- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Why Tilray Brands (TLRY) Is Down 10.3% After 1-for-10 Reverse Stock Split Announcement and Cost Cuts

Reviewed by Sasha Jovanovic

- Tilray Brands announced a 1-for-10 reverse stock split of its common stock effective December 1, 2025, consolidating every ten existing shares into one as part of efforts to align with industry norms and attract institutional investors.

- The company also expects annual cost savings of up to $1 million from reduced shareholder meeting expenses, reflecting an ongoing focus on operational efficiency and market positioning.

- Next, we will assess how the reverse stock split and operational changes may influence Tilray Brands' investment outlook and growth narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Tilray Brands Investment Narrative Recap

To be a shareholder in Tilray Brands, you need to believe in the long-term potential of legal cannabis markets and the company’s ability to achieve profitability and revenue growth amid regulatory uncertainty and ongoing market challenges. The recent reverse stock split announcement primarily impacts share structure and administrative costs, but it does not materially change Tilray’s exposure to its biggest near-term catalyst, faster regulatory progress in key markets, or its most urgent risk, which is continued unprofitability and cash burn.

Among Tilray's latest updates, the launch of Good Supply vape products in Quebec stands out as an effort to grow market share in Canada’s adult-use cannabis segment. While product expansion can support revenue growth, it is primarily broader market access and regulatory shifts that are the central short-term catalysts for the business. On the other hand, persistent losses continue to magnify containment of costs and margin improvements as priorities for management. Despite this, investors should be aware that ongoing losses and negative free cash flow signal a risk that...

Read the full narrative on Tilray Brands (it's free!)

Tilray Brands' narrative projects $940.4 million revenue and $193.4 million earnings by 2028. This requires 4.6% yearly revenue growth and a $2.4 billion increase in earnings from -$2.2 billion currently.

Uncover how Tilray Brands' forecasts yield a $1.78 fair value, a 119% upside to its current price.

Exploring Other Perspectives

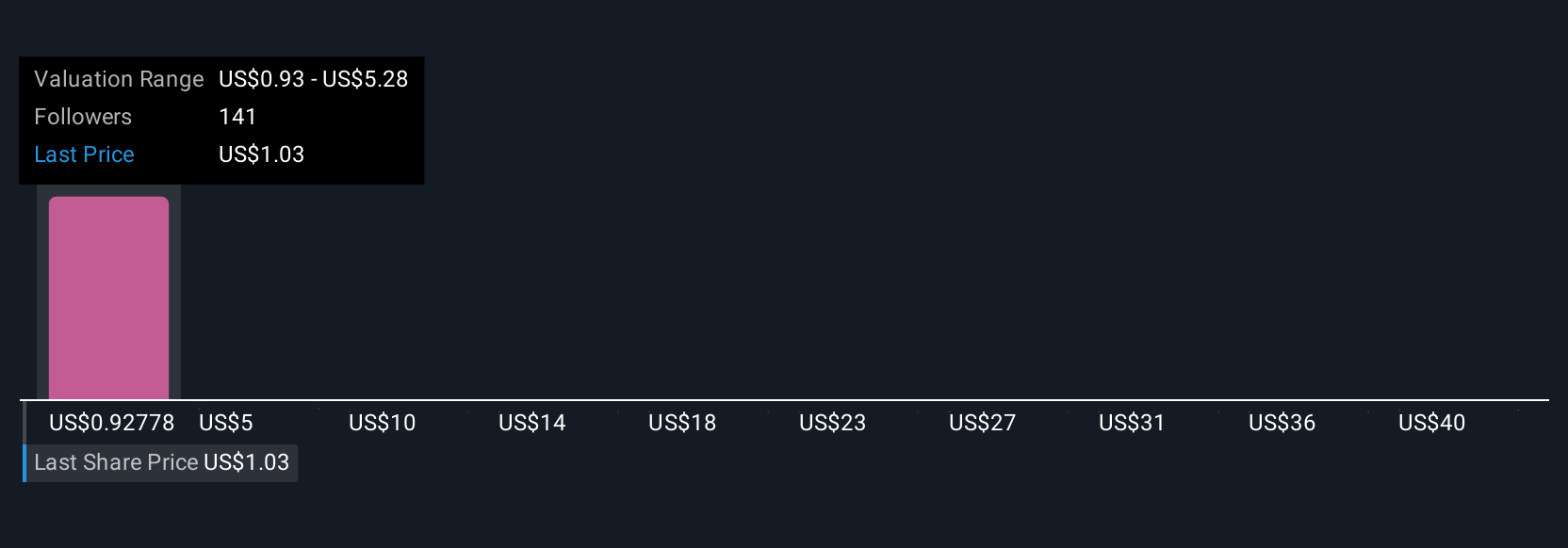

Simply Wall St Community members provided 20 fair value estimates for Tilray Brands, with valuations ranging from US$1.12 to US$8.04 per share. Many emphasize that persistent operating losses and negative cash flow remain key challenges for Tilray’s outlook, prompting a wide range of opinions about future performance and value.

Explore 20 other fair value estimates on Tilray Brands - why the stock might be worth just $1.12!

Build Your Own Tilray Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tilray Brands research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tilray Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tilray Brands' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.