- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Tilray (NasdaqGS:TLRY) Valuation Spotlight After Earnings Beat and Expansion into New Markets

Reviewed by Simply Wall St

Tilray Brands (NasdaqGS:TLRY) caught investors’ attention after delivering quarterly results that exceeded expectations, thanks to ongoing diversification efforts and expansion into new medical cannabis markets, including Panama. Recent optimism over U.S. cannabis reform is also fueling interest.

See our latest analysis for Tilray Brands.

A string of upbeat headlines, from a major earnings beat to Tilray’s entrance into Panama’s medical market, sparked strong momentum and pushed its 30-day share price return to just over 20%. That said, long-term investors are still under water, with the one-year total shareholder return down nearly 14% and a three-year return well in the red. At the moment, momentum seems to be building, reflecting renewed speculation on U.S. reform and the company’s expansion rollouts. However, questions about sustained growth and risk remain in focus.

If you’re keeping an eye on this turnaround story and want to look beyond cannabis, now’s a good moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares rebounding but longer-term returns still deeply negative, the key question now is whether Tilray’s recent momentum signals that the stock is still undervalued, or if the market has already priced in all the good news.

Most Popular Narrative: 30.5% Overvalued

Tilray Brands' most followed narrative places fair value at $1.11 per share, notably below the recent closing price of $1.45. This suggests the market might be ahead of fundamentals as optimism grows around regulatory change and international expansion.

"Tilray's international cannabis business is achieving rapid organic growth, with European cannabis revenue up 112% YoY (excluding Australia) and significant share gains in Germany due to regulatory tailwinds, broader medical adoption, and expanding legalization. This supports a long runway for top-line revenue acceleration as global cannabis markets open."

What is really powering this valuation? There is a bold growth trajectory baked in, one that hinges on international breakthroughs and a shift in earnings profile. Curious what profit margins, industry multiples, and revenue ambitions are driving this surprisingly high price tag? The details just might change how you see Tilray’s future.

Result: Fair Value of $1.11 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent delays in U.S. cannabis legalization and profit challenges could quickly undermine the growth trajectory that investors are counting on for Tilray’s future.

Find out about the key risks to this Tilray Brands narrative.

Another View: Is the Market Missing Something?

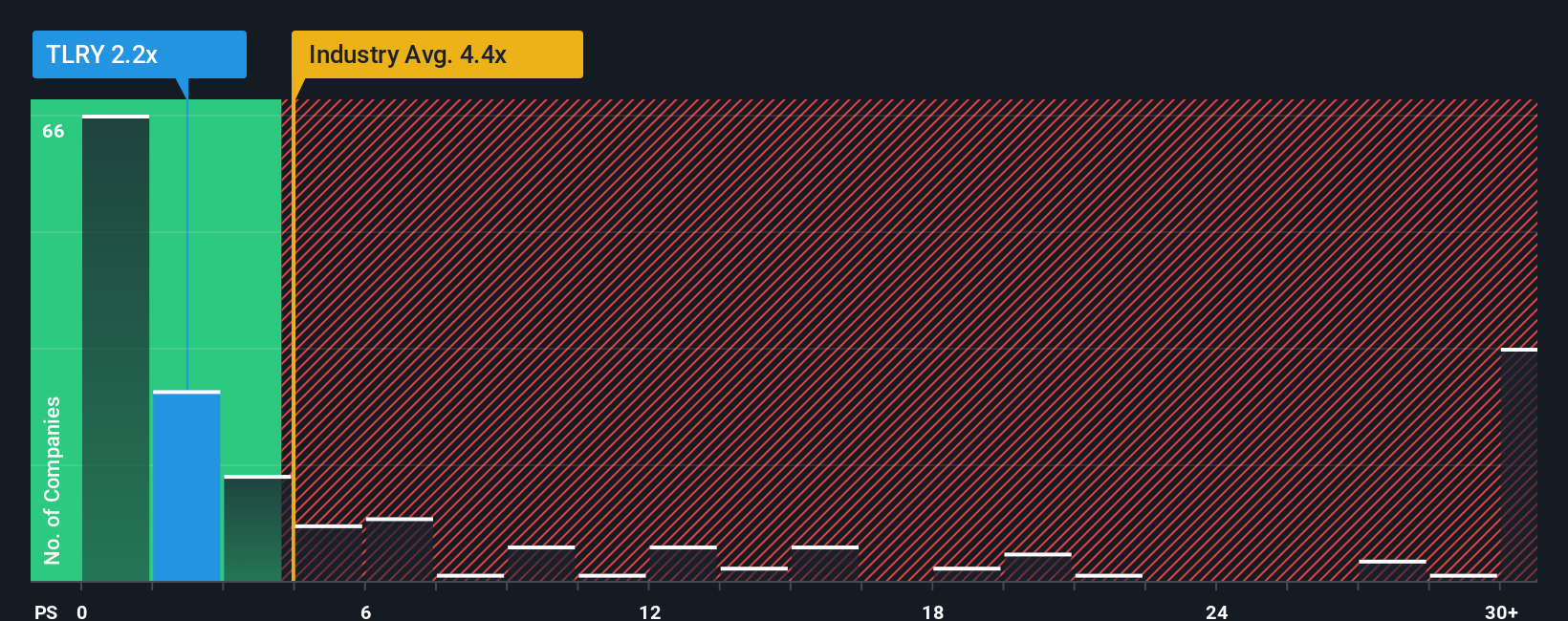

Looking at Tilray’s price-to-sales ratio of 2x, it is clear the stock is trading at a steep discount compared to the US Pharmaceuticals industry average of 4.4x and even below the estimated fair ratio of 2.3x. This deep gap might signal opportunity, but it also raises the stakes if the narrative does not play out. Which metric should investors trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tilray Brands Narrative

If you see things differently or want to dive into the numbers yourself, you can shape your own Tilray narrative in just a few minutes. Do it your way

A great starting point for your Tilray Brands research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Winning Opportunities?

Smart investors are spotting fresh trends every day. Give yourself the inside track by checking out these timely ideas. There’s no reason to miss the next breakout stock.

- Target reliable returns by reviewing these 17 dividend stocks with yields > 3% offering yields above 3 percent and strong fundamentals for stable, income-focused portfolios.

- Stay ahead of the curve with emerging tech by assessing these 26 AI penny stocks set to shape tomorrow’s AI landscape with real-world breakthroughs.

- Take advantage of market mispricing by evaluating these 874 undervalued stocks based on cash flows poised for growth based on robust cash flow analysis and compelling valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives