- United States

- /

- Biotech

- /

- NasdaqGM:URGN

UGN-103 Phase 3 Success and FDA Support Could Be a Game Changer for UroGen Pharma (URGN)

Reviewed by Sasha Jovanovic

- In early November 2025, UroGen Pharma reported third-quarter results, highlighted by preliminary Phase 3 data showing a 77.8% complete response for UGN-103 in treating recurrent low-grade intermediate-risk non-muscle invasive bladder cancer, and received FDA feedback supporting a potential New Drug Application for this therapy.

- This regulatory milestone not only validates UroGen’s clinical development approach but also indicates a clearer path toward new product approvals in the urothelial cancer market.

- We'll explore how the robust clinical results for UGN-103 and FDA support could reshape UroGen Pharma's long-term investment outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

UroGen Pharma Investment Narrative Recap

To own a piece of UroGen Pharma, I believe an investor needs confidence that the company can translate strong clinical results, like the recent UGN-103 Phase 3 data and supportive FDA feedback, into approved, widely adopted products, all while managing persistent losses and funding needs. The latest news meaningfully boosts the odds of a new pipeline addition, and in my view, acts as the most important near-term catalyst, but big financial risks remain if commercial uptake continues to lag.

The company’s $75 million follow-on equity offering, announced alongside clinical and regulatory milestones, is especially relevant here: it reinforces the necessity for ongoing capital to support late-stage development and commercialization even as product catalysts approach. This aligns with the pivotal role new approvals could play in broadening the revenue base and reducing reliance on just two marketed therapies.

Yet, in contrast, investors should be aware that significant dilution risk remains if UroGen’s newest therapies don’t translate into...

Read the full narrative on UroGen Pharma (it's free!)

UroGen Pharma's narrative projects $463.3 million revenue and $137.0 million earnings by 2028. This requires 70.0% yearly revenue growth and a $292.0 million earnings increase from current earnings of $-155.0 million.

Uncover how UroGen Pharma's forecasts yield a $33.75 fair value, a 42% upside to its current price.

Exploring Other Perspectives

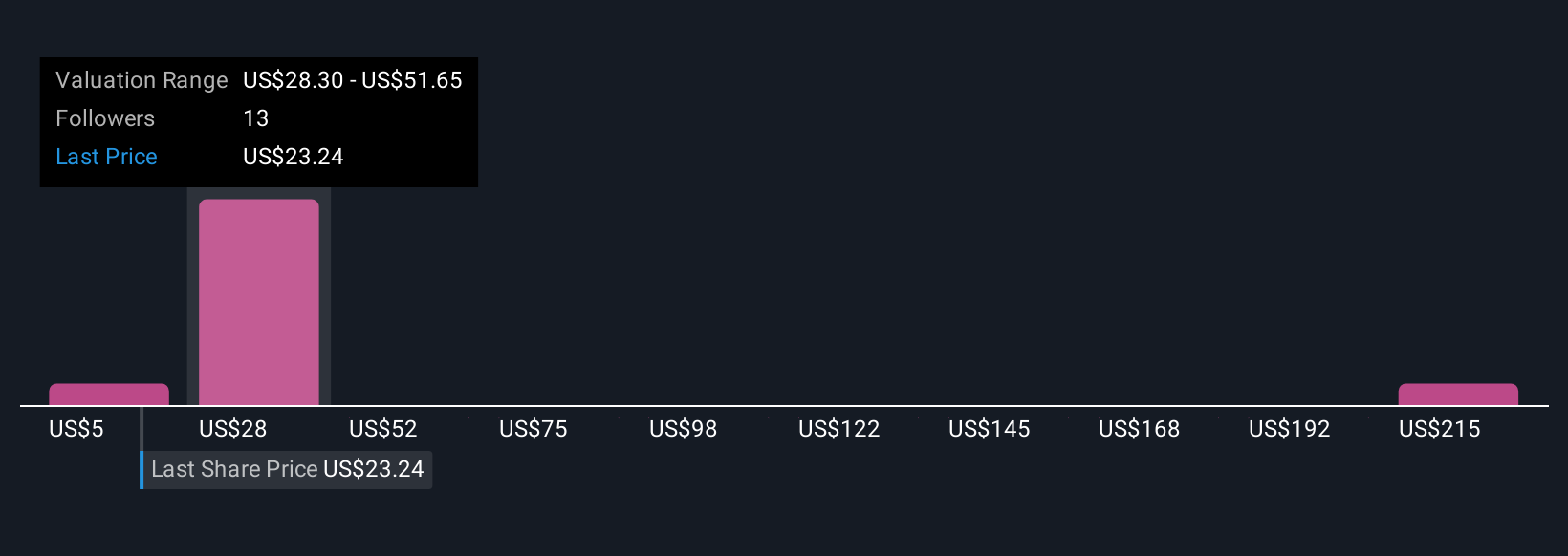

You’ll find US$4.94 to US$239.27 per share reflected in four fair value estimates from the Simply Wall St Community. Some see the path to wider adoption as rapid while others caution about the revenue ramp, showing just how differently market participants assess the company’s outlook.

Explore 4 other fair value estimates on UroGen Pharma - why the stock might be worth less than half the current price!

Build Your Own UroGen Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UroGen Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free UroGen Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UroGen Pharma's overall financial health at a glance.

No Opportunity In UroGen Pharma?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:URGN

UroGen Pharma

Engages in the development and commercialization of solutions for urothelial and specialty cancers.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives