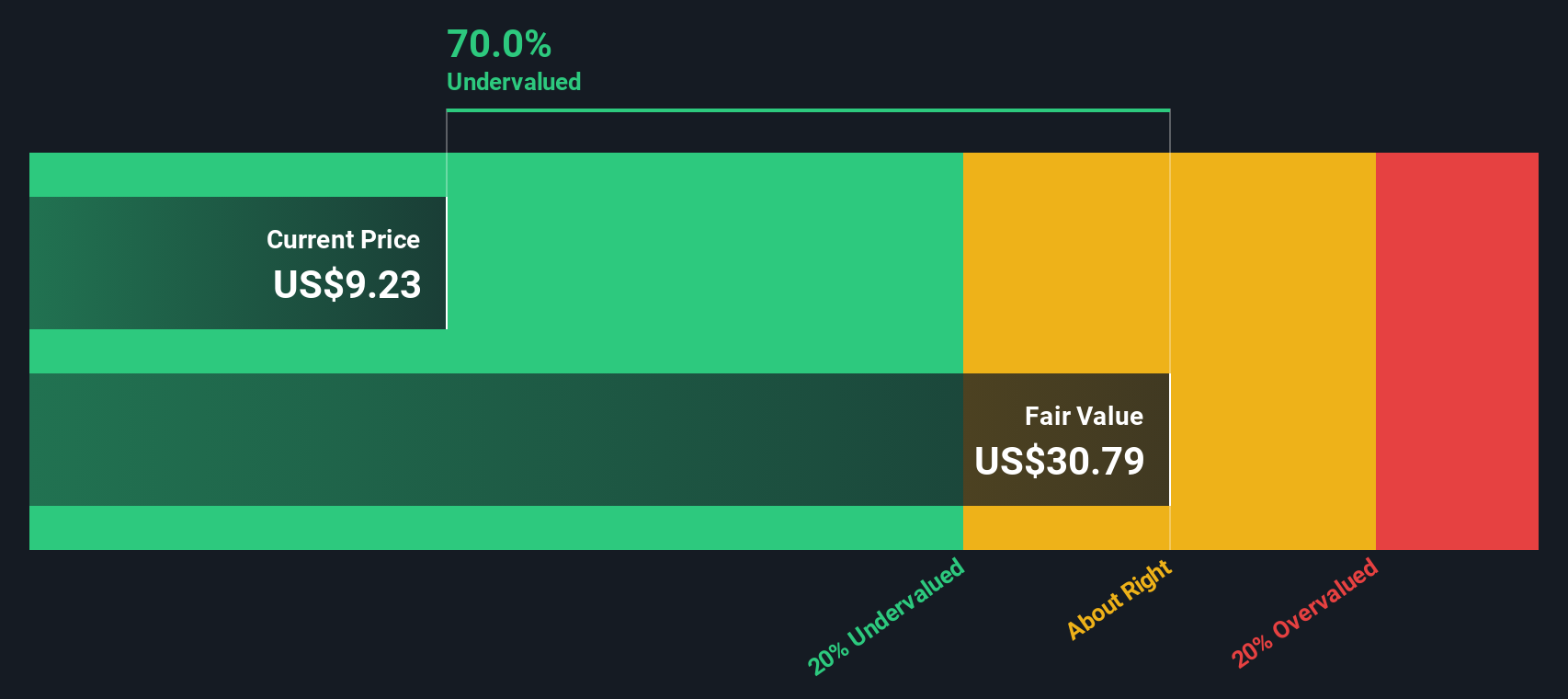

While analysts view Xeris Biopharma Holdings as slightly overvalued based on price targets and multiples, our SWS DCF model arrives at a dramatically different conclusion. According to this cash flow-focused analysis, shares are trading nearly 70% below intrinsic fair value. Is the market overlooking something significant, or does this underscore the challenges in forecasting future cash flows for a company like Xeris?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Xeris Biopharma Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Xeris Biopharma Holdings Narrative

If you see the story differently or want to dig deeper into the numbers, you can quickly build your own perspective in just a few minutes. Do it your way.

A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss the chance to uncover fresh opportunities. Some of the best future winners might be outside your current radar. Be proactive and check out more stock ideas now.

- Start generating passive income and build wealth by reviewing these 17 dividend stocks with yields > 3%, featuring stocks offering market-beating yields.

- Spot emerging trends in AI by checking out these 27 AI penny stocks, where innovation drives potential for rapid growth.

- Stay ahead of the curve by evaluating these 28 quantum computing stocks, home to pioneering companies at the cutting edge of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Reasonable growth potential and fair value.

Market Insights

Community Narratives