- United States

- /

- Biotech

- /

- NasdaqGS:AUTL

November 2025's Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As the Dow Jones Industrial Average reaches an all-time high amid optimism over the potential end of a prolonged U.S. government shutdown, investors are keenly observing market dynamics and seeking opportunities across various sectors. Penny stocks, often seen as a gateway to investing in smaller or emerging companies, continue to hold allure for those looking for growth at accessible price points. Despite their historical reputation for volatility, penny stocks with strong financials and solid fundamentals can present unique opportunities for investors aiming to discover promising under-the-radar companies poised for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.77 | $387.89M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.68 | $600.36M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $4.24 | $715.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.96 | $56.46M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.15 | $26.73M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.54 | $594.93M | ✅ 4 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.80 | $1.01B | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.889 | $6.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.21 | $72.96M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 351 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Allogene Therapeutics (ALLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Allogene Therapeutics, Inc. is a clinical-stage immuno-oncology company focused on developing and commercializing genetically engineered allogeneic T cell therapies for cancer and autoimmune diseases, with a market cap of approximately $265.18 million.

Operations: Allogene Therapeutics, Inc. does not report any revenue segments as it is a clinical-stage company focused on developing genetically engineered allogeneic T cell therapies.

Market Cap: $265.18M

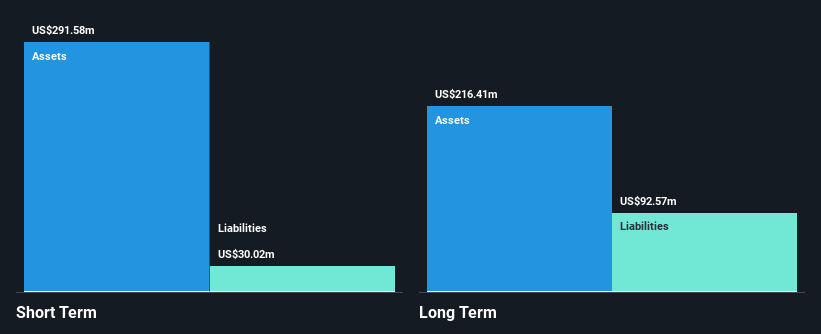

Allogene Therapeutics, Inc. is a pre-revenue clinical-stage biotech company focused on pioneering allogeneic CAR T therapies. Despite its negative return on equity and ongoing unprofitability, the company maintains a strong cash position with short-term assets significantly exceeding liabilities and no debt burden. Recent advancements include the pivotal Phase 2 ALPHA3 trial for LBCL treatment and the innovative ALLO-329 trial targeting autoimmune diseases without traditional lymphodepletion, both demonstrating potential to expand patient access to cell therapy. The company's management and board are experienced, providing strategic guidance as Allogene navigates these promising but high-risk developments in immuno-oncology.

- Navigate through the intricacies of Allogene Therapeutics with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Allogene Therapeutics' future.

Autolus Therapeutics (AUTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Autolus Therapeutics plc is a clinical-stage biopharmaceutical company focused on developing T cell therapies for cancer and autoimmune diseases, with a market cap of $351.31 million.

Operations: The company generates revenue of $29.93 million from its segment focused on developing and commercializing CAR-T therapies.

Market Cap: $351.31M

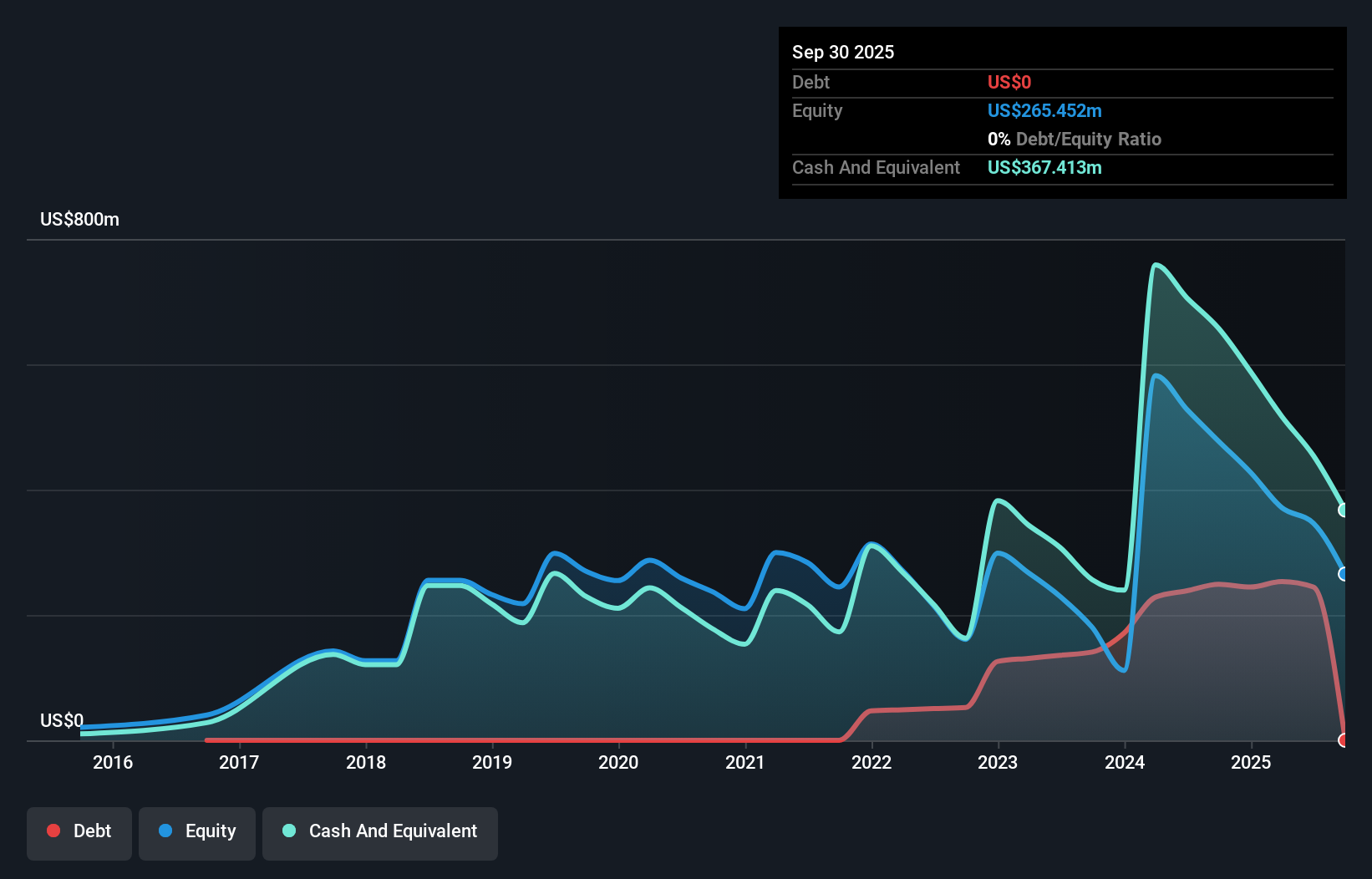

Autolus Therapeutics is a clinical-stage biopharmaceutical company focused on T cell therapies, with recent developments highlighting its progress in CAR-T treatments. Despite being unprofitable and experiencing increased losses over the past five years, it has made strides with FDA approval for AUCATZYL to treat B-cell precursor acute lymphoblastic leukemia. The company’s revenue of US$29.93 million reflects growth potential, though volatility remains high. Autolus' strategic alignment with the FDA for Phase 2 trials in lupus nephritis underscores its commitment to advancing its pipeline despite financial challenges and a negative return on equity.

- Get an in-depth perspective on Autolus Therapeutics' performance by reading our balance sheet health report here.

- Learn about Autolus Therapeutics' future growth trajectory here.

XBiotech (XBIT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XBiotech Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing true human monoclonal antibodies for treating various diseases, with a market cap of $74.69 million.

Operations: XBiotech Inc. has not reported any specific revenue segments.

