- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Vertex Pharmaceuticals (VRTX): Evaluating Valuation After Recent Steady Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Vertex Pharmaceuticals.

Vertex's share price has hovered in a narrow range lately, yet long-term momentum still matters. The company's 3-year total shareholder return stands at nearly 37%, and its 5-year figure is an impressive 52%. Recent price movement suggests that the market is cautiously optimistic as the business continues to deliver healthy top-line and earnings growth.

If Vertex's steady gains have you curious about where else long-term outperformance could be brewing, now is a perfect time to discover See the full list for free.

Yet with shares trading at a discount to analyst targets and solid earnings growth, the key question is whether Vertex is undervalued at current levels or if the market is already factoring in future success.

Most Popular Narrative: 14.8% Undervalued

With Vertex Pharmaceuticals trading at $408.85 and the consensus narrative fair value set at $479.83, there is a significant gap between the current price and what analysts think the company is worth. This spread reflects a belief in future profit growth and expanding opportunities, beyond what is currently reflected in the share price.

"Robust global launches, improving reimbursement, and disciplined reinvestment strengthen future earnings and broaden opportunities amid rising healthcare spending and AI-driven drug development trends."

Curious how ambitious global expansion ties into this bullish valuation? The underlying math leans heavily on future double-digit growth and climbing profit margins. Want to see what profit projections and sector trends make this possible? See what numbers drive such a lofty target.

Result: Fair Value of $479.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on cystic fibrosis drugs and setbacks in pipeline development could affect Vertex's future revenue and margin outlook.

Find out about the key risks to this Vertex Pharmaceuticals narrative.

Another View: Market Ratios Tell a Different Story

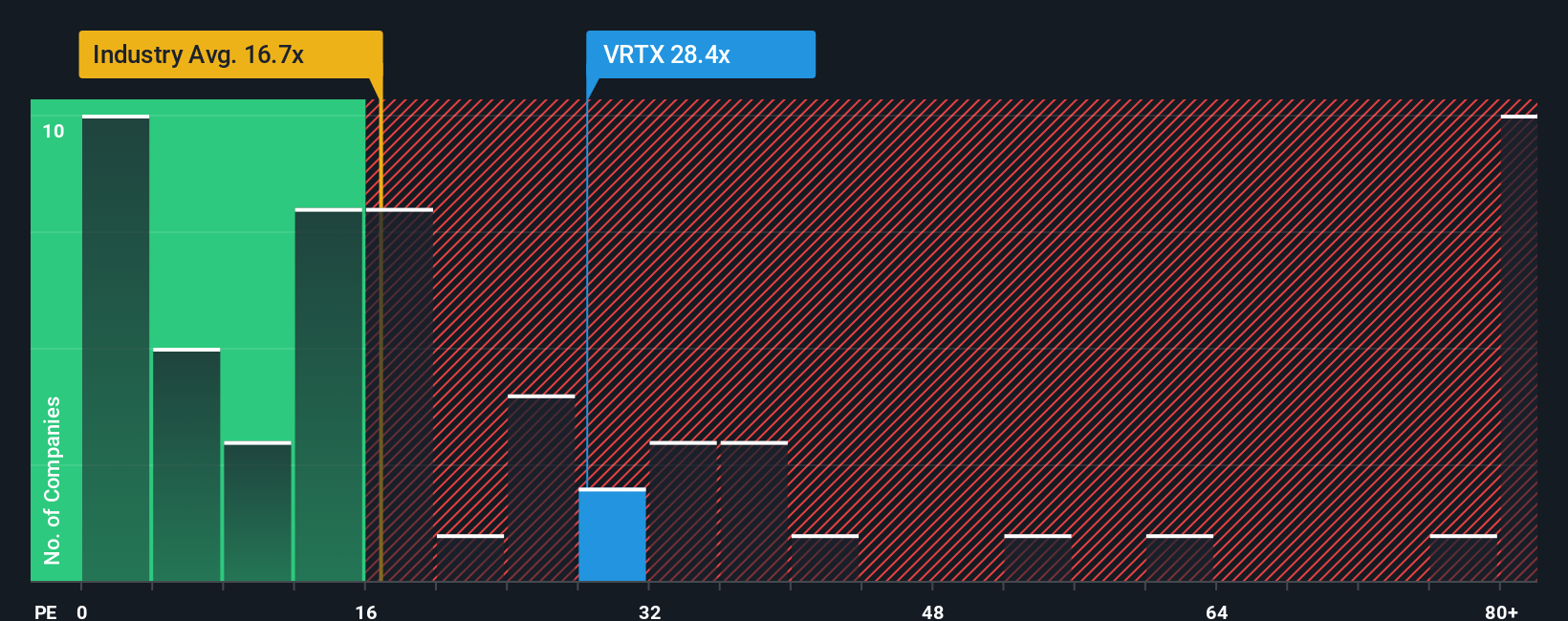

Looking at Vertex through the lens of its price-to-earnings ratio, the company appears expensive at 28.8 times earnings. This is noticeably above the US Biotech industry average of 16.6 and also above its own fair ratio of 26.9. This gap suggests investors are willing to pay a premium for future growth, but does this mean higher risk if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertex Pharmaceuticals Narrative

If the numbers or outlook here don't fit your view, taking a few minutes to explore the data for yourself could lead to a narrative of your own. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. The Simply Wall Street Screener makes it easy to spot standout investments you might have missed.

- Boost your portfolio’s long-term income by targeting rock-solid companies among these 19 dividend stocks with yields > 3% with yields above 3%.

- Catch the next wave of technological breakthroughs with these 24 AI penny stocks pushing the boundaries of artificial intelligence innovation.

- Capitalize on emerging financial trends by picking from these 78 cryptocurrency and blockchain stocks involved in blockchain, digital assets, and the future of money.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives