- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Could Trump’s CBD Endorsement Shift Tilray (TLRY)’s Global Strategy and U.S. Expansion Plans?

Reviewed by Sasha Jovanovic

- In the past week, Tilray Brands saw renewed interest after former U.S. President Donald Trump publicly endorsed the use of cannabidiol (CBD) for senior healthcare and voiced support for broader marijuana legalization and Medicare coverage for CBD products. This political development has fueled fresh optimism for the cannabis industry, suggesting that regulatory attitudes in the U.S. could soon shift in ways that affect market opportunities for companies like Tilray.

- Tilray Brands’ investment outlook has previously focused on rapid international cannabis growth, especially in Europe, and ongoing diversification into craft beverages, while still facing persistent industry headwinds and risks around U.S. regulatory change and ongoing losses.

- We'll explore how former President Trump's call for Medicare coverage of CBD could alter the trajectory of Tilray's global expansion narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Tilray Brands Investment Narrative Recap

To own Tilray Brands stock, you need conviction that regulatory reform, particularly in the U.S., will expand the company’s cannabis addressable market and drive revenue recovery. While former President Trump’s endorsement of CBD for seniors sparked a strong rally and renewed hopes for short-term U.S. legalization progress, real regulatory change remains uncertain, and the biggest immediate risk is still sluggish or stalling U.S. policy momentum.

Among recent company announcements, Tilray’s expansion of its craft beer lineup stands out. This product push is an example of the company’s continued diversification while regulatory headlines dominate, reminding investors that near-term performance may hinge just as much on beer industry trends as on cannabis legislation.

But with all the excitement, investors should be aware that...

Read the full narrative on Tilray Brands (it's free!)

Tilray Brands' outlook anticipates $940.4 million in revenue and $193.4 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 4.6% and a $2.4 billion improvement in earnings from the current level of -$2.2 billion.

Uncover how Tilray Brands' forecasts yield a $0.983 fair value, a 39% downside to its current price.

Exploring Other Perspectives

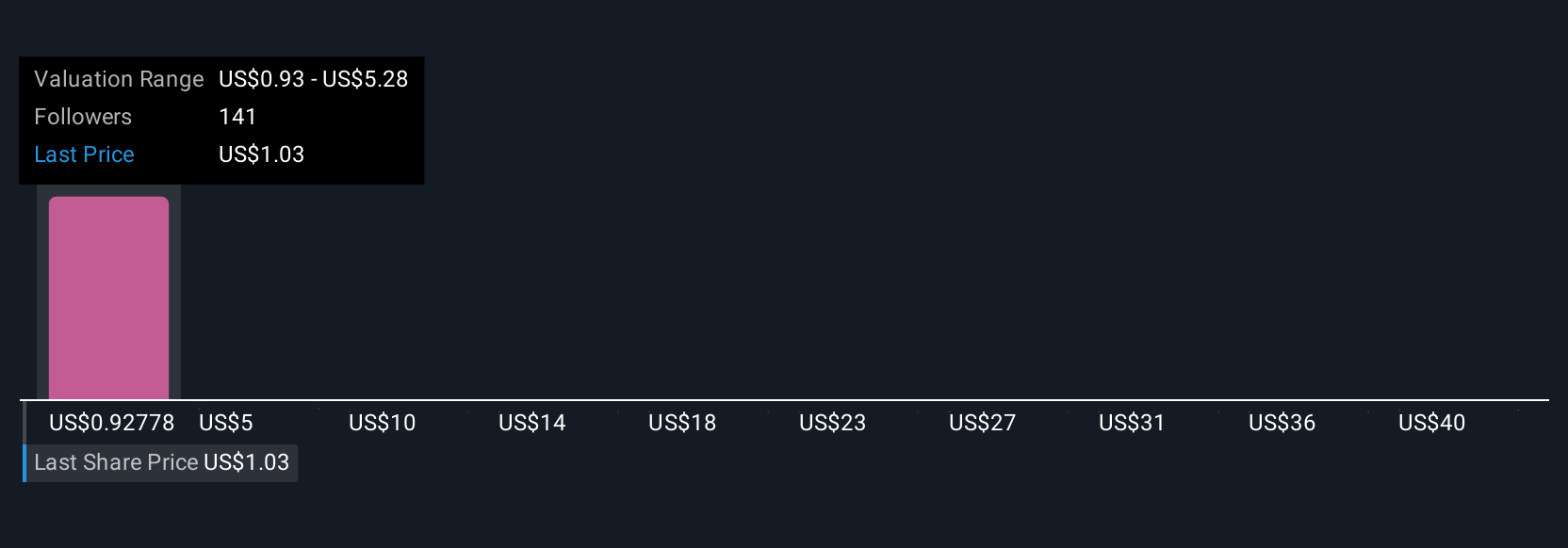

Simply Wall St Community members shared 18 fair value estimates for Tilray, with targets ranging widely from US$0.98 to US$8.04. While some investors see significant upside, persistent U.S. legalization risk could still shape long-term performance and your own expectations.

Explore 18 other fair value estimates on Tilray Brands - why the stock might be worth 39% less than the current price!

Build Your Own Tilray Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tilray Brands research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Tilray Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tilray Brands' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives