- United States

- /

- Biotech

- /

- NasdaqGM:TNGX

Little Excitement Around Tango Therapeutics, Inc.'s (NASDAQ:TNGX) Revenues As Shares Take 28% Pounding

Unfortunately for some shareholders, the Tango Therapeutics, Inc. (NASDAQ:TNGX) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 81% share price decline.

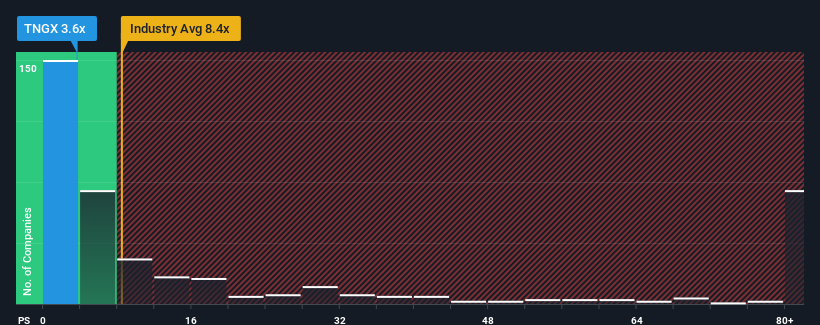

After such a large drop in price, Tango Therapeutics may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.6x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 8.4x and even P/S higher than 47x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 4 warning signs investors should be aware of before investing in Tango Therapeutics. Read for free now.View our latest analysis for Tango Therapeutics

What Does Tango Therapeutics' Recent Performance Look Like?

Recent times haven't been great for Tango Therapeutics as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Tango Therapeutics will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Tango Therapeutics?

The only time you'd be truly comfortable seeing a P/S as depressed as Tango Therapeutics' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. As a result, it also grew revenue by 14% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 11% per year as estimated by the six analysts watching the company. Meanwhile, the broader industry is forecast to expand by 173% per annum, which paints a poor picture.

In light of this, it's understandable that Tango Therapeutics' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Tango Therapeutics' P/S?

Having almost fallen off a cliff, Tango Therapeutics' share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Tango Therapeutics' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Tango Therapeutics' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Tango Therapeutics (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tango Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TNGX

Tango Therapeutics

A precision oncology company, focuses on the discovery and development of drugs in defined patient populations with unmet medical need.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives