- United States

- /

- Biotech

- /

- NasdaqGS:UTHR

Assessing United Therapeutics After Organ Manufacturing Milestone and Five-Year 214% Price Surge

Reviewed by Bailey Pemberton

Deciding what to do with United Therapeutics stock? You’re not alone. Whether you’ve watched its meteoric 5-year climb of 214.3% or are trying to make sense of this year’s 16.9% rally, there’s a lot to unpack. Despite a recent dip of 2.7% over the past month, the long-term trend shows resilience. This hints at underlying growth potential that has outlasted short-term wobbles.

Recent headlines have been peppered with news of the company’s expansion in organ manufacturing and regulatory milestones in pulmonary hypertension treatments. These updates have not just attracted media attention; they have arguably helped shift how the market perceives the company’s risk profile, even as shares gave up a bit of ground lately. Behind the scenes, analysts are watching as United Therapeutics continues to diversify its pipeline, setting up for potential future catalysts.

If you’re wondering how the numbers stack up, United Therapeutics scores a 5 out of 6 on our undervaluation checklist. That puts it near the top among its peers, suggesting there could be more room to run, even with some of the gains already locked in. Ready to dig into how those valuation scores break down across key metrics? Up next, we’ll look at the usual suspects analysts use to value a stock before diving into a smarter, more holistic approach later in the article.

Approach 1: United Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common way to estimate a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach attempts to answer a fundamental investing question: what is United Therapeutics really worth based on the money it is expected to generate?

United Therapeutics currently delivers annual Free Cash Flow (FCF) of $1.09 billion. Analyst forecasts drive FCF projections for the next five years, with estimates reaching $1.96 billion by 2029. After that, longer-term growth is extrapolated using reasonable assumptions, extending visibility for another five years. All values are calculated in US dollars.

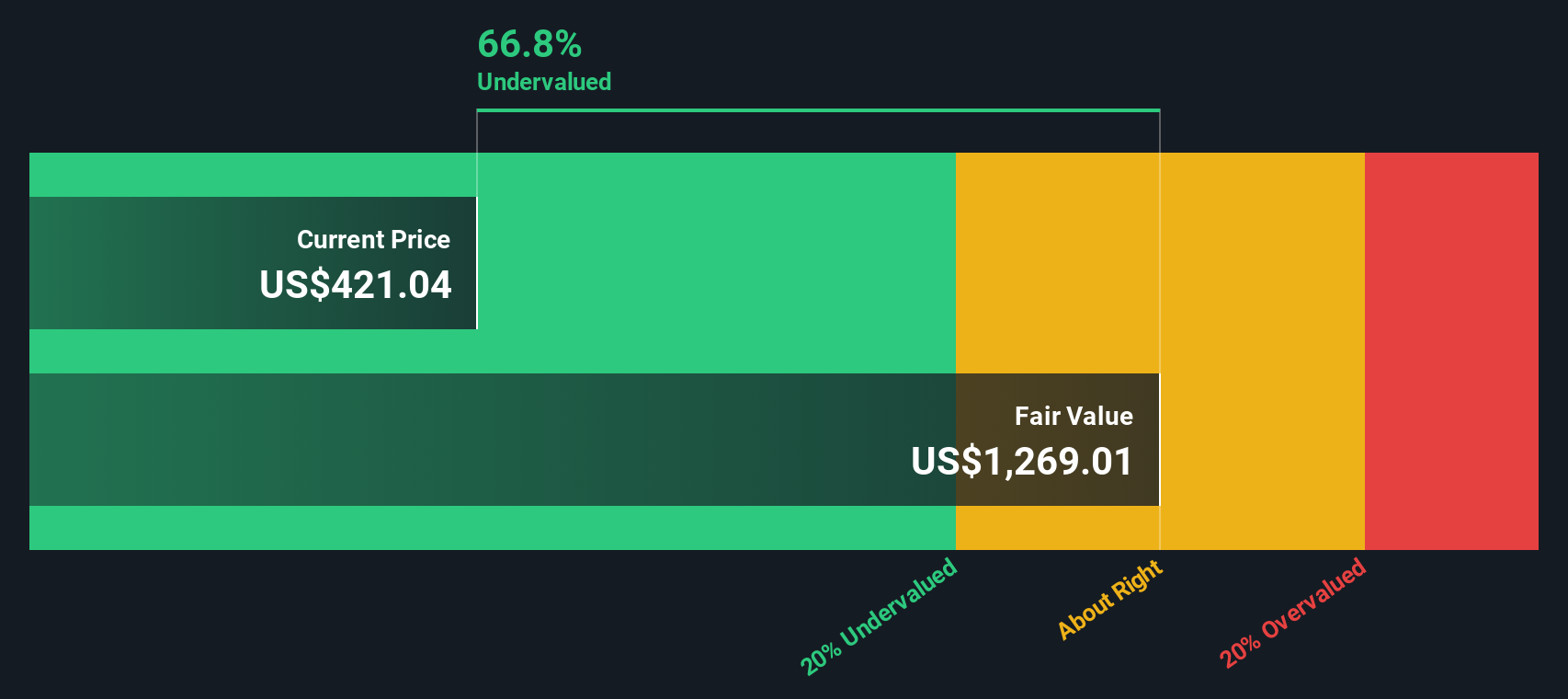

Across this projection period, DCF models suggest that United Therapeutics could see steadily increasing cash flows, based on both analyst insights and algorithmic extrapolations. The resulting intrinsic value is estimated at $1,269.01 per share. This value suggests the stock trades at a 66.8% discount to its fair value. In summary, the model indicates the stock is deeply undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Therapeutics is undervalued by 66.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: United Therapeutics Price vs Earnings

For companies like United Therapeutics that generate consistent profits, the Price-to-Earnings (PE) ratio stands out as a widely used and straightforward valuation tool. The PE ratio helps investors gauge how much they are paying for each dollar of current earnings, making it especially relevant for profitable firms in established industries.

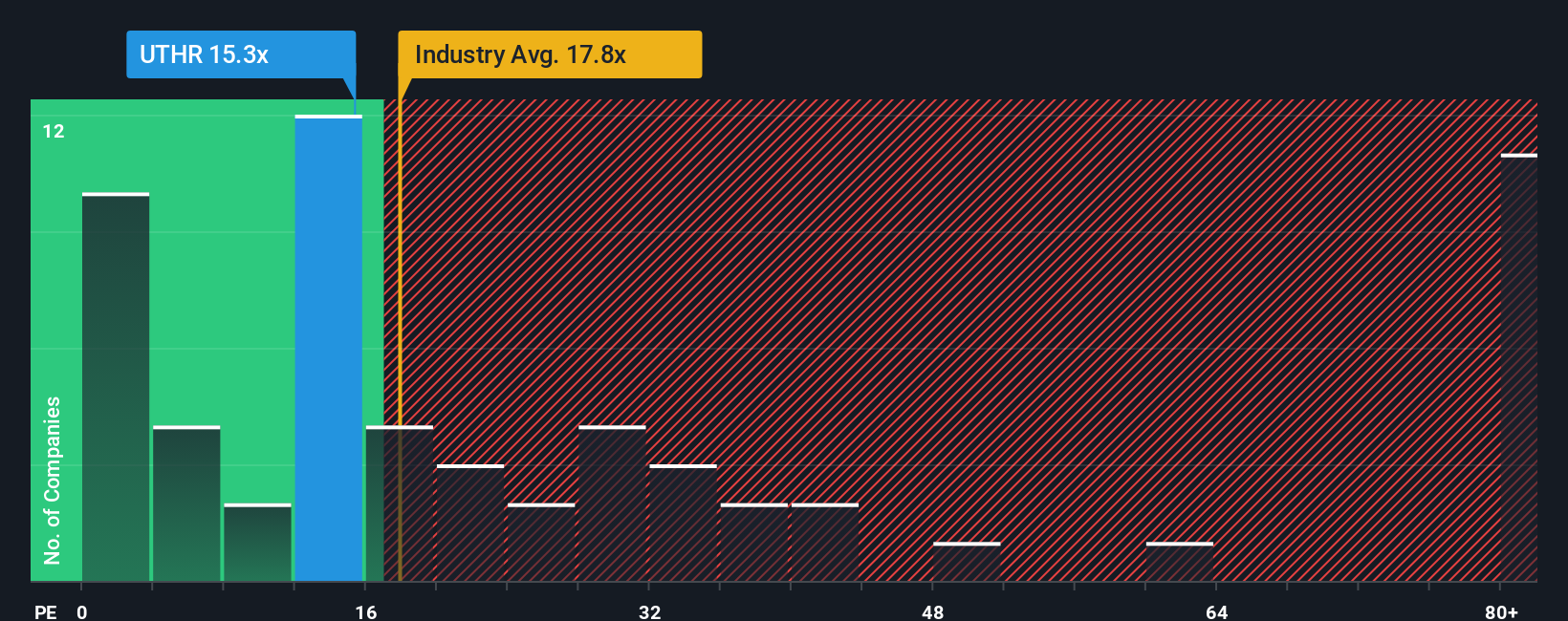

Interpreting a company’s PE ratio isn’t just about picking the lowest number. Growth expectations and risk levels play a critical role in determining what a “fair” PE should be. Higher-growth companies typically command higher PEs, while those with more risk or slower growth generally see lower multiples. For context, United Therapeutics currently trades at a PE ratio of 15.33x, compared to the Biotechs industry average of 17.82x and the average among its peers at 23.27x.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. It is a calculated benchmark that adjusts for factors such as earnings growth outlook, industry trends, profit margins, market capitalization, and overall risk. The Fair Ratio for United Therapeutics is estimated at 22.63x, suggesting what investors should expect to pay given all these variables. Unlike blunt peer or industry comparisons, this tailored measure is designed to provide a smarter, more holistic perspective on valuation.

Stacking up United Therapeutics' actual PE of 15.33x against its Fair Ratio of 22.63x signals meaningful undervaluation, even though the stock already trades below both peer and industry averages.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story behind your investment assumptions. It is where you connect what you believe about United Therapeutics and its future, such as upcoming drug launches, revenue growth, risks, and margins, to your own financial forecast and estimate of fair value.

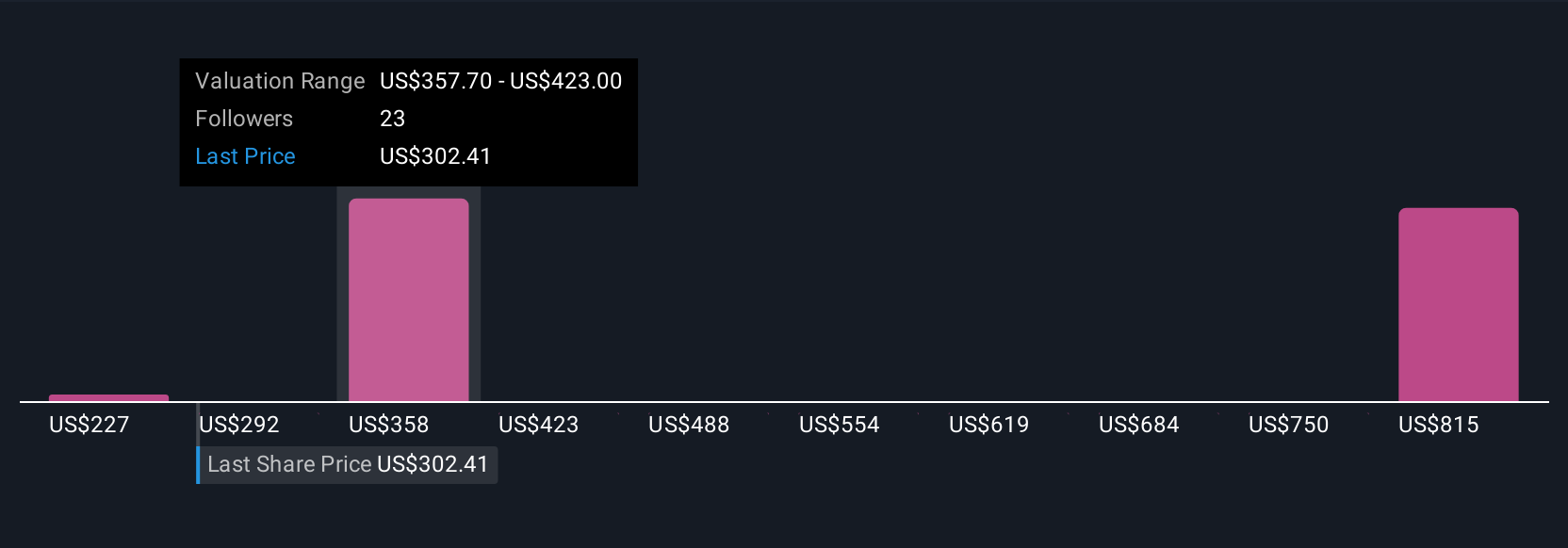

Instead of just crunching numbers, Narratives help bring clarity to your decision process by letting you spell out your reasoning, track your outlook, and see how your story drives your valuation. On Simply Wall St’s Community page, millions of investors add and update their Narratives, creating a diverse source of insights that goes far beyond standard financial models.

When you create a Narrative, you can easily compare your personal fair value to today’s share price and see in real time how new news, earnings, or trial data might affect your story. Narratives are updated dynamically, keeping your thesis relevant and actionable.

For example, one United Therapeutics investor may expect strong market expansion and forecast a fair value close to $575 per share, while another may take a more cautious view and estimate fair value near $320, reflecting their different expectations for future profits or competition.

Do you think there's more to the story for United Therapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UTHR

United Therapeutics

A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives