- United States

- /

- Biotech

- /

- NasdaqGM:TVTX

How FILSPARI’s Endorsement as First-Line Therapy Has Changed Travere Therapeutics’ (TVTX) Investment Story

Reviewed by Sasha Jovanovic

- Earlier this week, the updated KDIGO 2025 clinical practice guidelines for IgA Nephropathy management endorsed FILSPARI (sparsentan), developed by Travere Therapeutics, as a first-line treatment option based on its clinical efficacy.

- This endorsement by a globally recognized authority marks an important step that could accelerate FILSPARI's integration into standard care for IgA nephropathy.

- We'll explore how FILSPARI's inclusion as a recommended first-line therapy could affect Travere's investment outlook and long-term market reach.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Travere Therapeutics Investment Narrative Recap

For a Travere shareholder, the key premise is that FILSPARI can capture and defend a leading position as a first-line treatment in rare kidney diseases, fueling sustained revenue growth and margin improvement. The recent KDIGO endorsement directly supports FILSPARI’s market expansion ambitions, potentially accelerating its uptake in IgA nephropathy. In the near term, this is highly relevant to FILSPARI’s commercial momentum; however, the company’s dependence on this single asset means any regulatory, clinical, or competitive setbacks remain the biggest risk for investors to watch.

Among recent announcements, the FDA’s decision on September 10 to forgo an advisory committee for FILSPARI’s supplemental approval in FSGS is closely tied to current events. With both regulatory clarity for FSGS and guideline recognition for IgAN, Travere now sits at the intersection of two meaningful catalysts that could reshape its risk-reward profile, but these developments also concentrate company exposure to any adverse outcomes around FILSPARI’s safety or market adoption.

By contrast, investors should not overlook that FILSPARI’s growing market share also heightens Travere’s exposure to intensifying competition in...

Read the full narrative on Travere Therapeutics (it's free!)

Travere Therapeutics' outlook anticipates $832.7 million in revenue and $221.2 million in earnings by 2028. This scenario rests on a 35.6% annual revenue growth rate and a $390.2 million increase in earnings from the current $-169.0 million.

Uncover how Travere Therapeutics' forecasts yield a $35.71 fair value, a 41% upside to its current price.

Exploring Other Perspectives

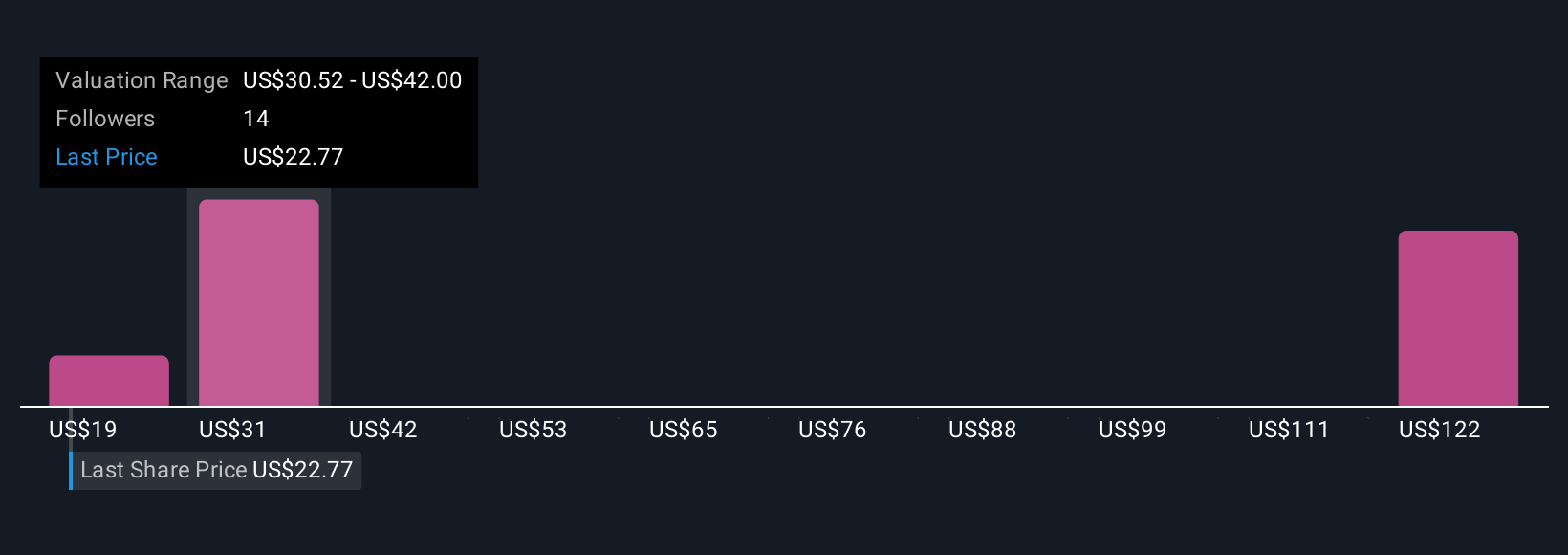

Eight Simply Wall St Community members estimate Travere's fair value between US$19.04 and US$133.26, reflecting a broad range of independent outlooks. While optimism about FILSPARI’s clinical positioning runs high, the potential for rival therapies and new drug classes is a factor you cannot ignore when weighing long-term market potential.

Explore 8 other fair value estimates on Travere Therapeutics - why the stock might be worth over 5x more than the current price!

Build Your Own Travere Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travere Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Travere Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travere Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travere Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TVTX

Travere Therapeutics

A biopharmaceutical company, identifies, develops, and delivers therapies to people living with rare kidney and metabolic diseases in the United States.

Exceptional growth potential and good value.

Market Insights

Community Narratives