- United States

- /

- Biotech

- /

- NasdaqCM:TLSA

3 Promising Penny Stocks With At Least $40M Market Cap

Reviewed by Simply Wall St

Major stock indexes in the United States have mostly risen, with investors eagerly anticipating Nvidia's earnings report, which could influence broader market trends. Though the term 'penny stock' might sound like a relic of past trading days, the opportunity it points to is still relevant. These smaller or newer companies, when built on solid financials, can lead to significant returns. We've selected three examples of penny stocks that combine balance sheet strength with potential for outsized gains, giving investors the chance to discover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.68 | $362.18M | ✅ 4 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.02 | $899.94M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.66 | $600.36M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.96 | $666.32M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.1873 | $27.23M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.27 | $546.53M | ✅ 5 ⚠️ 0 View Analysis > |

| Cricut (CRCT) | $4.60 | $969.79M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.896617 | $6.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.33 | $75.9M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.01 | $9.51M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 361 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Oriental Culture Holding (OCG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oriental Culture Holding LTD, with a market cap of $45.58 million, operates an online platform for e-commerce trading of artwork and collectibles in the People's Republic of China and Hong Kong.

Operations: No specific revenue segments are reported for the company.

Market Cap: $45.58M

Oriental Culture Holding LTD, with a market cap of US$45.58 million, operates an online platform for e-commerce trading of artwork and collectibles. The company is pre-revenue, reporting sales of only US$0.14 million for the half year ended June 30, 2025, down from US$0.45 million a year ago. It remains unprofitable with a net loss of US$3.82 million compared to US$1.87 million the previous year and has no debt obligations or long-term liabilities. Recent changes in company bylaws aim to provide flexibility in share capital management but require shareholder approval to implement fully.

- Click to explore a detailed breakdown of our findings in Oriental Culture Holding's financial health report.

- Review our historical performance report to gain insights into Oriental Culture Holding's track record.

Tiziana Life Sciences (TLSA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tiziana Life Sciences Ltd is a biotechnology company focused on developing transformative therapies for neurodegenerative and lung diseases in the United States, with a market cap of approximately $200.81 million.

Operations: Tiziana Life Sciences Ltd does not have any reported revenue segments.

Market Cap: $200.81M

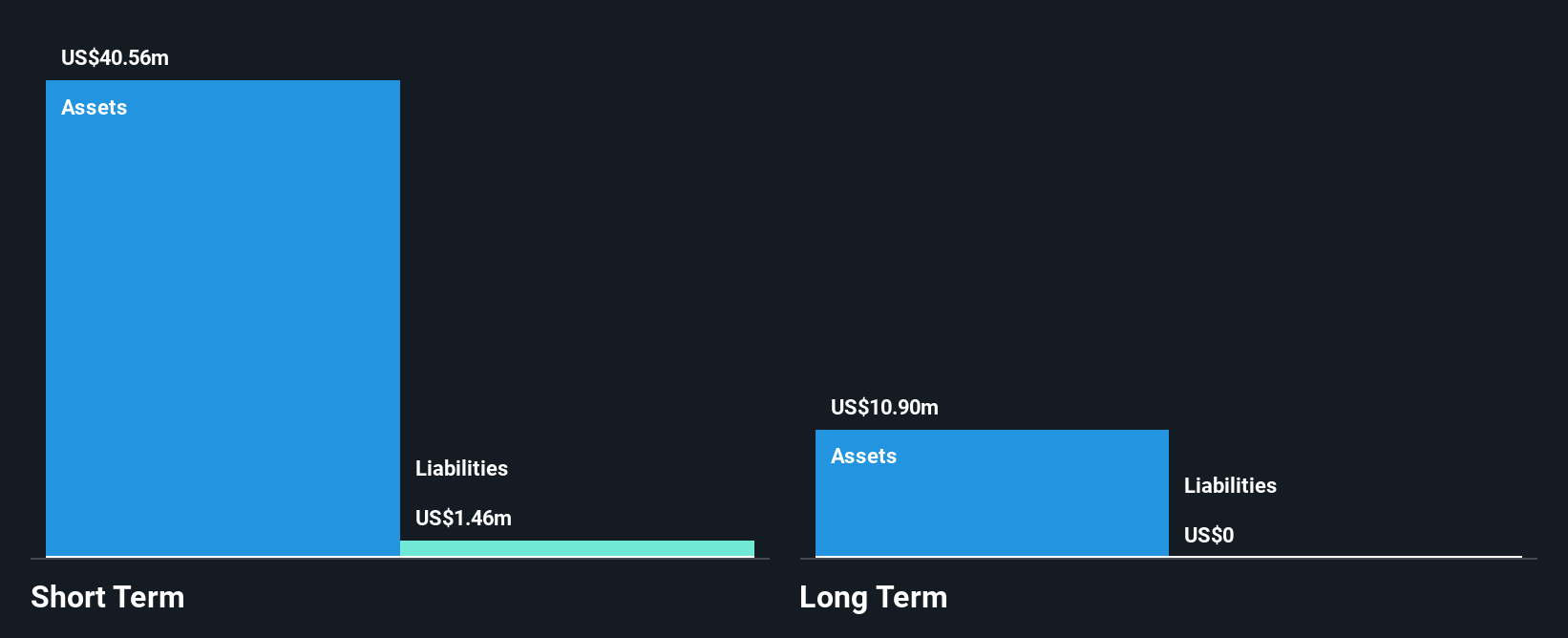

Tiziana Life Sciences Ltd, with a market cap of US$200.81 million, is pre-revenue and focuses on developing therapies for neurodegenerative and lung diseases. The company recently received a U.S. Department of Defense grant to study its intranasal anti-CD3 therapy for spinal cord injury, highlighting potential in unmet medical needs. Despite being unprofitable with a net loss of US$5.63 million for the half year ended June 30, 2025, Tiziana has reduced losses over five years by 13.7% annually and remains debt-free with short-term assets exceeding liabilities by US$5.3 million, indicating financial stability amidst high volatility and ongoing capital raises.

- Jump into the full analysis health report here for a deeper understanding of Tiziana Life Sciences.

- Assess Tiziana Life Sciences' future earnings estimates with our detailed growth reports.

Vasta Platform (VSTA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vasta Platform Limited offers educational printed and digital solutions to private K-12 schools in Brazil, with a market cap of $399.62 million.

Operations: The company generates revenue from its Educational Services segment, specifically in Education & Training Services, totaling R$1.74 billion.

Market Cap: $399.62M

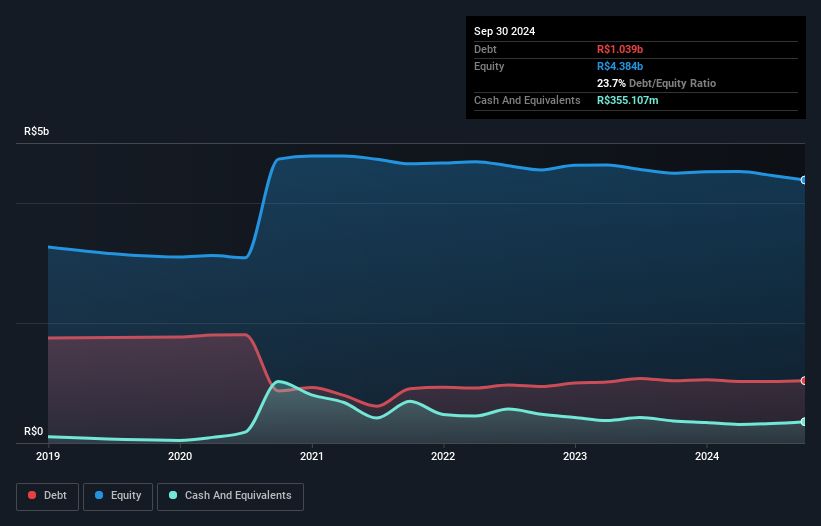

Vasta Platform Limited, with a market cap of $399.62 million, is involved in educational solutions for K-12 schools in Brazil. The company reported third-quarter revenue of R$249.6 million and a net loss of R$59.77 million, showing improvement from the previous year’s losses. Vasta's short-term assets exceed both its short and long-term liabilities, indicating solid financial footing despite low return on equity at 10%. The company's debt is well-covered by operating cash flow at 26.7%, although earnings are forecast to decline significantly over the next three years amid ongoing acquisition talks by Cogna Educação S.A., which may lead to delisting from Nasdaq.

- Get an in-depth perspective on Vasta Platform's performance by reading our balance sheet health report here.

- Learn about Vasta Platform's future growth trajectory here.

Summing It All Up

- Click here to access our complete index of 361 US Penny Stocks.

- Seeking Other Investments? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiziana Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TLSA

Tiziana Life Sciences

A biotechnology company, engages in the development of transformative therapies for neurodegenerative and lung diseases in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives