- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Does Italian Reimbursement Deal for CASGEVY Signal a Wider Gene Therapy Opportunity for Vertex (VRTX)?

Reviewed by Simply Wall St

- Vertex Pharmaceuticals recently announced a reimbursement agreement with the Italian Medicines Agency, granting eligible patients in Italy access to CASGEVY®, its CRISPR/Cas9 gene-edited therapy for transfusion-dependent beta thalassemia and severe sickle cell disease.

- This milestone marks an important step in expanding reimbursement-driven access to advanced gene therapies across major European healthcare systems and for rare disease patients.

- We’ll now examine how expanded reimbursement for CASGEVY in Italy may shape Vertex's investment narrative and future growth outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Vertex Pharmaceuticals Investment Narrative Recap

To be a stakeholder in Vertex Pharmaceuticals, you need to believe that ongoing innovation and access expansion, particularly around transformative gene therapies like CASGEVY, will offset long-term reliance on its cystic fibrosis franchise. The new reimbursement agreement with Italy is a positive step for short-term access expansion but may not significantly alter the most important near-term catalyst: the pace and breadth of global reimbursement wins. Growing pricing pressure remains the biggest risk, as further negotiation hurdles or reductions could cap future margin expansion.

Recent company conference presentations, such as Vertex’s participation in Cell & Gene Therapy International 2025, are directly relevant, highlighting management’s ongoing commitment to gene-editing leadership and expanding the impact of advanced therapies. This aligns with current catalysts around pipeline diversification and geographic expansion, which underpin expectations for broader revenue growth drivers beyond the traditional CF business.

However, investors should be aware that, as more countries negotiate reimbursement terms, Vertex’s ability to maintain premium pricing and margin expansion may be tested, especially...

Read the full narrative on Vertex Pharmaceuticals (it's free!)

Vertex Pharmaceuticals is projected to reach $14.9 billion in revenue and $5.6 billion in earnings by 2028. Achieving this outcome requires annual revenue growth of 9.4% and a $2.0 billion increase in earnings from the current $3.6 billion.

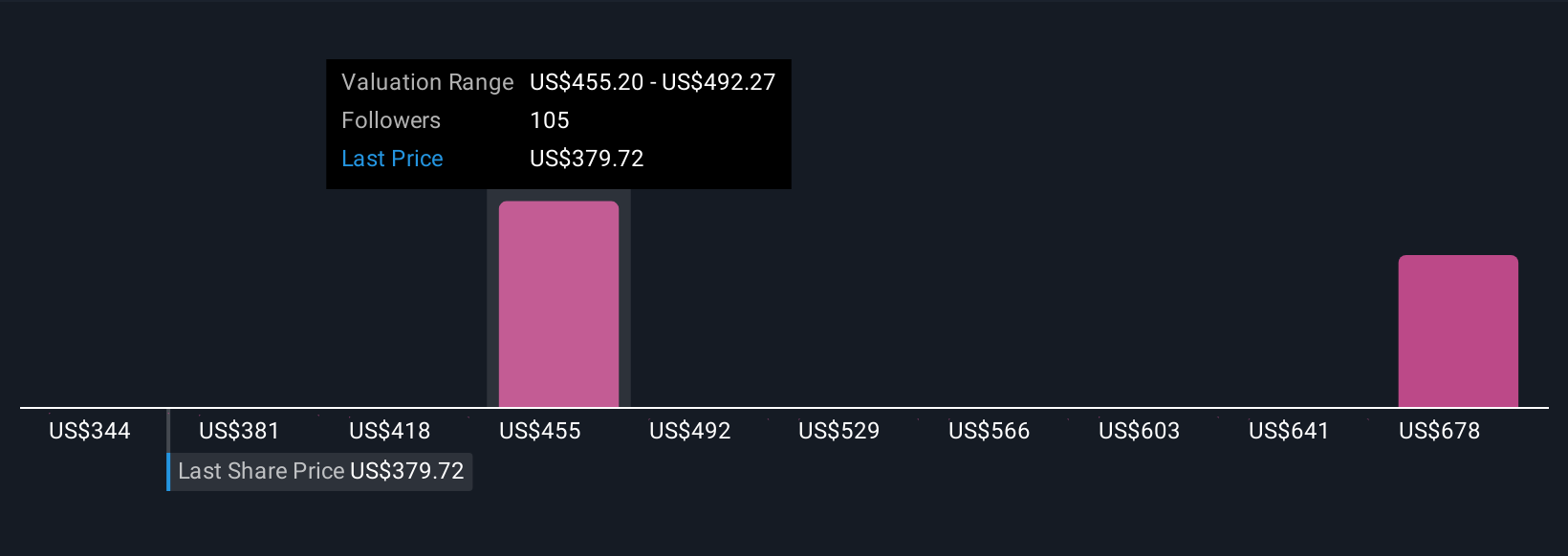

Uncover how Vertex Pharmaceuticals' forecasts yield a $479.83 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts anticipated Vertex's revenue could reach US$16.9 billion with profit margins soaring to 46.3 percent by 2028, based on rapid uptake of new therapies like CASGEVY. These high expectations showcase just how positive some forecasts can be, but with this new reimbursement deal in Italy, you might wonder if the bullish or baseline outlook best fits the evolving story.

Explore 8 other fair value estimates on Vertex Pharmaceuticals - why the stock might be worth as much as 87% more than the current price!

Build Your Own Vertex Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertex Pharmaceuticals research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Vertex Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertex Pharmaceuticals' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives