- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Accelerated Povetacicept Progress Could Be a Game Changer for Vertex Pharmaceuticals (VRTX)

Reviewed by Sasha Jovanovic

- Vertex Pharmaceuticals recently announced several regulatory milestones for povetacicept, including FDA Breakthrough Therapy Designation and a rolling review for its Biologics License Application in IgA nephropathy, with pivotal trial data to be presented at the upcoming American Society of Nephrology Kidney Week in Houston.

- This positions Vertex’s investigational therapy as a potential first-in-class option for multiple B cell-mediated kidney diseases and highlights the emerging value of its pipeline beyond cystic fibrosis.

- We'll examine how accelerated US regulatory progress for povetacicept influences Vertex’s prospects for revenue diversification and long-term growth.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Vertex Pharmaceuticals Investment Narrative Recap

If you are a shareholder in Vertex Pharmaceuticals, the big picture to understand is the company’s effort to diversify beyond its cystic fibrosis (CF) franchise into new areas such as kidney disease and gene editing. The latest milestones for povetacicept, including FDA Breakthrough Therapy Designation and the rolling BLA review, are positive for pipeline visibility but do not materially alter the most important short term catalyst, the commercial performance of non-CF therapies, including recent launches like JOURNAVX. The greatest risk remains Vertex’s heavy reliance on CF, with pipeline progress yet to fully offset maturing CF revenues.

Among recent announcements, the launch of JOURNAVX to an acute pain market targeting over 80 million US adults is particularly important. While povetacicept’s progress captures investor attention for future diversification, JOURNAVX is the clearest near-term opportunity to demonstrate revenue growth outside CF and show Vertex’s capacity to execute new commercial launches, an important factor as the company’s broader pipeline matures.

By contrast, investors should also be aware of how reimbursement and pricing pressures are quickly evolving for Vertex’s new therapies...

Read the full narrative on Vertex Pharmaceuticals (it's free!)

Vertex Pharmaceuticals is projected to reach $14.9 billion in revenue and $5.6 billion in earnings by 2028. This outlook assumes a 9.4% annual revenue growth rate and a $2 billion increase in earnings from the current $3.6 billion.

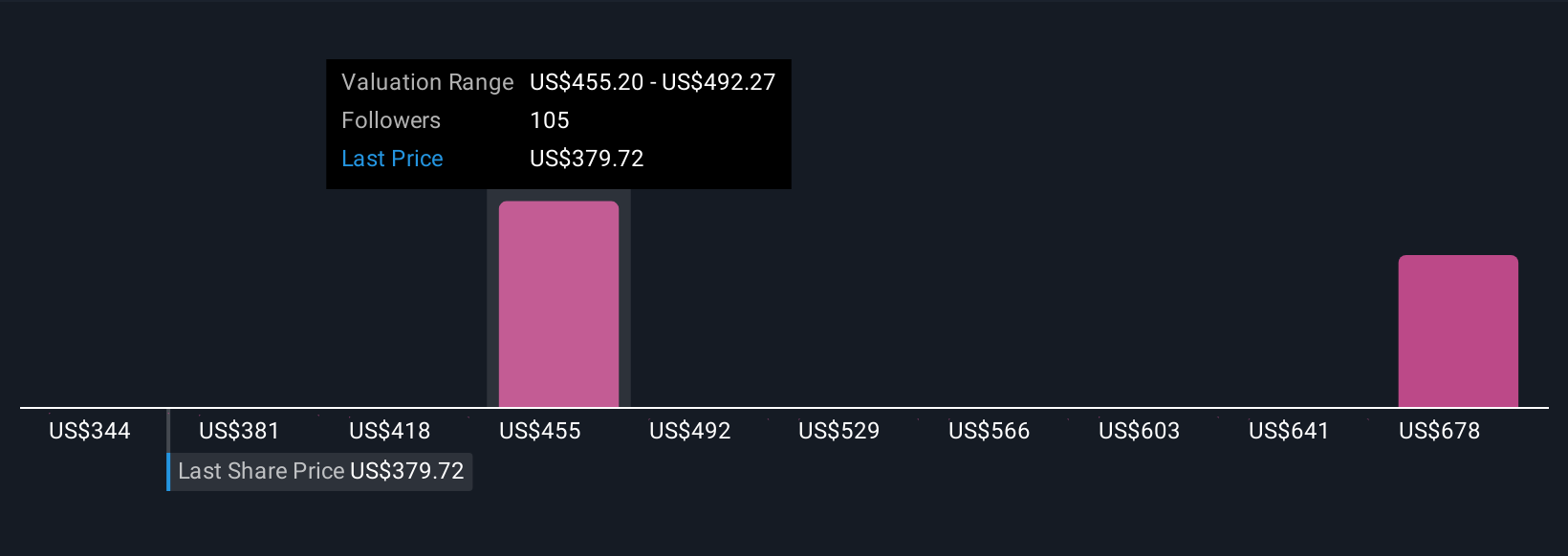

Uncover how Vertex Pharmaceuticals' forecasts yield a $479.83 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Some analysts were highly optimistic before this news, projecting annual revenue growth of 14 percent and profit margins above 46 percent by 2028. If you believe Vertex’s pipeline, including kidney and gene editing therapies, will fuel this type of outperformance, you might view the new regulatory milestones as a further accelerant. However, not everyone shares this outlook, so it’s helpful to see where your own expectations fit within these varied projections.

Explore 8 other fair value estimates on Vertex Pharmaceuticals - why the stock might be worth 17% less than the current price!

Build Your Own Vertex Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertex Pharmaceuticals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Vertex Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertex Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives