- United States

- /

- Biotech

- /

- NasdaqGM:XENE

Xenon Pharmaceuticals (XENE): Evaluating Valuation as New Epilepsy and Dravet Data Draw Investor Attention

Reviewed by Simply Wall St

Xenon Pharmaceuticals (XENE) is preparing to present a series of research updates at the American Epilepsy Society Annual Meeting. The company will feature new long-term data on its key drug candidates for epilepsy and Dravet syndrome.

See our latest analysis for Xenon Pharmaceuticals.

After gaining attention with its AES meeting announcement, Xenon Pharmaceuticals has seen its momentum build, posting a 15.3% 90-day share price return and an impressive 3-year total shareholder return of 20.6%. Short-term price gains reflect rising optimism, while long-term returns remain solid for a biotech at this stage.

Curious about other innovative companies with big healthcare ambitions? Now is a good moment to explore new ideas with our See the full list for free.

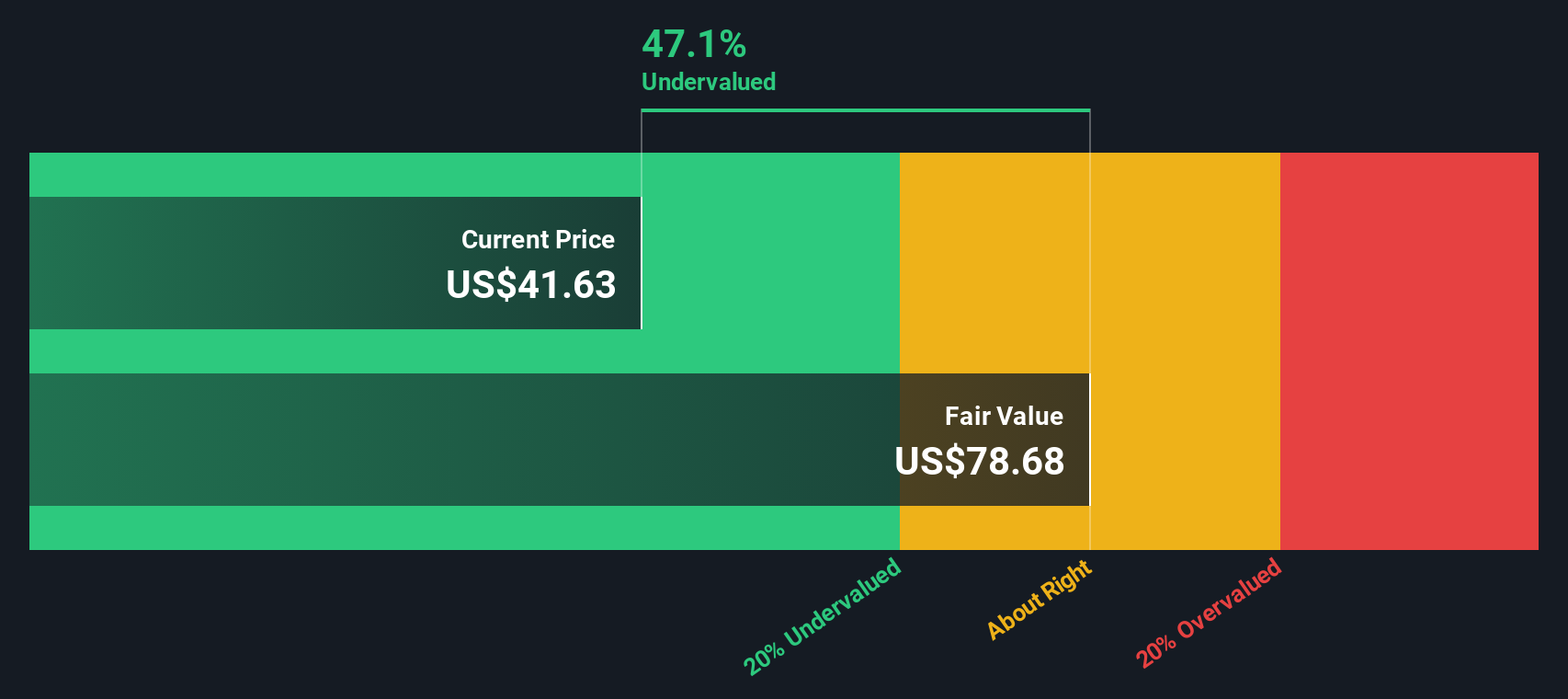

With robust clinical updates ahead and shares trading about 24 percent below average analyst targets, investors are left weighing whether Xenon is attractively undervalued or if the market has already factored in future clinical successes.

Price-to-Book of 6.1x: Is it justified?

Compared to its current share price of $44.49, Xenon Pharmaceuticals trades at a price-to-book ratio of 6.1x, which markets are pricing as a significant premium to both direct peers and the wider biotech industry.

The price-to-book ratio measures a company’s market value relative to its book value. For biopharmaceutical companies like Xenon, this multiple often reflects expectations around future pipeline breakthroughs, asset value, and clinical progress.

At 6.1x, Xenon’s valuation exceeds the peer group average of 5.6x, and is far above the US Biotechs industry average of 2.7x. This indicates that investors have bid up the stock more aggressively than for similar companies, signaling heightened expectations for the company’s clinical programs or market potential.

Despite this, there is insufficient data to determine a fair price-to-book ratio level using regression or other valuation methodologies. This makes it difficult to justify such a premium from a fundamentals perspective or to see if the market could move back towards a more "normal" level.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 6.1x (OVERVALUED)

However, risks remain if clinical milestones disappoint or if market enthusiasm fades. This could potentially challenge the current valuation narrative for Xenon Pharmaceuticals.

Find out about the key risks to this Xenon Pharmaceuticals narrative.

Another View: Our DCF Model Puts the Valuation in Perspective

Looking beyond market multiples, the SWS DCF model offers its own take on Xenon Pharmaceuticals' value. According to this model, Xenon's current share price of $44.49 sits above our estimate of fair value at $32.73. This suggests that the stock could be overvalued based on future cash flow assumptions. Does this cast doubt on the optimism reflected in today's share price, or is there more upside that the market sees beyond the model?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Xenon Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Xenon Pharmaceuticals Narrative

If you have a different perspective or want to develop your own view, you can quickly dive into the data and share your personal thesis in just a few minutes with Do it your way.

A great starting point for your Xenon Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your potential returns to just one stock. Take the reins and explore other high-potential opportunities with our favorite investing tools:

- Uncover the next wave of transformative tech companies by checking out these 25 AI penny stocks emerging as leaders in artificial intelligence and automation.

- Boost your passive income with these 15 dividend stocks with yields > 3% featuring companies offering solid yields and stable payouts above 3 percent.

- Stay ahead of the market by reviewing these 932 undervalued stocks based on cash flows with businesses trading below their fair value based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XENE

Xenon Pharmaceuticals

A neuroscience-focused biopharmaceutical company, engages in the discovery, development, and delivery of therapeutics to treat patients with neurological and psychiatric disorders in Canada.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success