- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Assessing Tilray After Its 13.7% Rebound and Recent US Expansion Moves

Reviewed by Bailey Pemberton

- Wondering if Tilray Brands is a bargain or a value trap? You are not alone. Investors have been watching this stock closely as opinions about its true worth continue to shift.

- The stock jumped 13.7% over the past week after a rough patch, but remains down 24.3% this month and 29.5% year-to-date, so sentiment is still on shaky ground.

- Recent headlines have highlighted Tilray’s aggressive push into the beverage and cannabis sectors, with acquisitions and partnership deals stirring excitement and skepticism in equal measure. These moves, especially its expansion in the U.S. market, are behind some of the recent swings and have traders talking about the company’s long-term growth story.

- On traditional metrics, Tilray Brands scores a 4 out of 6 for value, suggesting pockets of undervaluation that might be intriguing. However, there is more to fair value than just ticking boxes. Let’s break down how analysts, models, and market sentiment all size up Tilray’s worth, and why you will want to stick around for a smarter valuation method at the end of this article.

Find out why Tilray Brands's -23.1% return over the last year is lagging behind its peers.

Approach 1: Tilray Brands Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future free cash flows and then discounting those cash flows back to today's value. This method relies on careful forecasts and helps investors gauge whether a stock is trading below or above its intrinsic value.

For Tilray Brands, the most recent reported free cash flow stands at -$93.41 Million. Analyst estimates forecast that free cash flow could rise to $14.78 Million by 2026, growing steadily to $43 Million by 2030. While analysts only provide forecasts up to about five years, further projections beyond this horizon are extrapolated. All values are in US dollars, reflecting the currency used for Tilray's reporting and stock listing.

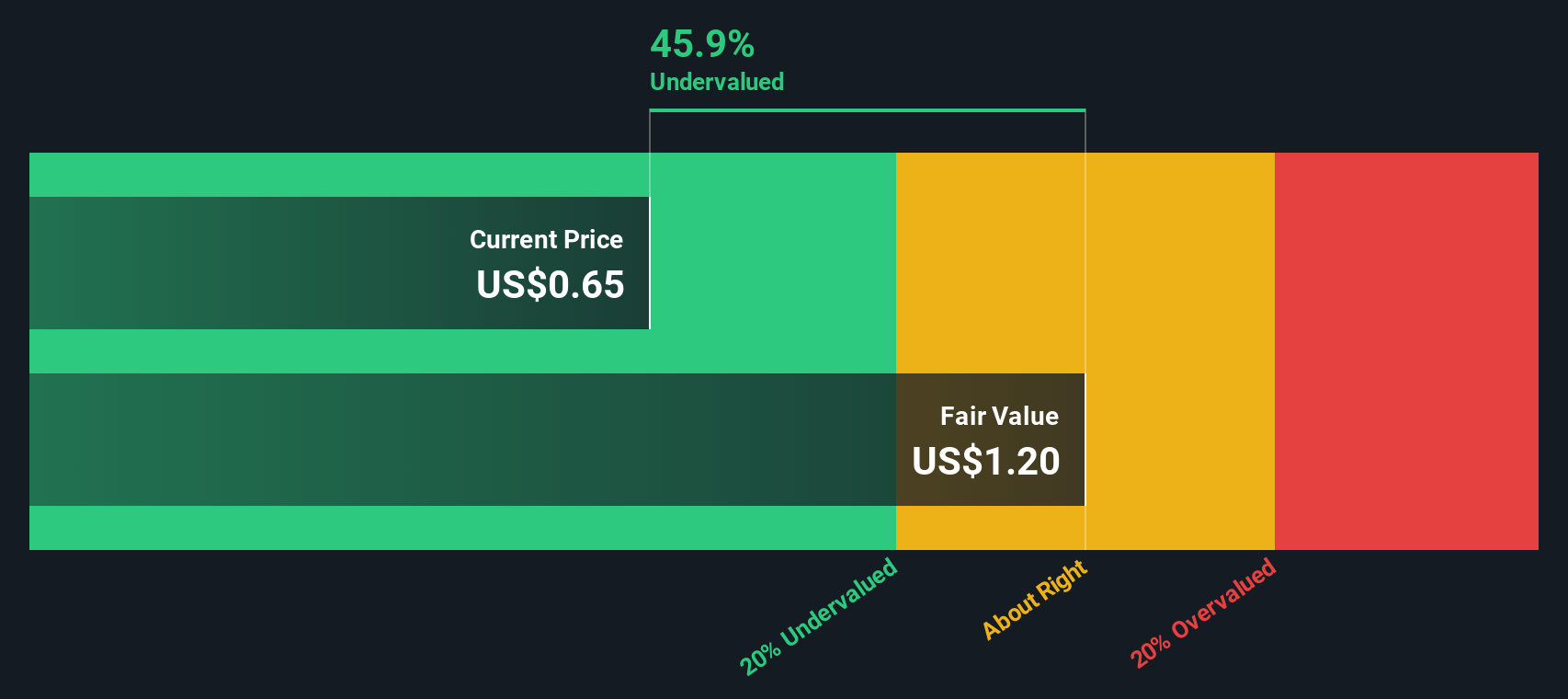

Using the "2 Stage Free Cash Flow to Equity" model, the DCF valuation suggests that Tilray’s fair value per share is $1.12. Compared to the current trading price, the model signals the stock is about 8.4% undervalued. However, because this margin is less than 10%, it is best described as close to fairly valued with only a slight discount built in for investors.

Result: ABOUT RIGHT

Tilray Brands is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

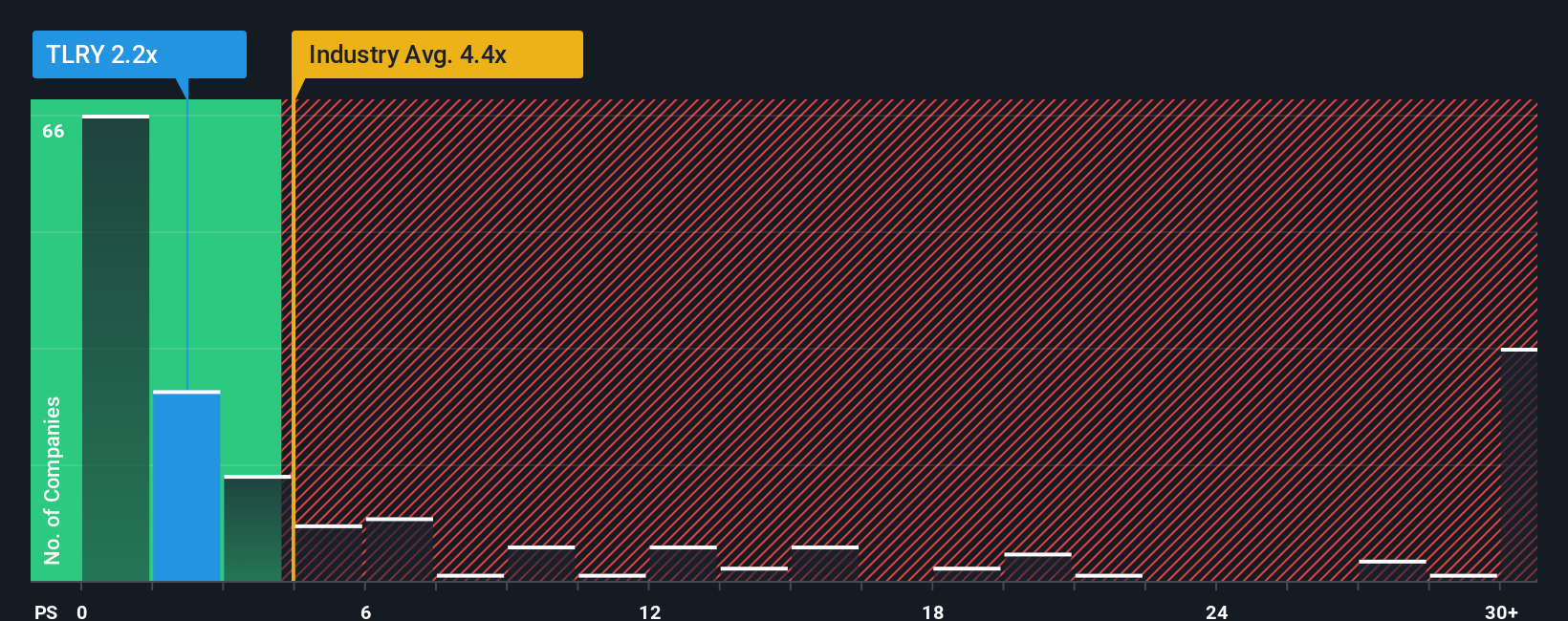

Approach 2: Tilray Brands Price vs Sales

The price-to-sales (P/S) ratio is a favored valuation tool for companies that may not yet be profitable, such as Tilray Brands, because it focuses on top-line revenue generation rather than earnings, which can be volatile or negative in growth-stage businesses. A company’s P/S ratio offers a quick snapshot of how much investors are willing to pay for each dollar of sales, which is especially relevant when bottom-line profits are not the key story.

Of course, what counts as a "reasonable" or "fair" P/S ratio depends on a company’s growth prospects and the risks it faces. Companies with faster expected growth, strong margins, or lower risk typically command a higher P/S, while slower growers or riskier firms may deserve a discount.

Currently, Tilray Brands trades at a P/S of 1.40x. This is well below the pharmaceutical industry average of 4.18x and also lags behind peers, whose average is 11.17x. At first glance, this low multiple suggests Tilray might be undervalued compared to its sector and competitors.

However, Simply Wall St’s proprietary “Fair Ratio” aims to provide an even more tailored comparison by blending the company’s individual characteristics, such as revenue growth, margins, industry, and market cap, to estimate what a fair multiple should be. For Tilray Brands, the Fair Ratio is calculated at 2.44x, indicating the stock could warrant a modestly higher valuation based on these factors. This method is more insightful than just stacking up against peers or industry averages, as it reflects Tilray’s unique risks and growth profile.

Since the difference between the actual P/S ratio and the Fair Ratio is more than 0.10, Tilray Brands looks undervalued on this metric, but not dramatically so.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

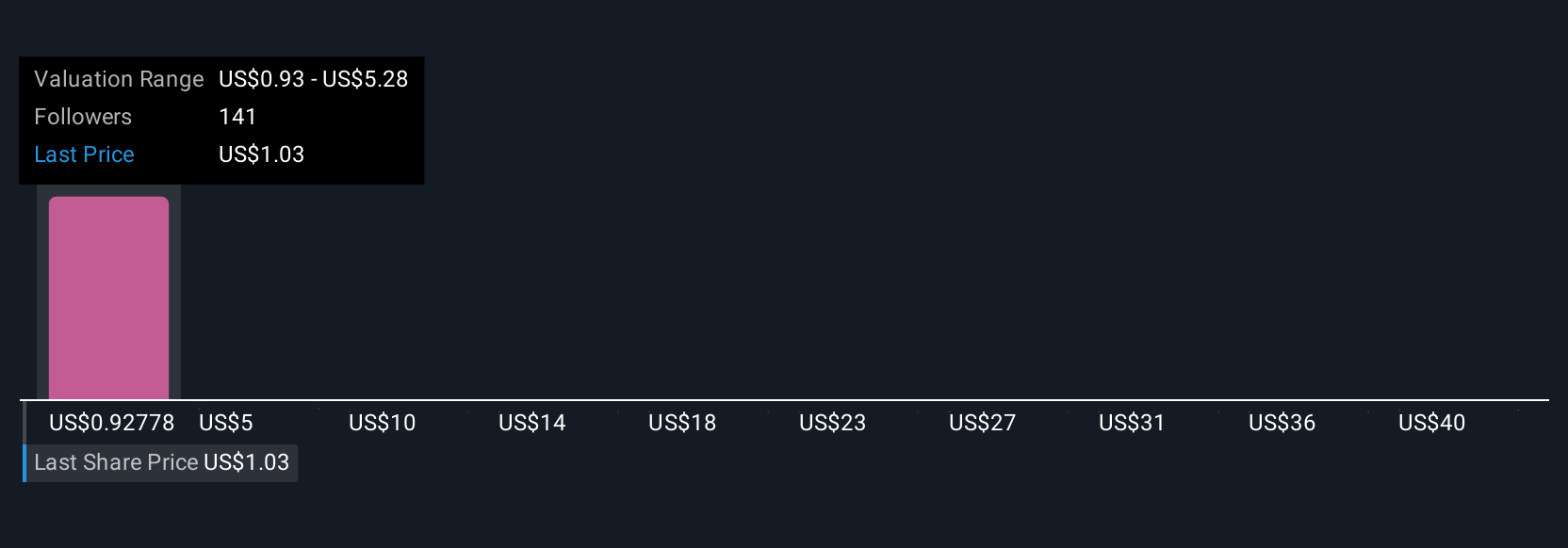

Upgrade Your Decision Making: Choose your Tilray Brands Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company. It is where you link your perspective and expectations directly to the numbers, such as your assumptions for Tilray Brands’ fair value, future revenue, earnings, and margins. Narratives bridge the gap between what you believe is happening in the business and what you think that should mean financially, offering a more dynamic way to invest than relying on static models alone.

Available on Simply Wall St's Community page, Narratives are intuitive tools used by millions of investors to map out their thesis and see how their story shapes fair value versus the current share price, helping clarify whether now is a time to buy or sell. What makes Narratives powerful is their ability to update automatically as new information (like news, earnings, or regulatory changes) comes out, ensuring your insights always reflect the latest reality.

For instance, the most optimistic investor might believe upcoming U.S. federal policy shifts and global market expansion will push Tilray's fair value as high as $2.00 per share, while the most conservative scenario puts it at just $0.60, all based on how each Narrative interprets recent momentum, risks, and future industry catalysts.

Do you think there's more to the story for Tilray Brands? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.