- United States

- /

- Biotech

- /

- NasdaqGM:XENE

Xenon Pharmaceuticals (XENE): Evaluating Valuation After Bringing on Veteran CFO Tucker Kelly

Reviewed by Simply Wall St

Xenon Pharmaceuticals (XENE) recently named Tucker Kelly as its new Chief Financial Officer, effective October 15. Kelly’s track record guiding other life science companies through commercialization makes this a development worth watching, especially with Xenon’s lead candidate in late-stage trials.

See our latest analysis for Xenon Pharmaceuticals.

Xenon Pharmaceuticals’ headline-grabbing CFO appointment comes as the stock’s momentum has picked up noticeably. Its 90-day share price return is a strong 35.7%, though total shareholder return over the past year is essentially flat. Investors seem increasingly optimistic about progress in late-stage clinical trials and the path toward commercialization.

Curious where else renewed management or clinical news might reveal exciting opportunities? Take your research further with our healthcare growth screener: See the full list for free.

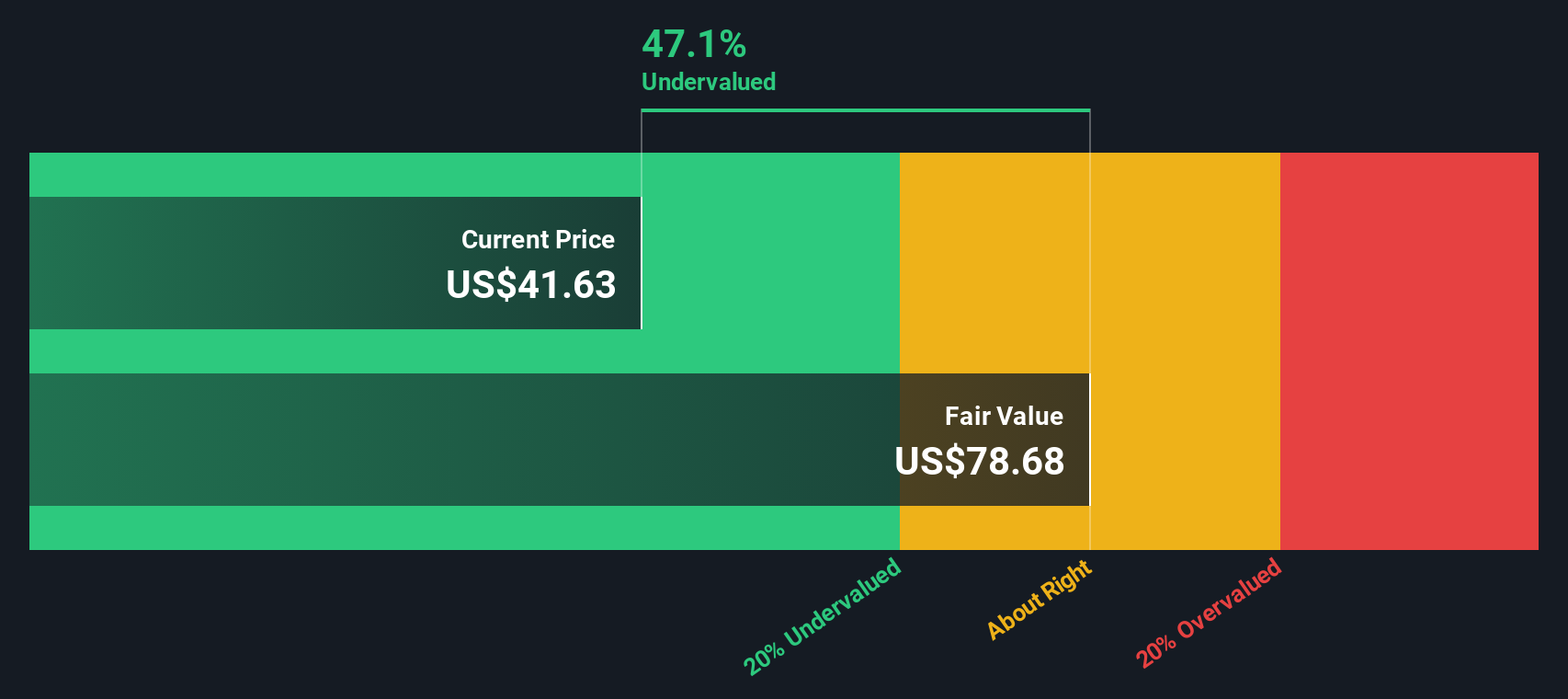

With the stock still trading at a significant discount to analyst price targets, the key question now is whether Xenon remains undervalued or if the market has already priced in the company’s next chapter of growth.

Price-to-Book of 5.1: Is it justified?

Xenon Pharmaceuticals’ shares trade at a price-to-book ratio of 5.1, notably higher than both its industry and peer group averages, despite still being well below some valuation targets. For context, the company closed at $41.89, while its price-to-book multiple appears expensive relative to the overall biotech landscape.

The price-to-book ratio compares a company's market price to its book value, essentially measuring how much investors are willing to pay for each dollar of net assets. For unprofitable biotechs in a late-stage development phase, this multiple can reflect belief in future breakthroughs and rapid revenue expansion. However, it may also highlight over-optimism if fundamentals do not catch up quickly.

With Xenon’s ratio at 5.1 versus a US biotechs industry average of 2.5 and its peer group average of 4.0, the stock trades at a substantial premium. The market is clearly pricing in optimistic expectations for progress in clinical trials and eventual commercialization. This goes well above the level that would reflect more typical sector risk and growth profiles based on asset value alone.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5.1 (OVERVALUED)

However, disappointing clinical trial outcomes or slower than expected commercialization progress could quickly challenge the optimism that is currently driving Xenon’s valuation premium.

Find out about the key risks to this Xenon Pharmaceuticals narrative.

Another View: Is the SWS DCF Model Too Optimistic?

While the price-to-book ratio paints Xenon Pharmaceuticals as overvalued, our SWS DCF model presents a very different perspective. According to this approach, Xenon is trading significantly below its estimated fair value of $78.37, which suggests the market may be underestimating its long-term potential. Could this gap present an opportunity, or is the market caution justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Xenon Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Xenon Pharmaceuticals Narrative

If you see the story differently or want to dig into the numbers yourself, you can uncover your perspective in just a few minutes, and Do it your way.

A great starting point for your Xenon Pharmaceuticals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop with just one opportunity. Some of the brightest stock stories are only visible if you look wider. Make your next move smarter by taking advantage of these powerful screeners before other investors do.

- Uncover strong cash flows and potential bargains when you compare companies with these 875 undervalued stocks based on cash flows relative to their future earnings.

- Target reliable income streams by browsing these 19 dividend stocks with yields > 3% that offer attractive yields above 3% for steady gains.

- Be early on the next tech surge with these 27 AI penny stocks that could benefit as artificial intelligence transforms entire markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XENE

Xenon Pharmaceuticals

A neuroscience-focused biopharmaceutical company, engages in the discovery, development, and delivery of therapeutics to treat patients with neurological and psychiatric disorders in Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives