- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Will Analyst Coverage and Promising Data Shift Wave Life Sciences' (WVE) Genetic Medicine Narrative?

Reviewed by Sasha Jovanovic

- Clear Street recently initiated coverage of Wave Life Sciences, highlighting the company's pipeline of genetic medicines, including WVE-007 for obesity and WVE-006 for alpha-1 antitrypsin deficiency.

- The analyst's attention on Wave Life Sciences follows positive Phase 1b/2a data for WVE-006, which demonstrated therapeutically restored serum AAT protein production, underscoring progress in gene-editing therapies.

- We will explore how renewed analyst coverage and encouraging clinical trial results might influence Wave Life Sciences' investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Wave Life Sciences Investment Narrative Recap

To believe in Wave Life Sciences as a shareholder, an investor needs confidence in the company’s proprietary genetic medicine platforms approaching large, underserved markets, and trust that pipeline progress will convert into commercial opportunities. The recent analyst coverage and positive WVE-006 data provide short-term validation of scientific progress, but do not materially shift the biggest catalyst, upcoming pivotal data for WVE-006 and WVE-007, or address the most pressing risk, the company’s declining collaboration revenue and widening losses.

Of the recent updates, the September 2025 announcement of positive Phase 1b/2a data for WVE-006 stands out, as it supports the potential for the lead program to advance and possibly unlock additional partnership funding. This momentum around WVE-006 directly relates to upcoming clinical milestones, which remain the defining short-term catalysts for investor sentiment and could impact future revenue streams if progress continues.

In contrast, investors should be aware of the mounting pressure from shrinking collaboration revenue and increasing...

Read the full narrative on Wave Life Sciences (it's free!)

Wave Life Sciences' narrative projects $177.5 million revenue and $41.2 million earnings by 2028. This requires 23.6% yearly revenue growth and a $171.1 million increase in earnings from the current $-129.9 million.

Uncover how Wave Life Sciences' forecasts yield a $20.27 fair value, a 159% upside to its current price.

Exploring Other Perspectives

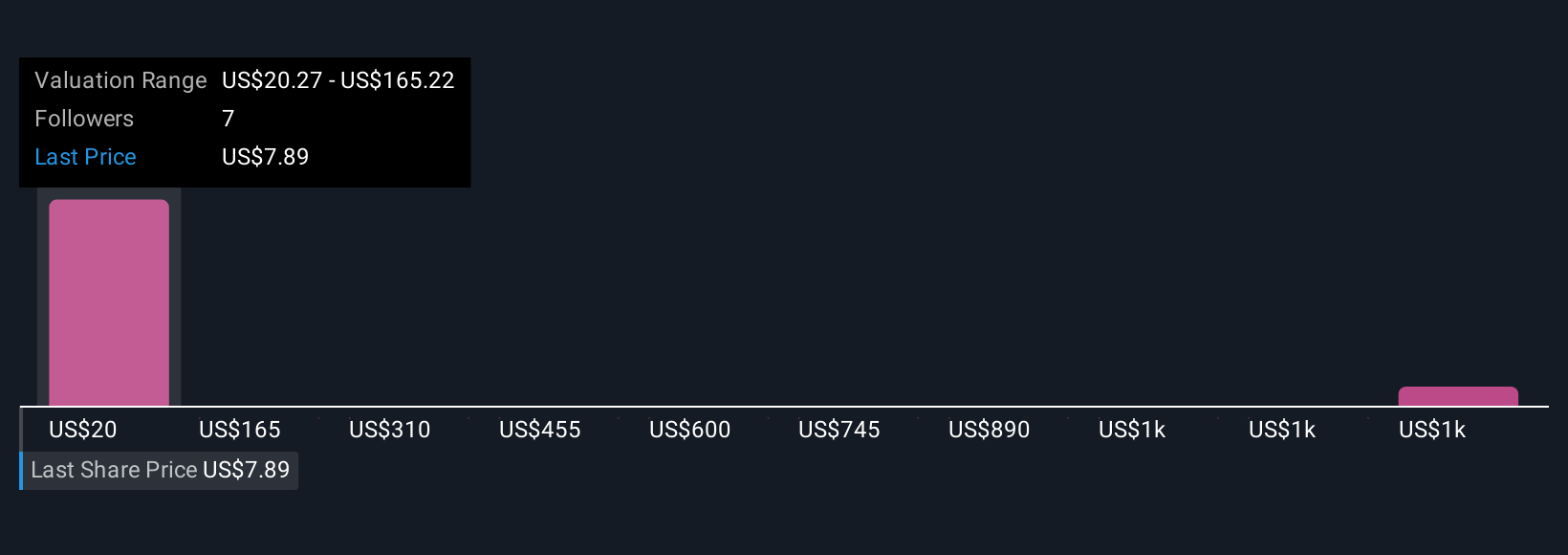

The Simply Wall St Community generated two fair value estimates for Wave Life Sciences, ranging from US$20.27 to a striking US$1,469.79 per share. With such wide variance, investor outlooks diverge sharply even as upcoming clinical milestones for lead programs remain the main focal point for future company performance.

Explore 2 other fair value estimates on Wave Life Sciences - why the stock might be worth just $20.27!

Build Your Own Wave Life Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wave Life Sciences research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Wave Life Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wave Life Sciences' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026