- United States

- /

- Biotech

- /

- NasdaqGM:TVTX

How FDA's Eased REMS for FILSPARI Has Changed Travere Therapeutics' (TVTX) Investment Story

Reviewed by Sasha Jovanovic

- In recent weeks, Travere Therapeutics announced that the FDA has modified the Risk Evaluation and Mitigation Strategies (REMS) requirements for FILSPARI, resulting in eased monitoring protocols and improved commercial potential for the drug.

- This regulatory change is expected to facilitate increased patient access and may support the company's ambitions for label expansion into additional indications such as focal segmental glomerulosclerosis (FSGS).

- We'll examine how the FDA's REMS modifications for FILSPARI could reshape Travere Therapeutics' investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Travere Therapeutics Investment Narrative Recap

To be a Travere Therapeutics shareholder, you need to believe in the transformative potential of FILSPARI as a foundational therapy for rare kidney diseases and in Travere’s ability to expand into additional indications amidst fierce competition. The recent easing of FDA REMS requirements directly improves FILSPARI’s near-term commercial access, supporting a key catalyst: progress toward FSGS label expansion. The biggest risk remains the company’s concentrated revenue reliance on FILSPARI, which could become problematic if the drug loses clinical or commercial momentum.

The announcement of positive Phase 3 DUPLEX Study data for FILSPARI in FSGS is particularly relevant. This new data, showing greater proteinuria reduction versus irbesartan, reinforces FILSPARI’s clinical edge, underlining both its immediate and longer-term potential as the company works toward gaining FDA approval for this high-need indication.

However, against these positive developments, investors should be aware of risks from intensifying competition in the kidney disease treatment field, as ...

Read the full narrative on Travere Therapeutics (it's free!)

Travere Therapeutics' outlook points to $832.7 million in revenue and $221.2 million in earnings by 2028. This scenario assumes a 35.6% annual revenue growth rate and an increase in earnings of $390.2 million from the current level of -$169.0 million.

Uncover how Travere Therapeutics' forecasts yield a $41.50 fair value, a 17% upside to its current price.

Exploring Other Perspectives

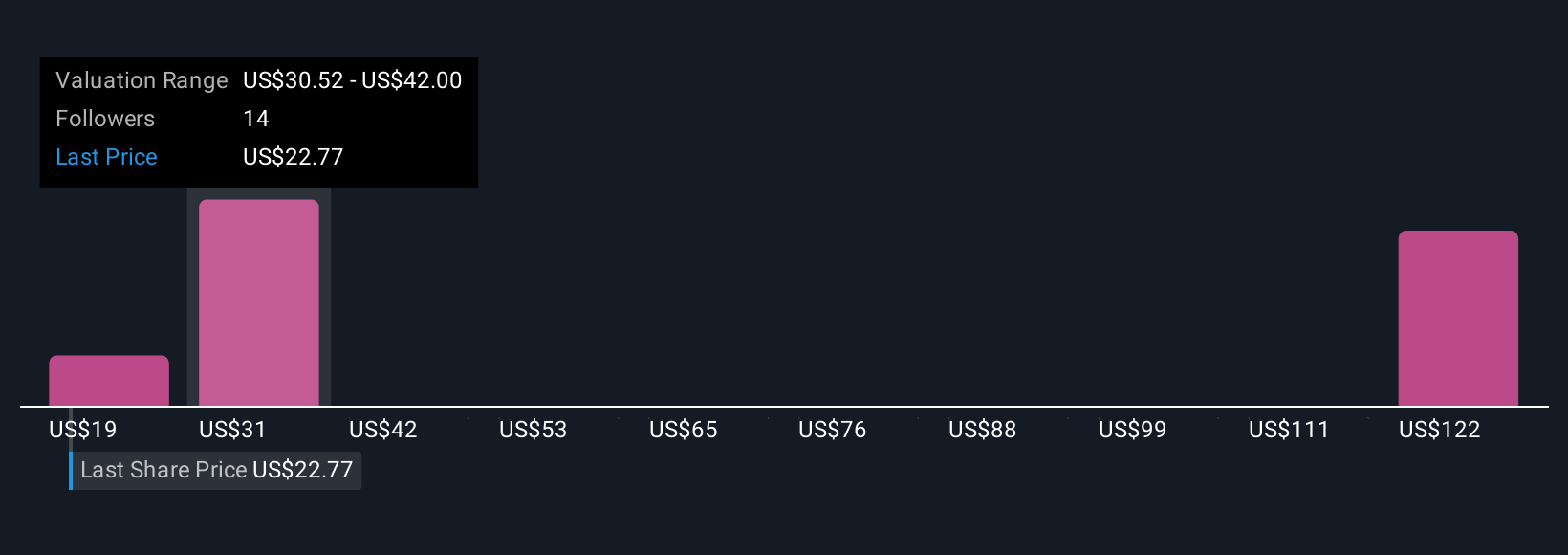

Fair value estimates from 9 Simply Wall St Community members range from US$19.04 to US$141.78, reflecting both significant caution and optimism. With regulatory changes supporting increased FILSPARI access, consider how competitive pressures could affect consensus and potential outcomes for Travere Therapeutics.

Explore 9 other fair value estimates on Travere Therapeutics - why the stock might be worth over 4x more than the current price!

Build Your Own Travere Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travere Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Travere Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travere Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travere Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TVTX

Travere Therapeutics

A biopharmaceutical company, identifies, develops, and delivers therapies to people living with rare kidney and metabolic diseases in the United States.

Exceptional growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.