- United States

- /

- Biotech

- /

- NasdaqGS:TWST

Twist Bioscience Corporation's (NASDAQ:TWST) Price Is Right But Growth Is Lacking After Shares Rocket 44%

Despite an already strong run, Twist Bioscience Corporation (NASDAQ:TWST) shares have been powering on, with a gain of 44% in the last thirty days. The last 30 days bring the annual gain to a very sharp 45%.

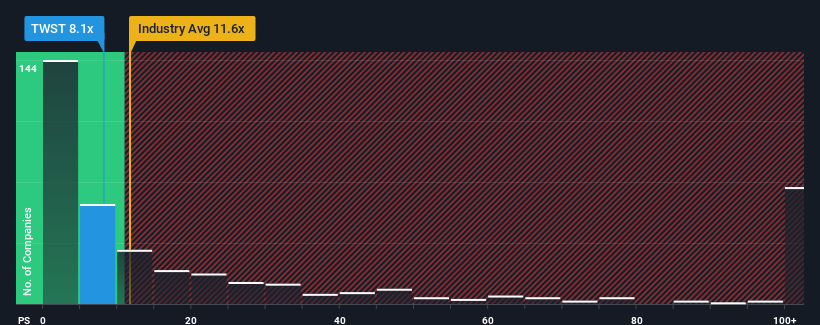

Although its price has surged higher, Twist Bioscience may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 8.1x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.6x and even P/S higher than 49x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Twist Bioscience

How Has Twist Bioscience Performed Recently?

With revenue growth that's inferior to most other companies of late, Twist Bioscience has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Twist Bioscience's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Twist Bioscience's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. The latest three year period has also seen an excellent 172% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 221% per year, which is noticeably more attractive.

In light of this, it's understandable that Twist Bioscience's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The latest share price surge wasn't enough to lift Twist Bioscience's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Twist Bioscience maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Twist Bioscience that you need to be mindful of.

If these risks are making you reconsider your opinion on Twist Bioscience, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Twist Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TWST

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives