- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

A Fresh Look at Veracyte (VCYT) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Veracyte (VCYT) shares have had a fairly active stretch, with the stock moving nearly 8% over the past month. Investors may be watching closely for further insight into what is driving recent interest in the company.

See our latest analysis for Veracyte.

Veracyte’s 47% share price jump over the past three months suggests momentum is building. This year’s gain in total shareholder return comes in at just over 5%. That recent strength could reflect renewed confidence in Veracyte’s growth outlook or a shift in how investors view risk for the business.

If you’re interested in other healthcare stocks on the move, check out the See the full list for free..

With shares surging and the price still nearly 34% below some intrinsic value estimates, is Veracyte an undervalued opportunity for investors, or is the market already factoring in its potential for future growth?

Most Popular Narrative: 12.7% Undervalued

Compared to the last close at $35.97, the most widely followed narrative estimates Veracyte’s fair value at $41.22. This narrative draws on the company’s product momentum, execution potential, and expectations for higher long-term profitability.

Continued market penetration and share gains for Decipher Prostate, including expansion into metastatic and high-risk segments (now covering the entire prostate cancer spectrum), are fueling outsized growth. Robust clinical evidence and guideline inclusions are likely to drive further physician adoption and payer coverage, bolstering both revenues and earnings visibility.

Think Veracyte’s upside is all priced in? The narrative hinges on bold revenue growth, margin expansion, and future earnings leaps beyond the obvious. Want to know what numbers are needed to keep the valuation ahead of today’s price? Discover the driver that analysts believe sets this stock apart from the rest.

Result: Fair Value of $41.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained reliance on key products and intensified pricing pressures could quickly dampen Veracyte’s outlook if market dynamics shift unexpectedly.

Find out about the key risks to this Veracyte narrative.

Another View: Based on Earnings Ratios

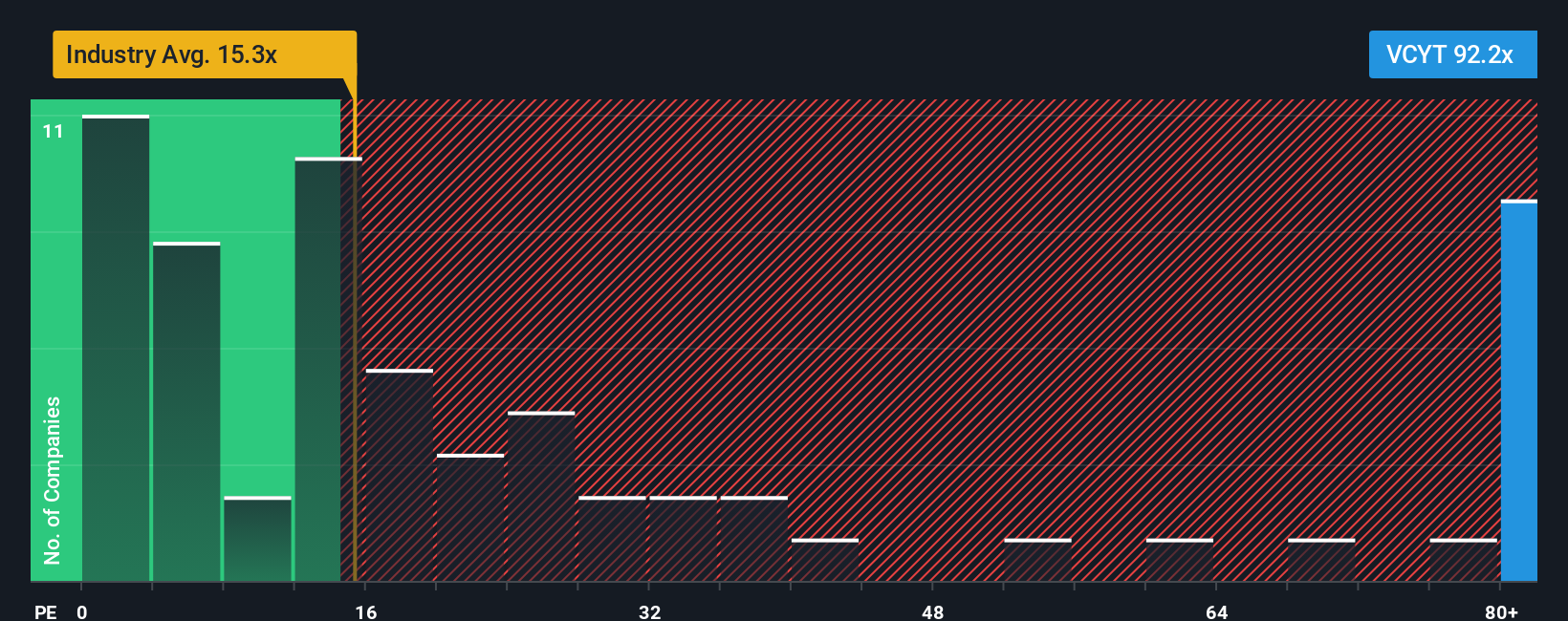

Looking at valuation a different way, Veracyte is trading at a much higher price-to-earnings ratio (107.5x) than both the US Biotechs industry average (17.3x) and the peer group average (12x). Even compared to its fair ratio (24.7x), the current multiple indicates investors are paying a hefty premium. Does this raise the risk that the market is counting on very strong future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veracyte Narrative

If you want to challenge the current view or dig into Veracyte’s numbers yourself, you can craft a personalized narrative in just a few minutes using Do it your way.

A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your next winning opportunity could be just one search away. Make sure you’re not missing out on unique stocks that fit your strategy and goals.

- Tap into explosive future growth by targeting these 27 AI penny stocks as companies capitalize on artificial intelligence advancements across every sector.

- Collect powerful yields by leveraging these 19 dividend stocks with yields > 3%, where established companies provide steady income and financial resilience.

- Get ahead of the curve with these 80 cryptocurrency and blockchain stocks, which leads the charge in blockchain innovation and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives