- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

Scienjoy Holding Leads Our 3 US Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. market navigates a mixed landscape with investors digesting a slew of earnings reports, penny stocks continue to capture attention for their unique investment opportunities. Despite their somewhat outdated moniker, these stocks often represent smaller or newer companies that can offer both affordability and growth potential when backed by strong financials. This article explores several penny stocks that stand out for their financial strength and potential long-term prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8577 | $6.52M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.59M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2799 | $9.75M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.03 | $88.27M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.43 | $47.85M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.09 | $51.01M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.35 | $21.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9234 | $83.69M | ★★★★★☆ |

| SideChannel (OTCPK:SDCH) | $0.038815 | $9.04M | ★★★★★★ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Scienjoy Holding (NasdaqCM:SJ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scienjoy Holding Corporation operates mobile live streaming platforms in the People’s Republic of China and has a market cap of $36.82 million.

Operations: The company generates revenue from its Internet Telephone segment, which amounts to CN¥1.44 billion.

Market Cap: $36.82M

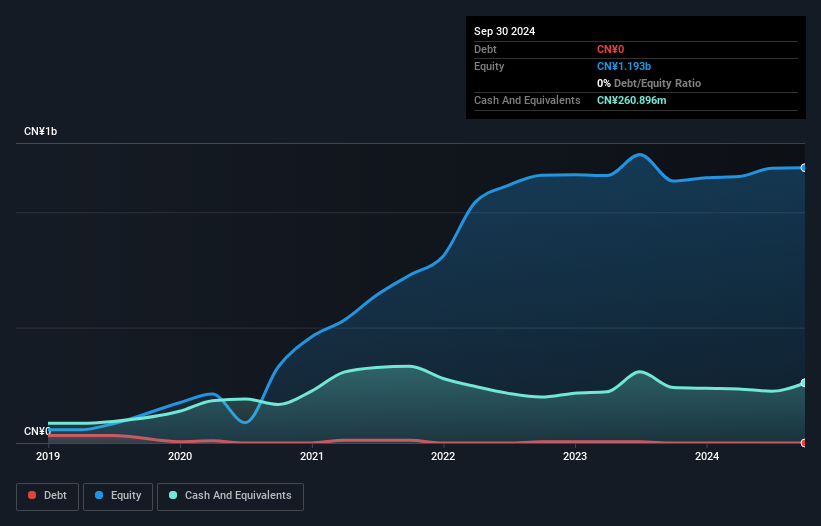

Scienjoy Holding Corporation, with a market cap of US$36.82 million, has recently turned profitable, reporting net income of CN¥42.69 million for the nine months ending September 2024. The company's revenue guidance for Q4 2024 is between RMB 300 million and RMB 330 million. Despite high volatility in its share price over the past three months, Scienjoy remains debt-free with strong short-term asset coverage over liabilities and no recent shareholder dilution. However, its return on equity is low at 3.1%, and earnings have declined by an average of 32.2% annually over the past five years despite recent profitability improvements.

- Click here to discover the nuances of Scienjoy Holding with our detailed analytical financial health report.

- Learn about Scienjoy Holding's historical performance here.

Accuray (NasdaqGS:ARAY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Accuray Incorporated designs, develops, manufactures, and sells radiosurgery and radiation therapy systems for tumor treatment across various global markets with a market cap of $220.24 million.

Operations: The company's revenue segment is comprised of $444.20 million from proprietary medical devices used in radiation therapy.

Market Cap: $220.24M

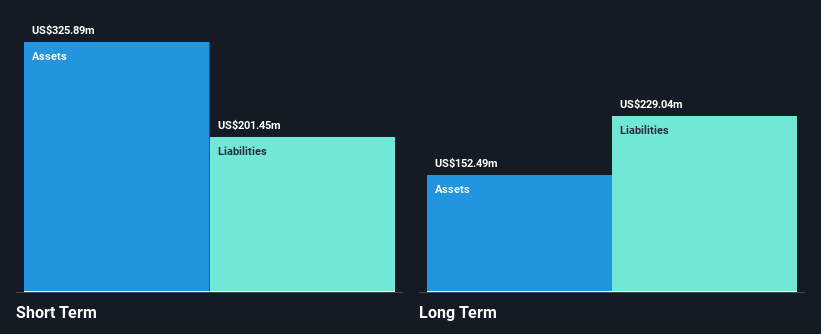

Accuray Incorporated, with a market cap of US$220.24 million, offers potential within the penny stock landscape due to its robust asset position and innovative product approvals in China. The company's short-term assets exceed both short and long-term liabilities, providing financial stability amidst ongoing unprofitability. Accuray's recent regulatory approvals for advanced radiation therapy systems in China could drive future revenue growth. However, challenges persist with a high net debt to equity ratio of 245.5% and increasing losses over the past five years. Despite these hurdles, analysts expect significant stock price appreciation based on current valuations and forecasts.

- Get an in-depth perspective on Accuray's performance by reading our balance sheet health report here.

- Explore Accuray's analyst forecasts in our growth report.

Taysha Gene Therapies (NasdaqGS:TSHA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taysha Gene Therapies, Inc. is a gene therapy company that develops and commercializes adeno-associated virus-based treatments for monogenic diseases of the central nervous system, with a market cap of $313.56 million.

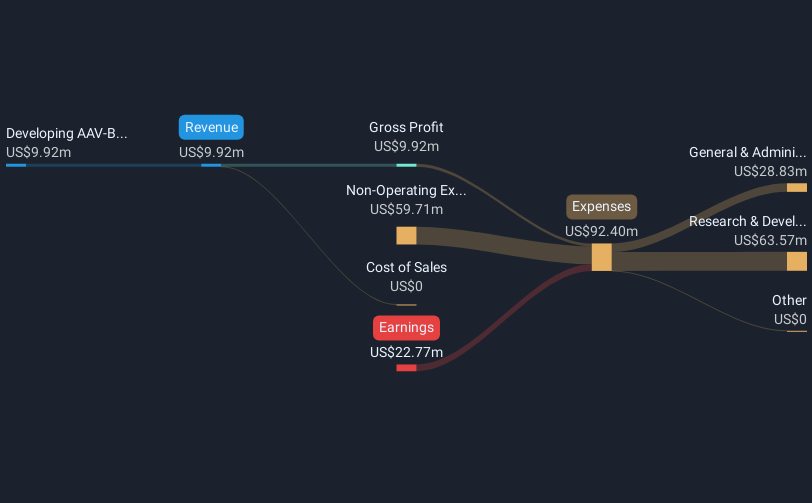

Operations: The company's revenue segment focuses on developing AAV-based gene therapies for the treatment of rare monogenic diseases, generating $9.92 million.

Market Cap: $313.56M

Taysha Gene Therapies, Inc., with a market cap of US$313.56 million, navigates the penny stock arena with its focus on gene therapies for rare monogenic diseases. Despite being pre-revenue and unprofitable, the company maintains financial stability as its short-term assets exceed both long-term and short-term liabilities. Recent filings for shelf registrations totaling over US$326 million suggest potential capital raising efforts to support operations and development activities. The company's cash reserves offer a runway exceeding one year even as it faces high volatility in share price movements and lacks near-term profitability forecasts.

- Navigate through the intricacies of Taysha Gene Therapies with our comprehensive balance sheet health report here.

- Understand Taysha Gene Therapies' earnings outlook by examining our growth report.

Seize The Opportunity

- Investigate our full lineup of 706 US Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success