- United States

- /

- Biotech

- /

- NasdaqCM:VXRT

Earnings Update: Here's Why Analysts Just Lifted Their Vaxart, Inc. (NASDAQ:VXRT) Price Target To US$6.50

As you might know, Vaxart, Inc. (NASDAQ:VXRT) just kicked off its latest first-quarter results with some very strong numbers. Results overall were solid, with revenues arriving 3.6% better than analyst forecasts at US$2.9m. Higher revenues also resulted in substantially lower statutory losses which, at US$0.02 per share, were 3.6% smaller than the analysts expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Vaxart

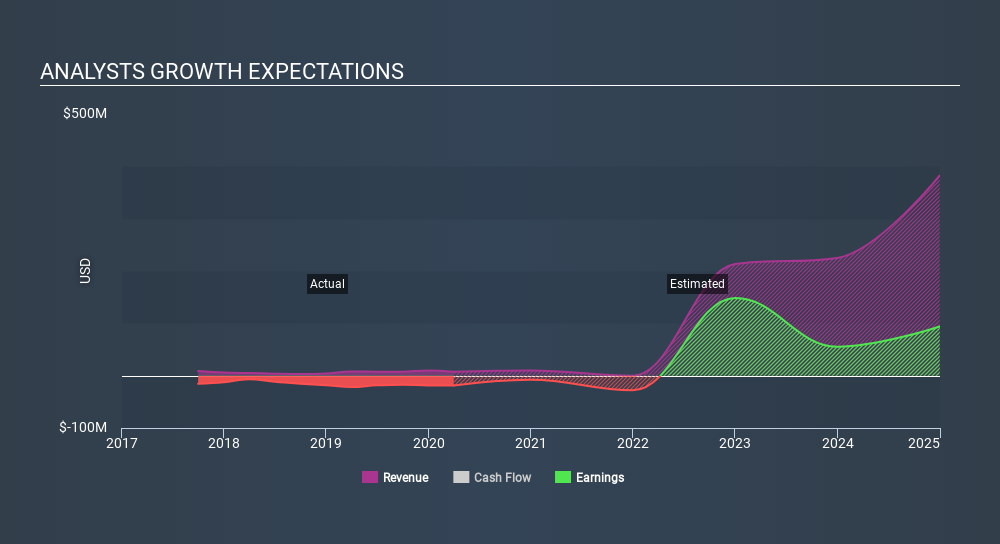

Following the latest results, Vaxart's two analysts are now forecasting revenues of US$10.1m in 2020. This would be a major 37% improvement in sales compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 81% to US$0.10. Before this earnings announcement, the analysts had been modelling revenues of US$12.3m and losses of US$0.15 per share in 2020. We can see there's definitely been a change in sentiment in this update, with the analysts administering a meaningful downgrade to next year's revenue estimates, while at the same time reducing their loss estimates.

The consensus price target rose 117% to US$6.50, with the analysts increasingly optimistic about shrinking losses, despite the expected decline in sales.

Of course, another way to look at these forecasts is to place them into context against the industry itself. For example, we noticed that Vaxart's rate of growth is expected to accelerate meaningfully, with revenues forecast to grow 37%, well above its historical decline of 8.7% a year over the past year. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 24% per year. Not only are Vaxart's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. They also downgraded their revenue estimates, although industry data suggests that Vaxart's revenues are expected to grow faster than the wider industry. Even so, earnings are more important to the intrinsic value of the business. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

You still need to take note of risks, for example - Vaxart has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:VXRT

Vaxart

A clinical-stage biotechnology company, discovers and develops oral recombinant protein vaccines based on its vector-adjuvant-antigen standardized technology proprietary oral vaccine platform in the United States.

Excellent balance sheet and good value.

Market Insights

Community Narratives