- United States

- /

- Biotech

- /

- NasdaqGM:TRDA

Entrada Therapeutics, Inc.'s (NASDAQ:TRDA) Shares Bounce 30% But Its Business Still Trails The Industry

The Entrada Therapeutics, Inc. (NASDAQ:TRDA) share price has done very well over the last month, posting an excellent gain of 30%. The last 30 days bring the annual gain to a very sharp 46%.

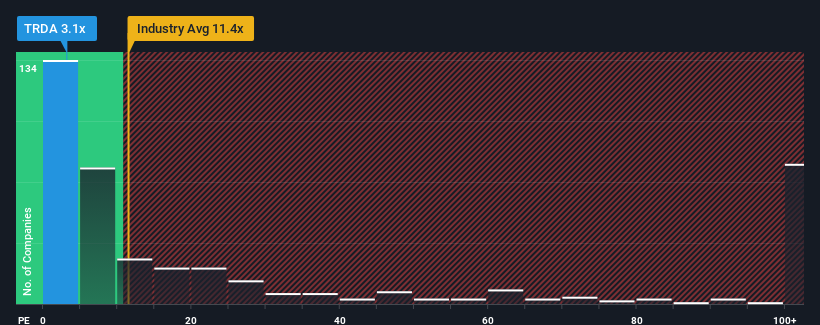

In spite of the firm bounce in price, Entrada Therapeutics may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.1x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.4x and even P/S higher than 65x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Entrada Therapeutics

What Does Entrada Therapeutics' P/S Mean For Shareholders?

Entrada Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Entrada Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Entrada Therapeutics' Revenue Growth Trending?

Entrada Therapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 25% per year during the coming three years according to the five analysts following the company. Meanwhile, the broader industry is forecast to expand by 209% per year, which paints a poor picture.

With this in consideration, we find it intriguing that Entrada Therapeutics' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Entrada Therapeutics' recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Entrada Therapeutics' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Entrada Therapeutics' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Entrada Therapeutics that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Entrada Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TRDA

Entrada Therapeutics

A clinical-stage biotechnology company, develops endosomal escape vehicle (EEV) therapeutics for the treatment of multiple neuromuscular diseases.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives