- United States

- /

- Biotech

- /

- NasdaqGS:UTHR

How Will UTHR’s Recent Earnings Shortfall Shape United Therapeutics’ Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- United Therapeutics has reported its third quarter 2025 earnings, following heightened anticipation from investors after missing revenue estimates in the previous quarter and announcing a scheduled release and call on October 29, 2025.

- Analyst expectations pointed to a slowdown in revenue growth for this quarter, with attention focused on the company’s outlook after last quarter’s results and recent insider share sales.

- We’ll now examine how the company’s recent earnings miss and slowing revenue growth may influence its investment narrative moving forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

United Therapeutics Investment Narrative Recap

Being a shareholder in United Therapeutics today hinges on confidence that the company can keep driving pulmonary and rare disease innovation while weathering slower near-term revenue growth and recurring competitive pressures. The recent earnings miss and softer revenue forecast do not significantly alter the importance of its upcoming TETON clinical readouts, but they reinforce the biggest immediate risk: heightened competition in core therapies which could pressure revenue and margins in the short term.

One announcement that stands out is the positive TETON-2 study result for Tyvaso in idiopathic pulmonary fibrosis, which met its primary endpoint this quarter. This development could offer a substantial new market opportunity for United Therapeutics and serves as a direct counterbalance to current concerns surrounding competition and revenue growth headwinds.

However, despite positive clinical progress, investors should be aware that, unlike previous years, pressure from competitor product launches could affect growth in the coming quarters...

Read the full narrative on United Therapeutics (it's free!)

United Therapeutics' narrative projects $3.7 billion in revenue and $1.5 billion in earnings by 2028. This outlook assumes a 6.6% yearly revenue growth rate and a $300 million earnings increase from the current earnings of $1.2 billion.

Uncover how United Therapeutics' forecasts yield a $492.85 fair value, a 19% upside to its current price.

Exploring Other Perspectives

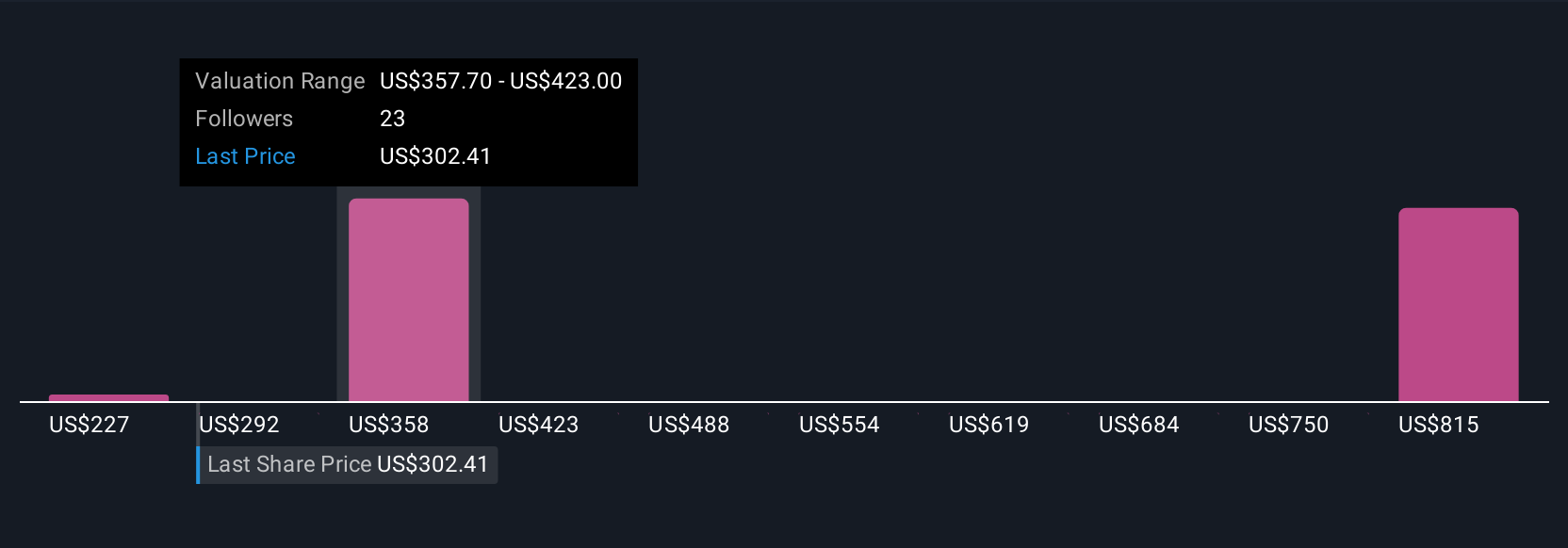

Five recent fair value estimates from the Simply Wall St Community range from US$279.96 up to US$1,266.35 per share. With product competition posing a near-term risk, these perspectives reflect just how much views can differ, consider reviewing several viewpoints before forming your outlook.

Explore 5 other fair value estimates on United Therapeutics - why the stock might be worth 33% less than the current price!

Build Your Own United Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UTHR

United Therapeutics

A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives