- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

10x Genomics (TXG): Assessing Valuation After Recent 34% Share Price Rise

Reviewed by Simply Wall St

See our latest analysis for 10x Genomics.

10x Genomics’ share price has surged 34% over the past month, catching a strong wave of renewed interest, even as the 1-year total shareholder return stands at 19%. Despite a difficult few years, with a 3-year total return of -55% and -89% over five years, there is a sense that investor sentiment is turning a corner as the stock builds momentum.

If 10x Genomics' rally has you wondering what other growth stories might be brewing, this could be the perfect moment to discover See the full list for free.

The rapid ascent in 10x Genomics’ share price raises a fundamental question: Is the market underestimating its long-term potential, or is every bit of future growth already reflected in today’s valuation?

Most Popular Narrative: Fairly Valued

With the narrative’s fair value essentially matching the latest share price, there is little room for disagreement between analysts and the market right now. However, underlying business drivers could still shift the picture quickly, for better or worse. The next quote zeroes in on one of those pivotal elements.

Adoption of new lower-cost consumables (like GEM-X Flex and Universal On Chip Multiplex) is increasing reaction volumes and enabling scale, positioning 10x Genomics to capture growing demand in single-cell and multiomic analysis driven by precision medicine, likely supporting long-term revenue and recurring, high-margin consumables sales.

Why are analysts so confident about the valuation? The most important assumption in this narrative is a future business mix tilted toward premium products and scale advantages. Want to see what aggressive projections are hidden in the full story? Uncover the financial forecasts that make this price target possible.

Result: Fair Value of $15.86 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing funding uncertainty and shrinking pricing power could quickly shift the outlook if academic budgets tighten or if price declines continue.

Find out about the key risks to this 10x Genomics narrative.

Another View: Market Multiples Tell a Subtler Story

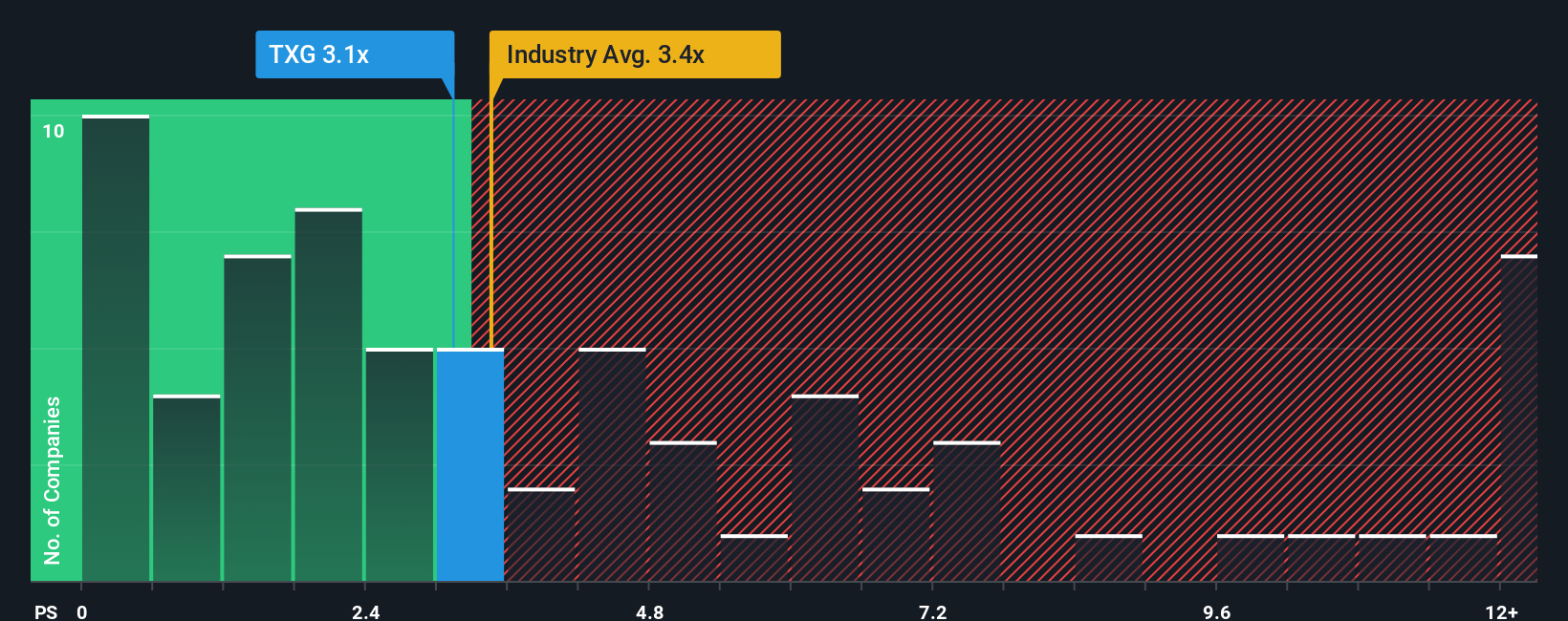

Looking at 10x Genomics through a price-to-sales lens reveals the shares trade at 3.1 times sales, notably cheaper than both the peer average (3.7x) and industry average (3.4x). This is also below the fair ratio of 3.9x that the market could eventually gravitate toward, which suggests shares might offer relative value, despite the challenges highlighted earlier. If market perception shifts, could this gap provide a cushion or just mask further risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 10x Genomics Narrative

If these conclusions don’t fit your perspective, you can easily dive into the numbers and assemble your own view of 10x Genomics in just a few minutes with Do it your way.

A great starting point for your 10x Genomics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Act now and uncover new investing opportunities you can’t afford to overlook. Use these screener tools to spot stocks poised for tomorrow’s success:

- Secure steady income for your portfolio by tapping into these 16 dividend stocks with yields > 3% offering attractive yields and reliable returns.

- Stay ahead of the tech curve by checking out these 25 AI penny stocks leading breakthroughs in artificial intelligence innovation and high-impact growth.

- Capitalize on affordable growth stories with these 886 undervalued stocks based on cash flows primed for potential upside based on strong fundamentals and cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the Americas, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives