- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Vertex (VRTX) Kidney Pipeline Upgrades: A Turning Point in Its Diversification Strategy?

Reviewed by Sasha Jovanovic

- Recently, Morgan Stanley and other analysts upgraded their views on Vertex Pharmaceuticals, citing growing confidence in its kidney disease pipeline, particularly povetacicept and inaxaplin, which are progressing through late-stage clinical trials.

- This renewed focus on Vertex’s kidney candidates highlights how successfully broadening beyond cystic fibrosis treatments could reshape the company’s long-term revenue mix and risk profile.

- We’ll now explore how this increased optimism around Vertex’s kidney pipeline influences its investment narrative and future diversification efforts.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Vertex Pharmaceuticals Investment Narrative Recap

To own Vertex today, you have to believe the company can gradually reduce its dependence on cystic fibrosis by turning late stage programs in kidney disease, pain and gene editing into durable commercial franchises. The recent analyst upgrades around povetacicept and inaxaplin reinforce that diversification path, but they do not change the reality that clinical and regulatory outcomes for these kidney assets remain the most important near term catalyst and the biggest source of risk.

The most relevant recent development is the strong RUBY 3 data for povetacicept in IgA nephropathy and primary membranous nephropathy, together with FDA Breakthrough Therapy and Fast Track designations. With the RAINIER Phase 3 trial fully enrolled and a rolling BLA planned for potential accelerated approval in IgAN, pove has moved closer to being a meaningful non CF revenue pillar, putting more investor attention on how quickly Vertex can convert this clinical momentum into approvals and real world uptake.

Yet while optimism is building, investors should be aware that the biggest near term catalyst is still tightly linked to clinical data and regulatory timing in kidney disease...

Read the full narrative on Vertex Pharmaceuticals (it's free!)

Vertex Pharmaceuticals' narrative projects $14.9 billion revenue and $5.6 billion earnings by 2028. This requires 9.4% yearly revenue growth and a $2.0 billion earnings increase from $3.6 billion today.

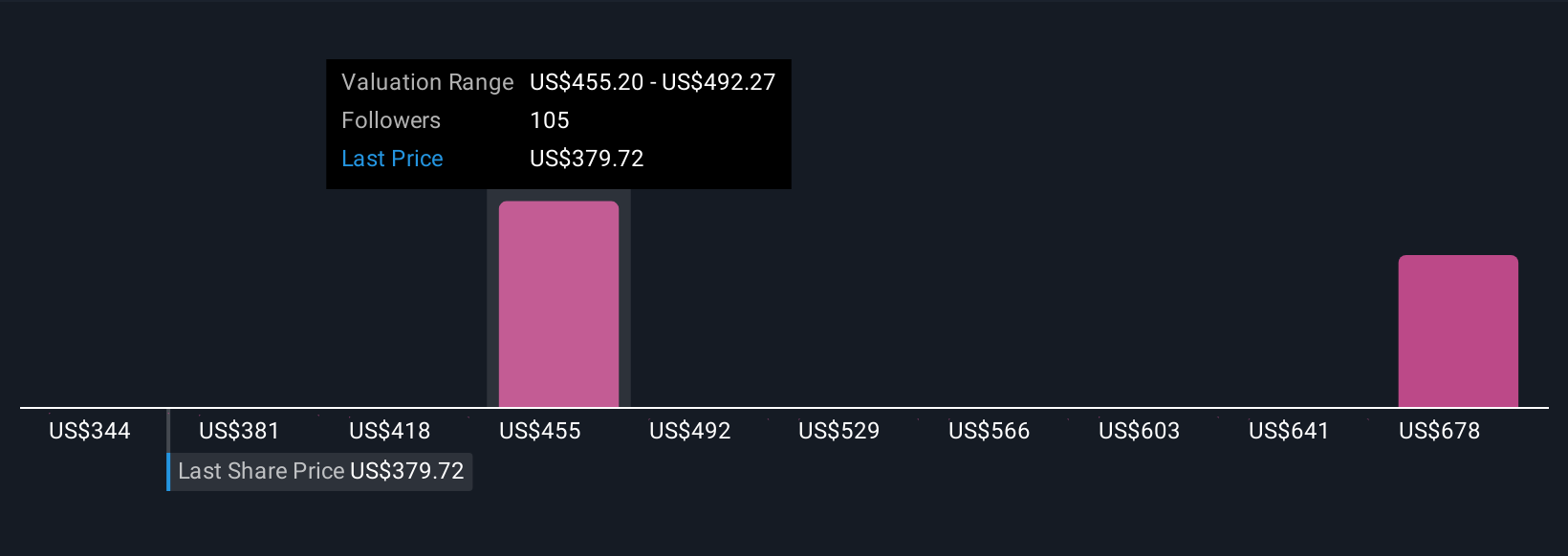

Uncover how Vertex Pharmaceuticals' forecasts yield a $485.36 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Before this news, the most optimistic analysts were already assuming revenue could reach about US$16.9 billion and earnings US$7.8 billion by 2028, largely on the back of leadership in gene and cell therapies. Compared with the baseline focus on diversification risk, this far more optimistic view leans heavily on the idea that breakthrough treatments will offset CF concentration and pricing pressure, reminding you that expectations differ widely and may shift again as the kidney pipeline story develops.

Explore 8 other fair value estimates on Vertex Pharmaceuticals - why the stock might be worth 24% less than the current price!

Build Your Own Vertex Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertex Pharmaceuticals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Vertex Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertex Pharmaceuticals' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026