- United States

- /

- Biotech

- /

- NasdaqCM:VSTM

Introducing Verastem (NASDAQ:VSTM), The Stock That Zoomed 112% In The Last Three Years

It hasn't been the best quarter for Verastem, Inc. (NASDAQ:VSTM) shareholders, since the share price has fallen 17% in that time. But in three years the returns have been great. The share price marched upwards over that time, and is now 112% higher than it was. So the recent fall in the share price should be viewed in that context. If the business can perform well for years to come, then the recent drop could be an opportunity.

See our latest analysis for Verastem

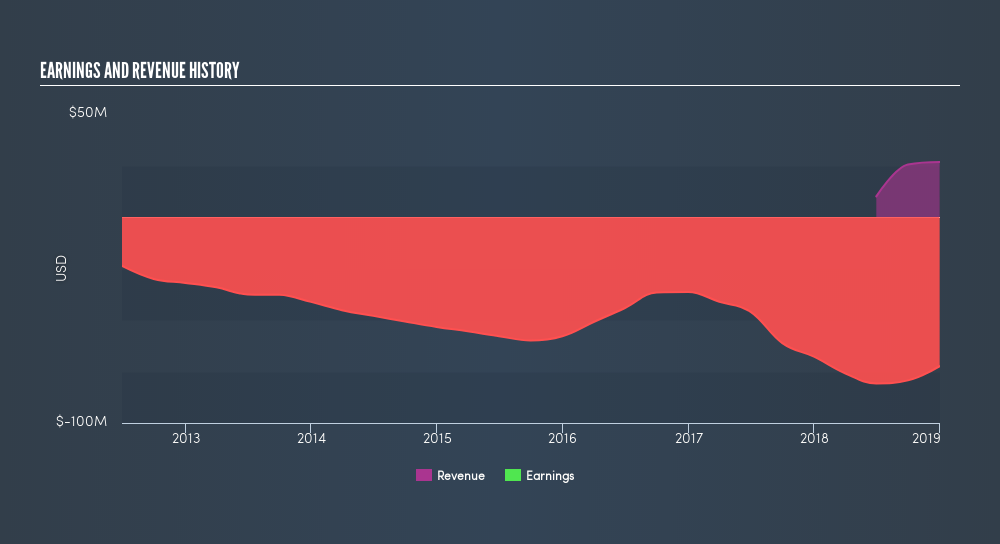

Verastem isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this freereport showing consensus forecasts

A Different Perspective

Verastem shareholders are up 5.4% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 20% endured over half a decade. So this might be a sign the business has turned its fortunes around. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:VSTM

Verastem

A development-stage biopharmaceutical company, focuses on developing and commercializing drugs for the treatment of cancer in the United States.

Moderate and slightly overvalued.

Market Insights

Community Narratives