Market Cap: $74.69M

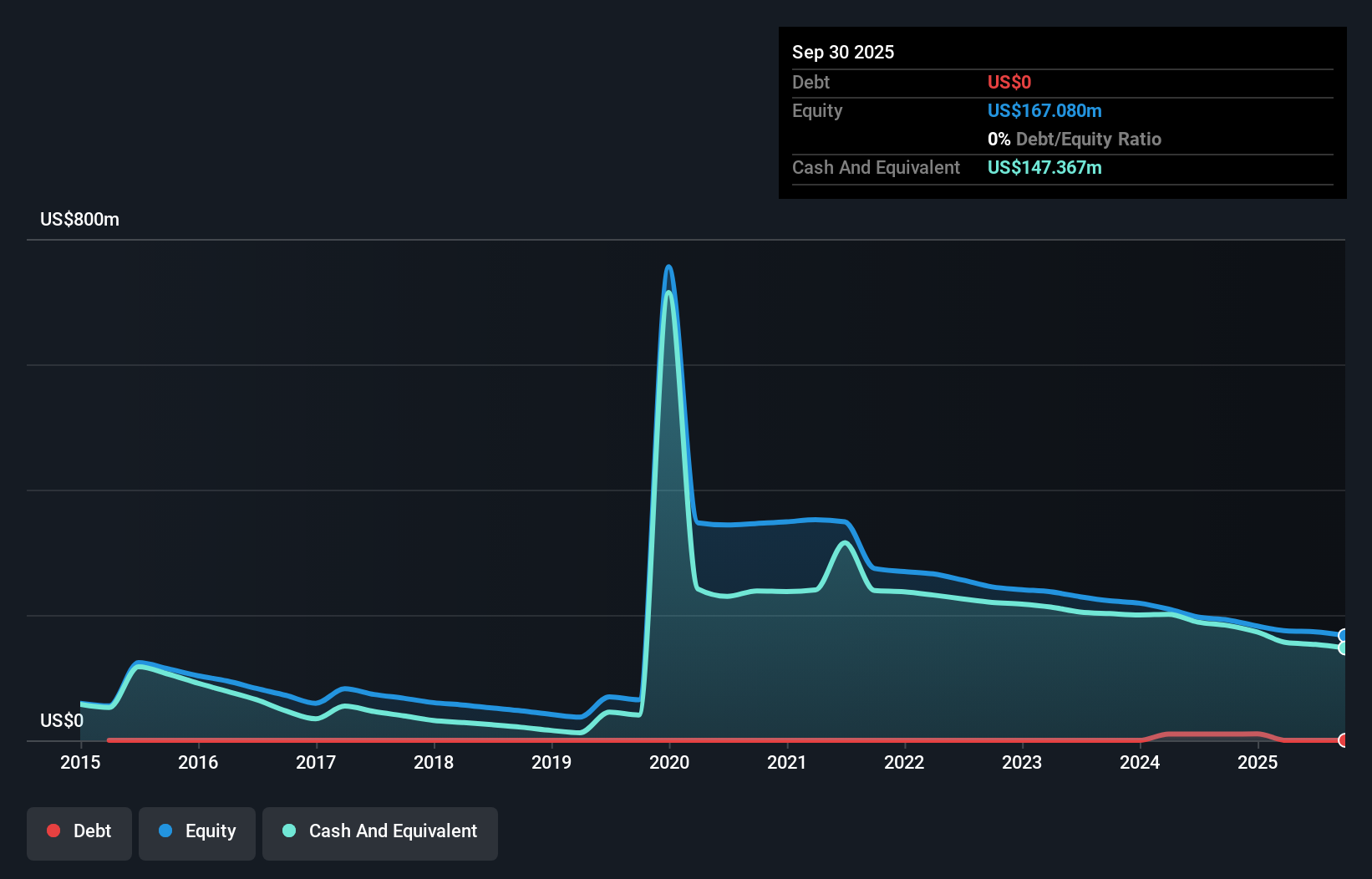

XBiotech Inc., a biopharmaceutical company, is pre-revenue with no significant revenue streams, and remains unprofitable with losses increasing by 83.2% annually over the past five years. Despite this, its financial stability is supported by short-term assets of US$154.9 million exceeding both short- and long-term liabilities. The company benefits from an experienced board and management team with average tenures of 7.5 and 8 years respectively. Recent developments include a reduction in net loss for the second quarter compared to the previous year, though it was dropped from the S&P Global BMI Index in September 2025.

- Take a closer look at XBiotech's potential here in our financial health report.

- Gain insights into XBiotech's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Unlock more gems! Our US Penny Stocks screener has unearthed 348 more companies for you to explore.Click here to unveil our expertly curated list of 351 US Penny Stocks.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUTL

Autolus Therapeutics

A clinical-stage biopharmaceutical company, develops T cell therapies for the treatment of cancer and autoimmune diseases in United Kingdom and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives