- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Tilray Brands (NasdaqGS:TLRY) Advances Medical Cannabis Research With New Bioavailability Study

Reviewed by Simply Wall St

Tilray Brands (NasdaqGS:TLRY) has recently published a scientific study through its medical division, comparing the bioavailability of different cannabinoid formulations. This event, paired with the company's launch of a new summer cannabis collection through its subsidiaries, reflects its active role in the cannabis industry. Additionally, Tilray faced the challenge of being removed from several key stock indices. Over the past week, Tilray's stock price increase of 2.74% was slightly above the market's 1.7% rise, with these events potentially adding some weight to the broader positive market trend.

The recent scientific study released by Tilray Brands through its medical division underscores its commitment to exploring cannabinoid formulations, potentially boosting its standing in the scientific community and enhancing its product portfolio. This development might positively impact future revenue streams by increasing product demand in medical cannabis, aligning with the company's focus on international expansion and margin improvement. Simultaneously, Tilray's introduction of a new summer cannabis collection could support brand visibility and contribute to revenue growth, though macroeconomic challenges and competition remain significant hurdles.

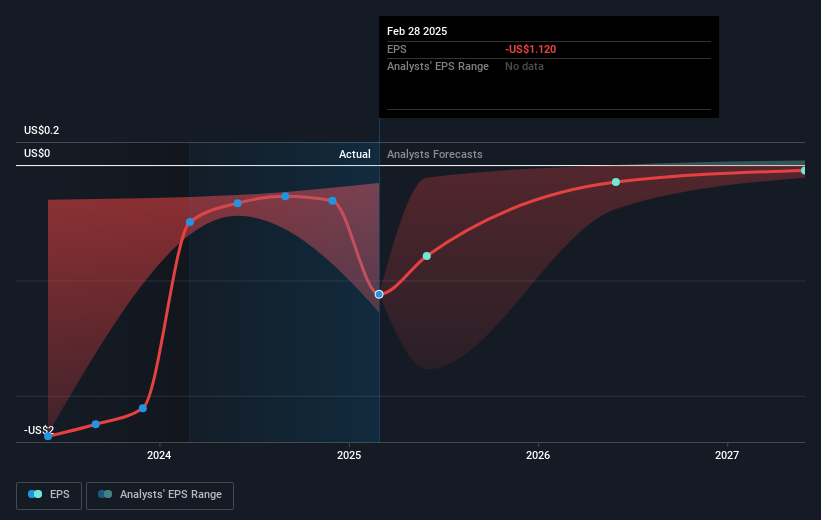

Over the past year, however, Tilray's total shareholder return, including both share price movements and dividends, recorded a severe 77.24% decline, reflecting challenges within the broader cannabis sector and operational difficulties. Comparatively, Tilray underperformed both the US market, which saw a 12% increase, and the US Pharmaceuticals industry, which experienced an 10.7% decline over the same period. Despite a recent 2.74% increase in share price within a week, linked to recent developments, the company continues to face a protracted path to profitability.

With Tilray's consensus analyst price target set at US$1.32, significantly above the current share price of US$0.38, investor sentiment may remain cautious without clear indicators of a turnaround. Adverse impacts on revenue and earnings due to strategic shifts, such as SKU rationalization and inventory allocation, highlight the uncertainties Tilray needs to navigate to align with analyst expectations. These challenges underscore the need for both prudent management and external factors to align positively to reach the price target.

Review our historical performance report to gain insights into Tilray Brands' track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, Australia, New Zealand, Latin America, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives