- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

What Taysha Gene Therapies, Inc.'s (NASDAQ:TSHA) 55% Share Price Gain Is Not Telling You

Taysha Gene Therapies, Inc. (NASDAQ:TSHA) shares have continued their recent momentum with a 55% gain in the last month alone. The last 30 days were the cherry on top of the stock's 306% gain in the last year, which is nothing short of spectacular.

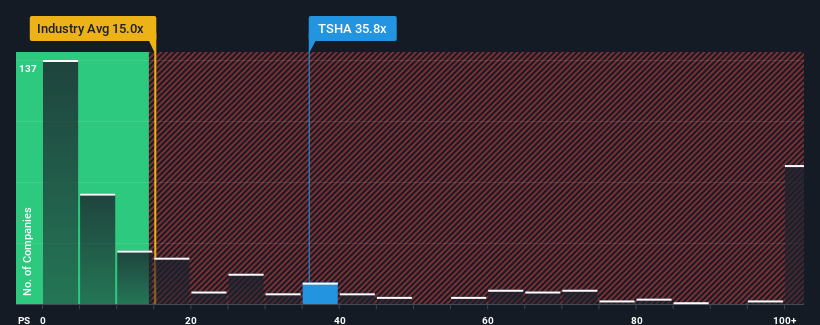

Following the firm bounce in price, Taysha Gene Therapies may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 35.8x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 15x and even P/S lower than 4x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Taysha Gene Therapies

How Taysha Gene Therapies Has Been Performing

Taysha Gene Therapies certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Taysha Gene Therapies.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Taysha Gene Therapies' to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue growth is heading into negative territory, declining 60% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 145% each year.

With this in mind, we find it intriguing that Taysha Gene Therapies' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Taysha Gene Therapies' P/S?

The strong share price surge has lead to Taysha Gene Therapies' P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Taysha Gene Therapies currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 3 warning signs for Taysha Gene Therapies (2 shouldn't be ignored!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives