- United States

- /

- Biotech

- /

- NasdaqGM:URGN

UroGen Pharma (URGN): Assessing Valuation After 37% Share Price Surge in the Past Month

Reviewed by Simply Wall St

See our latest analysis for UroGen Pharma.

Zooming out, UroGen Pharma’s 37% share price rise over the past month has pulled it well ahead of the sector, building on a stellar year-to-date share price return of 122%. That momentum is reflected in the 112% total shareholder return over the past year and a remarkable 183% over three years. This signals renewed optimism and highlights the market’s increased appetite for the company’s growth and risk profile.

If UroGen’s momentum has piqued your curiosity, it could be the perfect moment to explore more promising opportunities using our healthcare stocks screener: See the full list for free.

But with shares rocketing higher and strong financial growth in the mix, the key question emerges: Is UroGen Pharma still trading at a bargain, or is its recent success already baked into the current share price?

Most Popular Narrative: 29.6% Undervalued

UroGen Pharma’s most widely followed valuation narrative suggests there is significant upside from the last close of $23.76, with a fair value estimate at $33.75. This large gap highlights aggressive earnings growth and market share milestones that underpin the narrative’s bullish case.

The shift toward minimally invasive, office-based therapies (away from repeated surgeries) and demonstrated long-term durability data for ZUSDURI directly align with industry-wide transitions in care standards. These factors support broader market penetration and the company's ability to command premium pricing, which could improve future net margins and profitability.

Want to see what’s fueling this potential? The narrative anchors its outlook on double-digit sales growth and a big swing in profitability. Find out which assumptions could change the game for this pricing power story.

Result: Fair Value of $33.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operating losses and slower than expected commercial uptake could challenge UroGen Pharma’s growth expectations and alter the current upbeat outlook.

Find out about the key risks to this UroGen Pharma narrative.

Another View: Market Multiples Tell a Different Story

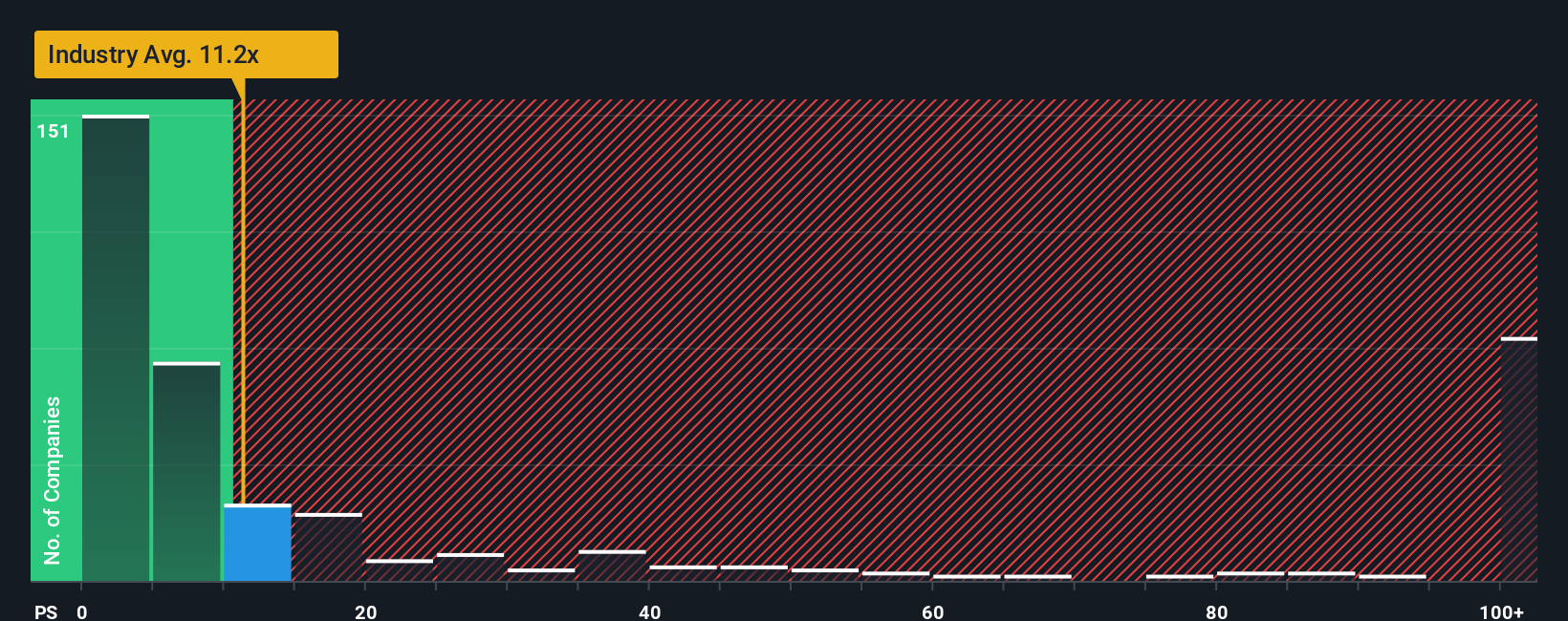

While the fair value estimate points to UroGen Pharma being undervalued, the market’s own yardstick sends mixed signals. The company trades at a price-to-sales ratio of 11.5x, only slightly above the US Biotechs industry average of 11.1x but well below the peer average of 13.1x. Interestingly, this remains a discount to its fair ratio of 15.3x, which the market could shift towards. Does this gap signal upside potential or lingering risks that keep some investors hesitant?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UroGen Pharma Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft your own valuation take in just a few minutes. Do it your way

A great starting point for your UroGen Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Missing out on other high-potential opportunities could mean leaving gains on the table. Put your portfolio ahead of the curve with a few more tailored ideas:

- Kickstart your search for growth by reviewing these 878 undervalued stocks based on cash flows, which offers strong cash flow potential at prices that savvy investors love.

- Supercharge your income with these 16 dividend stocks with yields > 3%, offering reliable yields above 3% to add stability to your returns.

- Catalyze your portfolio's tech edge by checking out these 25 AI penny stocks, leading the way in artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:URGN

UroGen Pharma

Engages in the development and commercialization of solutions for urothelial and specialty cancers.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives