Unfortunately for shareholders, when Verrica Pharmaceuticals Inc. (NASDAQ:VRCA) reported results for the period to December 2021, its auditors, KPMG LLP - Klynveld Peat Marwick Goerdeler, expressed uncertainty about whether it can continue as a going concern. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

Given its situation, it may not be in a good position to raise capital on favorable terms. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

Check out our latest analysis for Verrica Pharmaceuticals

What Is Verrica Pharmaceuticals's Net Debt?

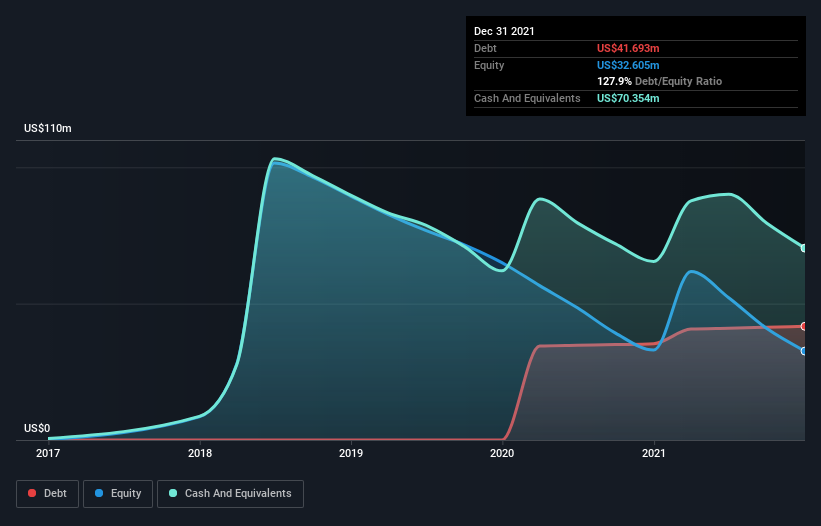

The image below, which you can click on for greater detail, shows that at December 2021 Verrica Pharmaceuticals had debt of US$41.7m, up from US$35.3m in one year. But it also has US$70.4m in cash to offset that, meaning it has US$28.7m net cash.

A Look At Verrica Pharmaceuticals' Liabilities

According to the last reported balance sheet, Verrica Pharmaceuticals had liabilities of US$46.1m due within 12 months, and liabilities of US$1.47m due beyond 12 months. Offsetting these obligations, it had cash of US$70.4m as well as receivables valued at US$11.5m due within 12 months. So it actually has US$34.3m more liquid assets than total liabilities.

This excess liquidity suggests that Verrica Pharmaceuticals is taking a careful approach to debt. Due to its strong net asset position, it is not likely to face issues with its lenders. Simply put, the fact that Verrica Pharmaceuticals has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Verrica Pharmaceuticals can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Verrica Pharmaceuticals managed to produce its first revenue as a listed company, but given the lack of profit, shareholders will no doubt be hoping to see some strong increases.

So How Risky Is Verrica Pharmaceuticals?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Verrica Pharmaceuticals had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$28m of cash and made a loss of US$35m. While this does make the company a bit risky, it's important to remember it has net cash of US$28.7m. That means it could keep spending at its current rate for more than two years. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example - Verrica Pharmaceuticals has 2 warning signs we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:VRCA

Verrica Pharmaceuticals

A clinical-stage dermatology therapeutics company, develops medications for the treatment of skin diseases in the United States.

Moderate and slightly overvalued.