- United States

- /

- Biotech

- /

- NasdaqGM:URGN

UroGen Pharma Ltd.'s (NASDAQ:URGN) Price Is Out Of Tune With Revenues

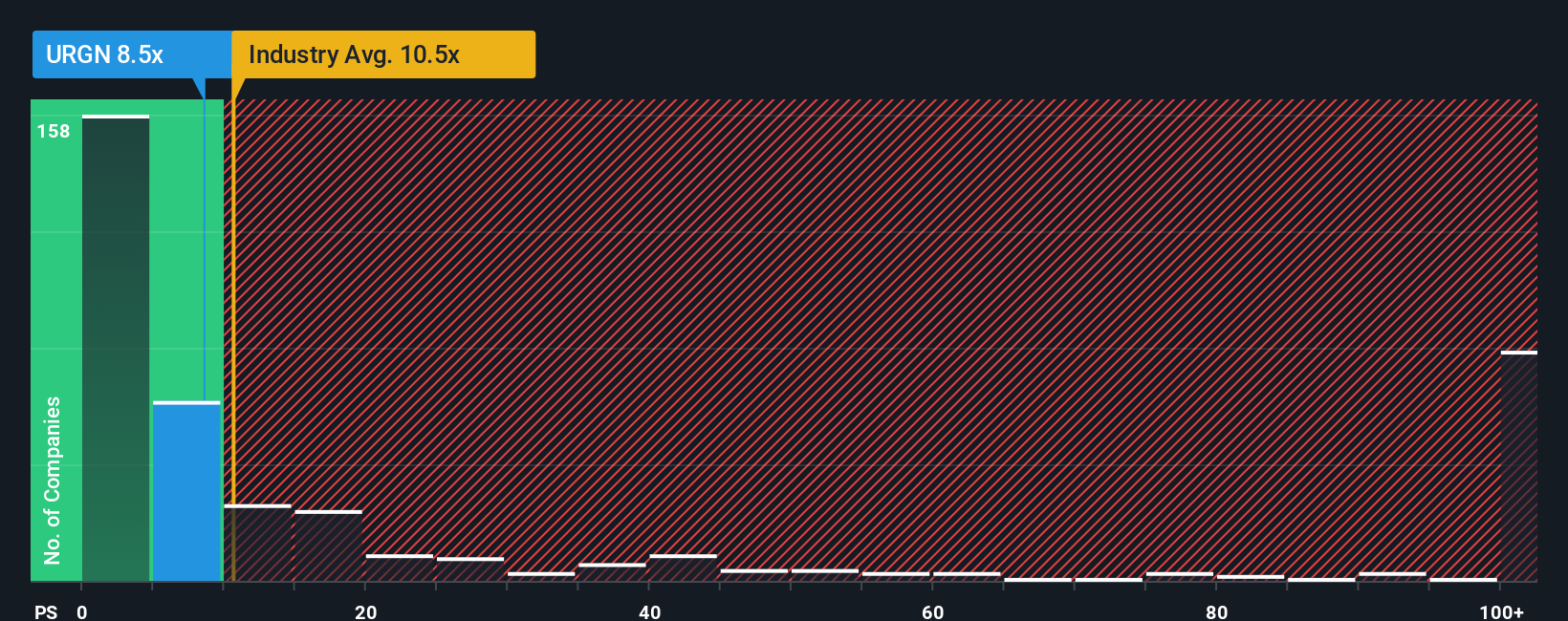

It's not a stretch to say that UroGen Pharma Ltd.'s (NASDAQ:URGN) price-to-sales (or "P/S") ratio of 8.5x right now seems quite "middle-of-the-road" for companies in the Biotechs industry in the United States, where the median P/S ratio is around 10.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for UroGen Pharma

What Does UroGen Pharma's P/S Mean For Shareholders?

UroGen Pharma could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on UroGen Pharma will help you uncover what's on the horizon.How Is UroGen Pharma's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like UroGen Pharma's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 63% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 72% each year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 128% per year, which is noticeably more attractive.

In light of this, it's curious that UroGen Pharma's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does UroGen Pharma's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that UroGen Pharma's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware UroGen Pharma is showing 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:URGN

UroGen Pharma

Engages in the development and commercialization of solutions for urothelial and specialty cancers.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives