- United States

- /

- Biotech

- /

- NasdaqCM:VKTX

What Viking Therapeutics (VKTX)'s New Maintenance Study for VK2735 Means for Shareholders

Reviewed by Sasha Jovanovic

- Viking Therapeutics recently announced the initiation of a Phase 1 exploratory maintenance dosing study for VK2735, its dual GLP-1/GIP agonist, to evaluate both oral and subcutaneous dosing regimens for obesity treatment in adults.

- This progress marks a meaningful advancement within Viking's obesity pipeline, as the study explores strategies for sustaining weight loss beyond initial treatment phases.

- We'll examine how this new maintenance dosing study could strengthen Viking's investment narrative by highlighting innovation in weight management therapies.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Viking Therapeutics' Investment Narrative?

For anyone keeping a close eye on Viking Therapeutics, the big picture remains centered on the successful development and eventual commercial launch of VK2735, the company’s most advanced and closely watched obesity candidate. The recent move to initiate a Phase 1 exploratory maintenance dosing study is a tangible step forward, adding momentum to ongoing Phase 3 trials and underscoring Viking’s push for innovation in weight management. While the maintenance study itself is not a short-term value driver, it does align with the broader trend toward developing more flexible obesity therapies and could bolster confidence in the company’s commitment to covering the entire treatment journey. The core risks are largely unchanged: Viking is still unprofitable with no meaningful revenue, and pipeline setbacks, delayed regulatory approvals, or competitive pressure, especially from market leaders like Lilly or Novo Nordisk, could amplify share price swings. With the share price already volatile, this latest study should serve as a reassuring sign for those focused on execution, but it adds little near-term catalyst without major data readouts imminent.

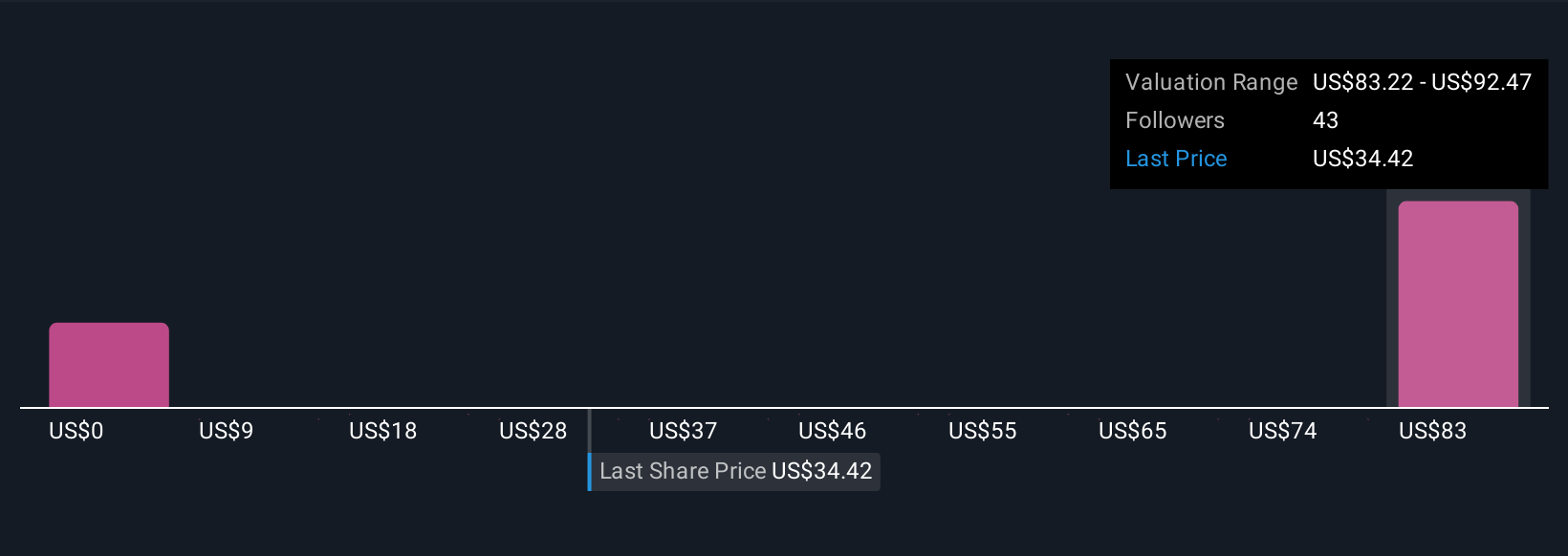

Yet, it’s important to recognize the risk of extended unprofitability even as new trials progress. The analysis detailed in our Viking Therapeutics valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 23 other fair value estimates on Viking Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Viking Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viking Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Viking Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viking Therapeutics' overall financial health at a glance.

No Opportunity In Viking Therapeutics?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VKTX

Viking Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives